Nvidia’s Meteoric Rise

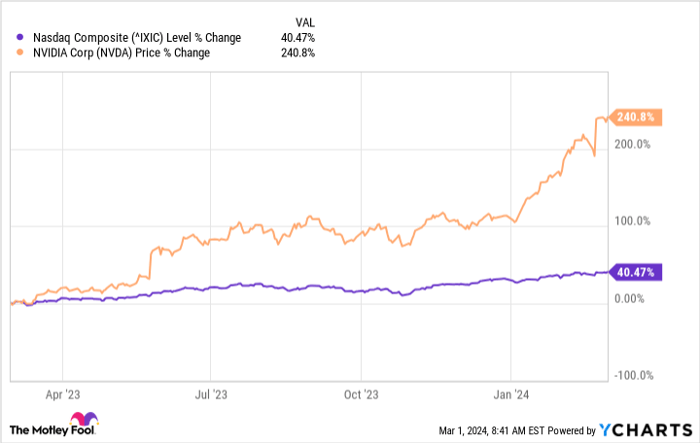

One of the key architects of the Nasdaq’s recent ascent has been Nvidia. The AI chip company has soared, outperforming the broader index by leaps and bounds. With a hefty 5.03% weighting, Nvidia’s stellar 240% surge over the past year has been a major force behind the Nasdaq’s success. The stock’s remarkable earnings performance adds fuel to the fire, with expectations of ongoing growth. Trading at a modest forward P/E of 32, analysts foresee a 34% annual earnings increase in the long run.

Amazon’s Dominance

Amazon, a heavyweight at approximately 6.45% of the index, has also been a powerhouse driving the Nasdaq skyward. With shares up 87% in the past year, doubling the Nasdaq’s gains, Amazon’s influence on the index’s performance has been undeniable. Positioned in the e-commerce and cloud computing realms, Amazon is primed to ride the wave of long-term growth, especially as AI technologies become more prominent. While trading at a forward P/E of 42, reflecting a 24% expected annual earnings growth, Amazon’s trajectory remains robust.

Alphabet’s Stealth Ascendancy

Another silent but impactful contender in the Nasdaq’s climb is Alphabet. Through its dual-share structure, Alphabet commands a substantial 6.72% of the index’s weight, surpassing Amazon. With shares outperforming the index by over 50% in the last year, Alphabet’s forward earnings valuation of 20 times presents an attractive opportunity. Analysts predict a 16% annual growth in earnings as Alphabet leverages its core business in digital advertising, a sector poised for enduring expansion.

Challenges in Apple and Microsoft

Despite the euphoria, the Nasdaq faces potential headwinds from two behemoths, Apple and Microsoft, accounting for almost a quarter of the index’s weight. While Microsoft saw a commendable 65% rise in stock price in the last year, Apple trailed behind significantly. However, the exorbitant valuations of both stocks relative to their expected growth rates pose a threat. Apple’s lofty forward P/E of 27 and Microsoft’s PEG ratio over 2 raise concerns about their sustainability. As stalwarts in the index, any stagnation or decline in these stocks could spell trouble for the Nasdaq’s trajectory.

Investors navigating the turbulent waters can steer their portfolios towards diversified investments, adopt a long-term vision, and employ a disciplined, gradual buying approach to mitigate potential downside risks in a volatile market landscape.

An Insightful Look into NASDAQ Composite Index Stocks

Stock Advisor’s Take on NASDAQ Composite

Investors eyeing the NASDAQ Composite Index should heed the recent insights from the prestigious Motley Fool Stock Advisor team. Unveiling a carefully curated list of the 10 best stocks poised for success, this elite group bypassed the NASDAQ Composite Index in their recommendations. Promising the potential for stellar returns, these selected stocks have captured the attention of savvy investors looking to maximize gains.

In-Depth Investment Strategies

Diving deeper into the world of investment, the Stock Advisor service offers a roadmap to prosperity, guiding investors on crafting a winning portfolio. With regular analyst updates and insightful stock picks bi-monthly, the Stock Advisor subscription has outperformed the S&P 500 by a staggering threefold since its inception in 2002*. This track record speaks volumes about the reliability and proficiency of their strategies.

Historical Performance and Cautious Optimism

Delving into the historical context, the steady growth and impressive returns of the Stock Advisor service since 2002* underscore its credibility and value to investors seeking to outperform market benchmarks. While the NASDAQ Composite Index is a significant player in the investment sphere, the strategic choices of the Stock Advisor team present a compelling case for diversification and potential upside opportunities.

Investing Wisely

As investors navigate the complex terrain of the stock market, selecting the right stocks is crucial for financial success. The Stock Advisor service equips investors with the tools and knowledge needed to make informed decisions, providing a valuable resource in a sea of investment options. By leveraging expert analysis and market insights, investors can position themselves for long-term growth.