Apple, Microsoft, and Tesla, revered names in the stock market, have been eclipsed by other key players in the S&P 500 index over the past decade. This shift highlights the cyclical nature of stock market leadership, as highlighted by analyst Charlie Bilello.

The best performing stocks in the S&P 500 over the last 5, 10, 15, and 20 years… pic.twitter.com/CQw9MQlPN1

— Charlie Bilello (@charliebilello) February 4, 2024

The last 10 years have seen the dominance of semiconductor stocks like Nvidia (NASDAQ: NVDA), Advanced Micro Devices (NASDAQ: AMD), and Broadcom (NASDAQ: AVGO) in the top three spots. Let’s delve into why these stocks have outperformed the giants and what sets them apart.

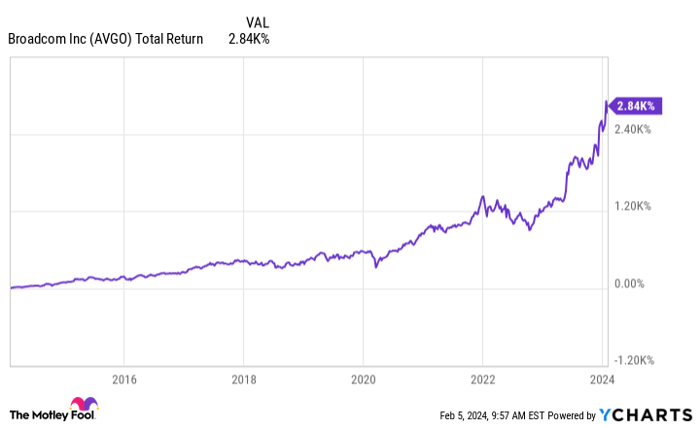

The Third Best Performing Stock: Broadcom

AVGO Total Return Level data by YCharts

Broadcom’s transformation began in 2016 when it merged with Avago Technologies, evolving into a conglomerate spanning various tech segments. Subsequent acquisitions of semiconductor device supplier CA Technologies, cybersecurity giant Symantec, and cloud computing software powerhouse VMware have further bolstered Broadcom’s standing. VMware’s cloud software aids enterprises in optimizing their computing infrastructure, crucial in the era of AI and high computing demands. Broadcom achieved a record $35.8 billion in 2023 revenue and anticipates a 40% increase to $50 billion in 2024, fueled by VMware’s integration.

The Second Best Performing Stock: Advanced Micro Devices

AMD Total Return Level data by YCharts

Advanced Micro Devices’ (AMD) CPUs and GPUs power leading gaming consoles and Tesla’s electric vehicles. However, recent gains are due to its data center business, featuring the groundbreaking MI300 series of chips catering to AI workloads. MI300 has garnered major customers such as Microsoft, Oracle, and Meta Platforms. AMD’s estimated 90% share in the market for AI chips for personal computers, propelled by the Ryzen 7000 series (Ryzen AI) CPUs, has resulted in a 62% year-over-year increase in client segment revenue during Q4. AMD forecasted an upward revision in data center GPU sales to $3.5 billion, up from the initial $2 billion estimate for 2024, reflecting the burgeoning demand for MI300.

Nvidia’s Meteoric Rise and Future Predictions

Nvidia: The Best Performing Stock Over the Last Decade

In the illustrious world of stocks, Nvidia emerges as the crowned champion, boasting an impressive surge of 17,900% over the past ten years. An investment of a mere $1,000 a decade ago would have metamorphosed into a staggering $179,000 today, setting a new precedent in the market. The company’s H100 GPU reigns supreme as the premier AI data center chip globally, with demand heating up to such an extent that Nvidia is struggling to keep pace with production. Even so, in the last fiscal quarter of 2024, its data center revenue witnessed a staggering tripling to an all-time high of $14.5 billion, signaling its undeniable might in this domain.

Nvidia’s Future Growth Forecast

All eyes are fixed on Nvidia’s forthcoming release of the H200 chip, poised to debut midyear. Designed for inferencing, the H200 promises twice the performance of its forerunner while consuming just half the energy, thus significantly reducing operational costs for data center operators. If Nvidia’s projection for the fiscal 2024 full year materializes, its anticipated $58.8 billion in revenue would signify an astounding 1,323% growth over the last decade, firmly cementing its stronghold in the industry.

Despite the inevitable plateau that follows such astronomical growth, Wall Street analysts remain sanguine about Nvidia, foreseeing a 58% surge in revenue and a 69% spike in the earnings per share for the upcoming fiscal year 2025. Moreover, with the advent of AI potentially injecting anywhere from $7 trillion to $200 trillion into the global economy over the next decade, Nvidia’s future prospects appear vibrant, albeit amid heightened competition from contenders like AMD.

Recommendations and Cautions for Potential Investors

Prospective investors weighing the decision of whether to infuse $1,000 into Nvidia’s stock are advised to reflect on the insights of the Motley Fool Stock Advisor analyst team, who have identified ten formidable stocks that they believe hold the promise of yielding monumental returns in the years to come. Notably, Nvidia did not make the esteemed list of recommendations.

The Stock Advisor service extends its user-friendly blueprint for investment triumph, furnishing patrons with invaluable counsel on curating a diversified portfolio, regular updates from astute analysts, and a duo of fresh stock recommendations each month. Embracing an impressive track record, the service has outperformed the S&P 500 by a staggering margin since 2002, offering a beacon of hope for investment enthusiasts.

As the financial realm weaves an intricate web with Nvidia, the company stands poised at the threshold of a pivotal juncture, harboring great potential for both exhilarating gains and unforeseen peril, as it continues its narrative of reshaping the tech landscape.