Artificial intelligence (AI) is currently in the spotlight as a transformative force, comparable to the internet. This surge in interest has driven Nvidia (NASDAQ: NVDA) stock to extraordinary levels. The company, known for designing and selling chips crucial for AI advancement, has experienced remarkable revenue growth, cementing its position within the tech industry.

Last week, Nvidia’s CEO, Jensen Huang, made headlines by selling 700,000 shares of the company’s stock. While this move may raise eyebrows, it is essential to maintain perspective. Huang’s total stake in the company exceeds 800 million shares, valued at over $100 billion. The recent sale represents a fraction of his holdings, possibly executed for practical reasons like tax obligations rather than signaling doubts about the company.

Analysts caution investors against solely relying on executive actions to guide their decisions. Instead, a comprehensive evaluation of the company should inform investment choices. Despite recent developments, the fundamental question remains: Is Nvidia still a desirable investment?

Nvidia’s Financial Performance: A Titan in the Making

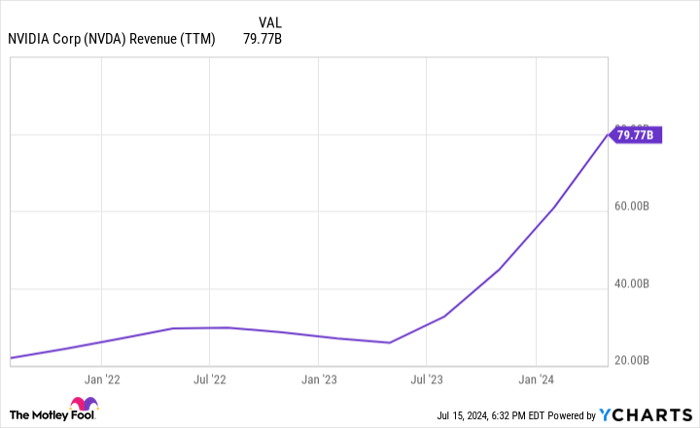

Boasting a dominant position in the AI chip market, Nvidia’s financial prowess is undeniable, showcasing substantial growth over recent years. The company’s revenue trajectory reflects this upward momentum, with forecasts predicting a nearly 98% surge to $120.6 billion this year alone. Such impressive growth solidifies Nvidia’s status as a strong contender for the title of the world’s largest company by market capitalization.

Looking ahead, Nvidia faces challenges in sustaining its growth, particularly amid intensified competition from longstanding rival, AMD. While AMD poses a threat to Nvidia’s market share, the latter’s significant investments in research and development afford it a competitive advantage. This strategic positioning has the potential to keep Nvidia ahead of the curve in the foreseeable future.

The Crucial Link: Nvidia’s Future Tied to AI’s Evolution

Despite its current success, Nvidia’s future hinges on the broader adoption and success of AI technology. The realization of AI’s potential remains a critical factor for Nvidia’s continued growth. If AI fails to deliver tangible value to consumers and businesses as anticipated, it could impede demand for Nvidia’s hardware solutions, impacting the company’s trajectory.

Visualize the AI ecosystem as a river, with Nvidia positioned upstream, supplying essential components to downstream entities delivering AI-enabled products. For Nvidia to thrive, downstream entities must successfully leverage AI to drive economic gains. Failure to do so could disrupt the flow, affecting Nvidia’s market position and revenue streams.

Investment Considerations: Is Nvidia the Right Bet?

Before diving into Nvidia stock, investors should weigh various factors. While recent developments may spark uncertainty, a comprehensive analysis of Nvidia’s market positioning, financial health, and industry trends is essential.

Remember, past success is not a guarantee of future performance. Expert opinions and market insights can provide valuable guidance when making investment decisions. It’s crucial to approach investment opportunities with a long-term perspective, considering factors beyond immediate stock price fluctuations.