Technology is making strides in artificial intelligence (AI), fifth-generation (5G) wireless, and cloud computing. These advancements are set to transform life as we know it in the forthcoming years. Among the plethora of tech companies in these domains, a select few are leading the way in innovation.

For investors eyeing portfolio growth, identifying the market leaders in these transformative fields is paramount. These are the growth stocks poised to outshine the market and provide substantial returns to shareholders for years to come. Let’s delve into the tech champions propelling the fields of AI, 5G, and the cloud.

Championing AI: Advanced Micro Devices (AMD)

Stepping into the AI arena, we encounter Advanced Micro Devices (AMD). While AMD currently trails its competitor Nvidia in AI-centric microchips and semiconductors, the company is fervently striving to narrow the gap. Early indicators are promising. During its recent financial results for the first quarter, AMD reported an 80% revenue surge in its Data Center unit to $2.3 billion, attributed to robust sales of its new MI300 series AI chip.

The company’s AI chip sales for this year are forecasted to hit $4 billion due to overwhelming demand, doubling the previous estimate. AMD has already sold over $1 billion worth of MI300 chips since their launch last year. Despite the chip’s six-month tenure, AMD is already crafting new AI chips and successors to its existing processors. Over the past year, AMD’s stock has soared by 40%.

Leading the 5G Revolution: Verizon Communications (VZ)

Verizon Communications takes the spotlight in the realm of fifth-generation wireless. Following an impressive Q1 performance and reduced losses among its wireless subscribers, Verizon’s stock has been on an upward trajectory. The company reported Q1 earnings per share of $1.15, surpassing the analysts’ expectation of $1.12. Revenue stood at $33 billion, in line with Wall Street projections.

Verizon attributes its success to flexible plans and streaming bundles, including discounted services like Netflix (NASDAQ: NFLX). The company also noted a milder decline of 68,000 wireless phone subscribers in Q1, significantly lower than the anticipated 100,000 loss. In the same period a year earlier, Verizon experienced a loss of 127,000 wireless subscribers.

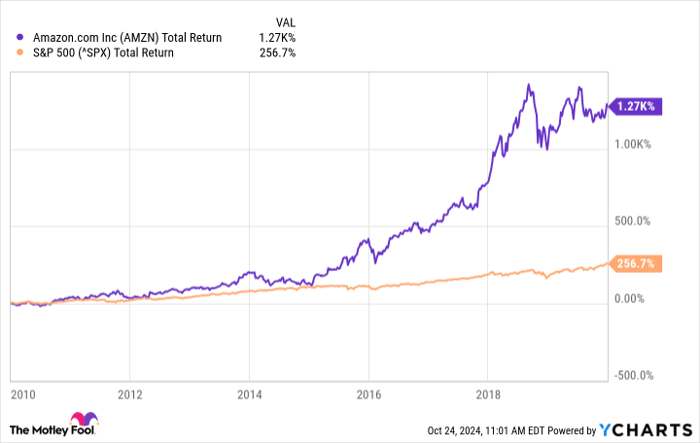

Cloud Computing Maestro: Amazon (AMZN)

Amazon, the e-commerce giant, stands as the frontrunner in cloud computing with a 31% market share. Amazon Web Services (AWS), its cloud computing arm, holds increasing significance within the company’s framework. AWS raked in $25 billion in revenue in Q1, surpassing estimates of $24.5 billion and contributing 62% to Amazon’s total operating profit.

Amazon’s executives attribute the company’s growth largely to the burgeoning demand for cloud services. AWS’s prominent performance fortified Amazon’s earnings, which more than tripled to 98 cents per share compared to the estimated 83 cents on Wall Street. Total sales reached $143.3 billion, reflecting a 13% year-over-year increase. Amazon’s stock has surged by 44% over the past year.

Author:

Joel Baglole has been a business journalist for 20 years. He spent five years as a staff reporter at The Wall Street Journal and has contributed to publications such as The Washington Post, Toronto Star, The Motley Fool, and Investopedia.