Elon Musk recently revealed Tesla’s Cybercab as the company accelerates efforts in deploying autonomous vehicles. The vision of Cybercabs hitting the streets in 2026, though promising, remains shrouded in uncertainty. While other industry players are also venturing into autonomous taxis, Tesla’s brand gravitas under Musk’s leadership stands out, making it a formidable contender. However, the current standing of TSLA stock leaves me rather tepid regarding investment prospects in this domain.

Exploring the Cybercab Potential

A fleet of Tesla robotaxis has the potential to disrupt market dynamics, challenging established ride-hailing giants like Uber and Lyft. This disruption could inject billions into Tesla’s revenue stream, eventually translating into robust margins. Yet, the lack of concrete details on the robotaxi strategy, mostly reliant on speculation, makes me approach TSLA with caution rather than enthusiasm.

While assessing the robotaxi landscape, a myriad of uncertainties loom ahead. Competitors such as Waymo, Cruise, and Zoox are actively engaged in the autonomous vehicle space, adding to the market complexity. Furthermore, envisioning Tesla owners renting out Cybercabs akin to the peer-to-peer car rental platform Turo suggests a potential market shift that Tesla could capitalize on if Cybercabs gain mass acceptance.

Concerns over Tesla’s Valuation

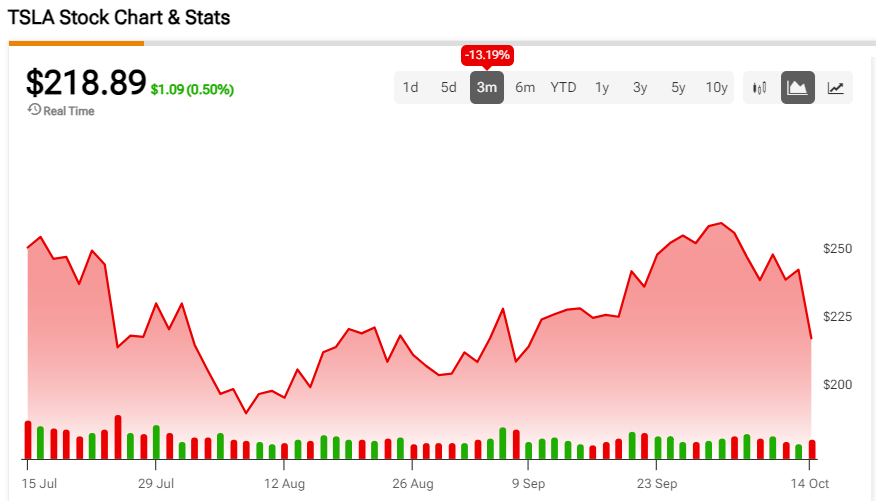

The outlook for Tesla stock seems less enticing when scrutinizing its valuation, prompting a lukewarm stance rather than a bullish outlook. With a year-to-date decline of 12%, including a recent 9% dip post the robotaxi event, investor expectations were left largely unmet. Despite the pullback, TSLA stock maintains a lofty trailing GAAP P/E ratio of 61x, in stark contrast to a company like Ford trading at an 11x P/E ratio.

Although luxury automotive brands may command high P/E ratios, the disparity in revenue growth and profit margins between Tesla and certain peers like Ferrari raises questions. Ferrari, with a 54x P/E ratio, boasts superior growth rates and profit margins compared to Tesla, indicating a mismatch in valuation.

Challenges in Automotive Revenue

Robotaxis offer a glimmer of hope to reignite growth, given Tesla’s reported 7% year-over-year decline in automotive revenue during the second quarter. While energy and storage segments demonstrated uplift, the bulk of Tesla’s revenue stems from its automotive division, implying vulnerabilities amidst the evolving EV landscape.

Moreover, intense competition from Chinese EV manufacturers poses a threat, potentially pressuring Tesla to maintain competitive pricing at the expense of margins. As automotive sales struggle, sustained revenue growth appears elusive, fueling concerns about investor sentiments if sluggish trends persist.

Navigating Musk’s Influence

Elon Musk’s indelible imprint on Tesla’s narrative has long accentuated the stock, buoyed by investor confidence in his leadership acumen. Musk’s pioneering ventures like SpaceX and xAI underscore his entrepreneurial prowess, accentuating Tesla’s allure. However, while acknowledging Musk’s visionary strides and relentless innovation, prudence dictates a cautious approach towards TSLA stock.

Analyst Insight on Tesla

With Wall Street analysts maintaining a Hold rating on Tesla, a mixed sentiment prevails, indicated by 11 Buy, 16 Hold, and 8 Sell ratings. The average price target, marginally lower than the market price, reflects a nuanced consensus on Tesla’s future trajectory.

Final Verdict on Tesla Stock

While robotaxis hold promise as a transformative avenue for Tesla, the transition may entail a prolonged gestation period, dampening immediate investor gratification. The Musk mystique notwithstanding, decelerating sales growth and escalating competition underscore the need for prudent evaluation. Monitoring Tesla for opportune entry points or significant robotaxi advancements seems judicious, given the protracted developmental timeline.

In culmination, my assessment deems TSLA stock favorably as neutral, reflecting a cautious optimism tempered by the intricate dynamics at play.