The S&P 500 has had a turbulent July, marking its worst performance in a decade, jarring investors and analysts alike. The index’s relentless climb earlier in the year seemed to be subdued by a shift towards small-cap stocks, pulling back the momentum gained in the first half of the year. Despite a modest 1% gain in July, the overall outlook has investors on edge, evoking memories of unsettling months in the past.

A Historical Lens: Evaluating July Trends from the Past Decade

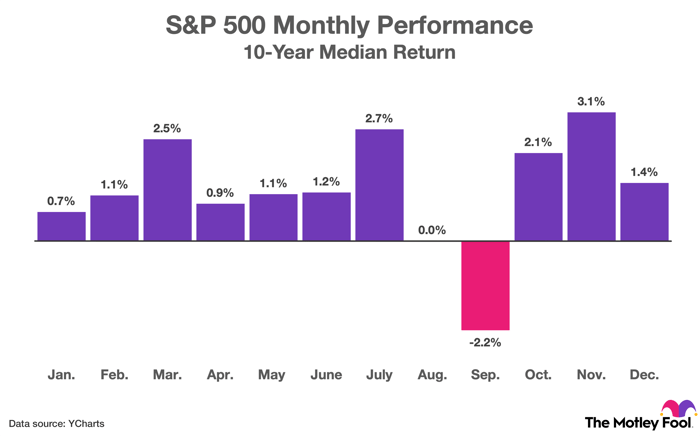

The comparison of July performances over the last years paints a stark picture. Historically, July has been a robust month for the stock market, with the S&P 500 returning a median of 2.7% in the last decade. However, August usually sees subdued gains, while September often brings a sharp downturn. These trends have analysts and investors on alert.

The median return of the S&P 500 in each month over the past 10 years.

Market Forecast: Decoding Trends Amidst Uncertainty

Given the historical data, analysts are predicting a potential decline of over 2% in the stock market through September. The looming “September Effect” often marks a volatile period. While short-term forecasts have their limitations due to quickly shifting sentiments, long-term economic fundamentals provide a steadier compass for investors navigating stormy market waters.

Embracing Long-Term Growth over Short-Term Peaks

The future trajectory of the stock market hinges on broader economic indicators like inflation rates, interest rates, and GDP trends. Forecasts suggest a positive uptick in S&P 500 companies’ revenue and earnings, fueled by anticipated rate cuts and economic stimulus measures. However, the market’s current valuation, trading at a significant premium, leaves little margin for error.

Analysts are divided on year-end prospects, with predictions ranging from substantial downturns to modest gains. However, the historical resilience of the S&P 500, delivering substantial returns over the past three decades, underscores the importance of long-term investment strategies. In a market rife with uncertainties, a patient focus on enduring growth seems to be the wisest choice for investors.

Despite the current market turmoil, opportunities for wealth creation abound, emphasizing the significance of a vigilant investment approach that transcends short-term market fluctuations.

The Untold Potential of Stock Advisor: A Game-Changer for Investors

Revolutionizing Stock Recommendations

Imagine identifying stocks poised to yield massive returns before they hit the mainstream market. That’s precisely the mission of the Stock Advisor analyst team. By bypassing conventional choices like the S&P 500 Index, they unearth opportunities that outshine the competition. These selections are not for the faint-hearted but are poised to deliver substantial gains for savvy investors.

A Historical Triumph: Nvidia’s Spectacular Rise

Reflecting on Nvidia’s inclusion in the Stock Advisor list in April 2005 evokes a sense of awe. A mere $1,000 investment at the time of the recommendation would have burgeoned into a staggering $635,614. Such a meteoric rise underscores the extraordinary potential that lurks within these exclusive stock picks. The past triumph of Nvidia sets a compelling precedent for the monumental returns possible through Stock Advisor’s curated selections.

The Allure of Stock Advisor’s Blueprint

Stock Advisor is not just a mere investment guide; it is a blueprint for success in the unpredictable world of the stock market. Providing investors with a comprehensive roadmap, regular updates from seasoned analysts, and two novel stock recommendations each month, Stock Advisor paves the way for astute investors to chart a course toward financial prosperity. Its track record, outpacing the S&P 500 Index by more than fourfold since 2002, is a testament to its unrivaled potential.

Unlocking Hidden Potential

Are you ready to delve into the realm of exclusive stock recommendations that transcend conventional market trends? Stock Advisor’s unparalleled insights could hold the key to unlocking hidden potential within your investment portfolio. By venturing beyond the confines of traditional market wisdom, investors gain access to a treasure trove of lucrative opportunities that could redefine their financial future.