Unmasking the ‘Soft Landing’ Fairy Tale

As the last echoes of the La-La-Land casino’s revelry fade, a stark reality emerges: the whimsical allure of a “soft landing” in the market is nothing but a fairy tale. It’s essential to understand that in the world of finance, all bubbles eventually burst. The premise of a “soft landing” hinges on the unrealistic expectation that bubbles can perpetually remain intact, ready to cushion the fall when speculation reaches unsustainable heights.

The Mirage of Economic Strength

In this fanciful narrative, economic strength is painted by a palette of rosy hues: investments flow freely, consumer spending thrives, businesses expand their workforce, all seemingly painting a picture of prosperity. Any hint of trouble is swiftly brushed aside with the magical stroke of central banks lowering interest rates, luring everyone back into a hypnotic dance of speculation and consumption.

A Walk Down Memory Lane: The Dot-Com Bubble

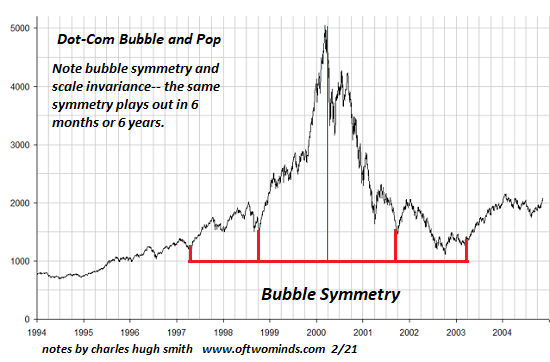

Reflecting on the infamous dot-com bubble of the early 2000s offers a sobering lesson. Scott McNealy’s poignant musings on the unsustainable valuations and unrealistic expectations exemplify the folly of chasing ephemeral riches based on unfounded optimism. The subsequent collapse serves as a poignant reminder that true market fundamentals eventually reassert themselves, erasing the illusory wealth created by the bubble.

The Unyielding Tide of History

History doesn’t falter in its rhythm; it echoes with a haunting symmetry. Just as in the past, we witness a current era of excess and exuberance. The ominous specter of the “Everything Bubble” looms large, hinting at a future where the mirage of prosperity may fade, and the stark truth of economic reality emerges once again, wiping away speculative gains in its wake.

Lessons from La-La-Land: A Cautionary Tale

In the mythical realm of La-La-Land, new sectors promise boundless riches, and the wheel of fortune spins endlessly. Yet, the harsh truths of history paint a different picture. Market players and punters may ride the wave of enthusiasm until the music stops, and the bubble inevitably bursts. The sobering chart of household wealth in stocks during the turbulent 1970s era serves as a stark reminder that the fanciful allure of market euphoria often leads to a harsh awakening.

It’s human nature to be captivated by fairy tales, drawn in by their emotional pull and tantalizing narratives. However, when these fables seep into the realm of reality, they can blind us to the impending storms on the horizon.