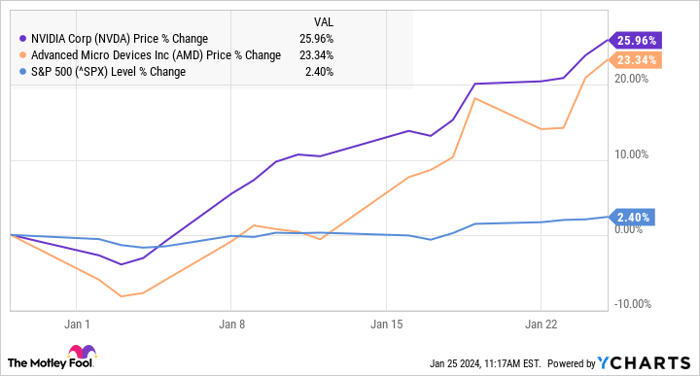

When it comes to futuristic tech, Advanced Micro Devices (AMD) and Nvidia are proving that they’re not just players but trendsetters. The streets are buzzing as both stocks continue to outpace the S&P 500 in 2024, building on their triumphant run in 2023. AMD shares have climbed 23% so far this year, while Nvidia stock has surged an impressive 26%, leaving the S&P 500 in their collective dust.

Riding the AMD Wave

AMD has cemented its status as a leading supplier of central processing units (CPUs) for PCs and servers, stealing market share from industry heavyweights like Intel. The company’s foray into high-performance computing chips has been a lucrative one, and the new year promises even more opportunities for this tech innovator.

As AMD seeks to leverage its recent CPU success into the data center graphics processing unit (GPU) market, the stage is set for a potential breakthrough in the booming AI market.

Taiwan Semiconductor Manufacturing’s bullish outlook for 2024 bodes well for AMD, as the global slowdown in the semiconductor industry has tempered the company’s revenue growth over the last year. With the chip foundry projecting robust growth, AMD stands to reap the benefits as one of its key customers.

In addition to eyeing $2 billion in revenue from data center GPUs this year, AMD is set to launch the new MI300 chip for AI workloads. The likes of Meta Platforms, OpenAI, and Microsoft are already onboard to adopt the new chips this year.

Furthermore, AMD’s CPU business is experiencing a solid resurgence, with its EPYC server chips and Ryzen 7000 series CPUs posting remarkable revenue growth over the last quarter of 2023.

While AMD’s stock may be pricier than Nvidia’s, trading at a forward price-to-earnings (P/E) ratio of 47, the company’s prospects in AI GPUs and a reviving CPU market make it a compelling long-term investment.

Nvidia: The Clear Leader

Nvidia’s stock continues its skyward trajectory, boasting an estimated 90% share of the AI chip market and trading at a relatively cheaper forward P/E ratio of just 31 based on this year’s earnings estimate.

With a storied history as a favorite brand for PC gamers and a visionary CEO in Jensen Huang, Nvidia’s long-term investments of over $37 billion in research and development have solidified its pole position in the GPU market.

Moreover, Nvidia’s profitability is a standout feature, with the company not just supplying chip hardware but also offering networking equipment, software libraries, and development toolkits to address industry-specific challenges. This has allowed Nvidia to achieve an impressive software-like profit margin of 42%, far outstripping AMD’s historical margins.

Mark Zuckerberg’s recent announcement of plans to utilize 350,000 of Nvidia’s H100 GPUs to bolster Meta’s computing infrastructure offers a preview of the escalating demand for these chips. The surge in demand propelled Nvidia’s data center revenue to $14.5 billion in the last quarter.

With robust profitability and growth on its side, Nvidia seems poised to ascend to fresh heights in the coming years, if not by the end of 2024.

In considering investments in Advanced Micro Devices, it’s critical to weigh the insights of knowledgeable analysts. For instance, The Motley Fool Stock Advisor analyst team has identified significant stocks for investors to consider, with Advanced Micro Devices not making the list. Their service has outperformed the S&P 500 by a significant margin since 2002, offering an enticing blueprint for investment success.