Market Momentum and Stock Performance

Amid a surge in market activity, numerous stocks are approaching or surpassing their 52-week highs. Among the standout performers are household names such as Amazon, Arista Networks, and Abercrombie & Fitch.

These companies not only exhibit strong momentum but also hold favorable Zacks Ranks, indicative of upward revisions in earnings estimates by analysts. For investors seeking to capitalize on this vigour, a closer examination of each stock is warranted.

Amazon: A Goliath in the Market

Amazon shares have outperformed the broader market significantly in the past year, solidifying their standing in the exclusive ‘Magnificent 7’ group. With a Zacks Rank of #1 (Strong Buy) and emphatic increases in earnings expectations, the company is poised for robust growth in the current fiscal year.

The consensus estimates signal a staggering 280% earnings surge on 11% higher sales, propelled by a reduction in costs. Despite this growth trajectory, the stock’s current valuation remains moderate, trading at a 2.5X forward price-to-sales ratio, well below its historical medians and highs.

The Networking Phenomenon: Arista Networks

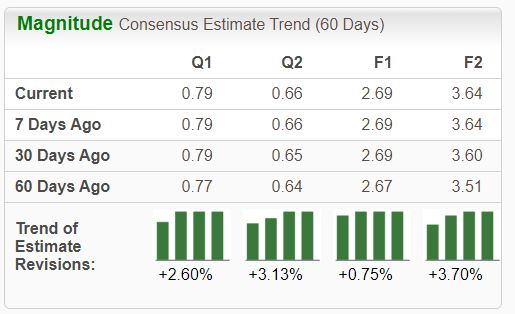

Arista Networks has benefitted from the artificial intelligence enthusiasm, offering network switches to hyperscalers that enhance server communication. With a Zacks Rank of #2 (Buy) and a remarkable surge in earnings estimates, the company demonstrates a promising growth profile for the current fiscal year.

Anticipated earnings growth of 43% on 33% higher sales indicates sustained momentum into the upcoming fiscal year. The release of the next quarterly results on February 12th holds the potential to further validate the company’s trajectory, as EPS estimates continue to climb.

Retail Resurgence: Abercrombie & Fitch

Abercrombie & Fitch, a Zacks Rank #1 (Strong Buy), operates as a premier retailer of high-quality casual apparel, boasting a robust earnings outlook. The company’s consecutive better-than-expected quarterly results underscore its bullish momentum and market perception.

The upward trajectory has translated into three successive post-earnings share price increases, solidifying the company’s resilient stance within the retail landscape.

The Verdict

The prevailing momentum in the market, exemplified by numerous stocks breaching 52-week highs, is undoubtedly a boon for investors eager to harness this strength. Among the standout options, Amazon, Arista Networks, and Abercrombie & Fitch present compelling opportunities.