Looming Decision at the June 13 Annual General Meeting

Tesla, listed on NASDAQ as TSLA, faces a pivotal moment as shareholders convene on June 13 to determine the fate of CEO Elon Musk’s $44.9 billion pay package. A recent ruling nullified the 2018 package, adding to the tension surrounding this high-stakes decision.

Insights from Jefferies Analyst, Philippe Houchois

Jefferies’ Philippe Houchois, a respected Wall Street analyst, foresees a complex aftermath regardless of the shareholder vote’s outcome. Recognizing Musk’s unique blend of tech innovation and market domination, Houchois urges the Board to explore new avenues of rewarding Musk beyond financial compensation.

Challenges in Tesla’s Automotive Innovation

Houchois points out challenges in Tesla’s automotive sector, citing a potential erosion of its innovative edge. The push for standardization and scaling, while noble, may be premature given the fast-evolving nature of the industry.

Autonomous Driving and Future Prospects

Regarding autonomous driving, Houchois remains cautious about Tesla’s path to profitability, especially in comparison to incumbent ride-sharing companies. While progress in China is promising, the analyst warns of the country leveraging Tesla to spur domestic competition.

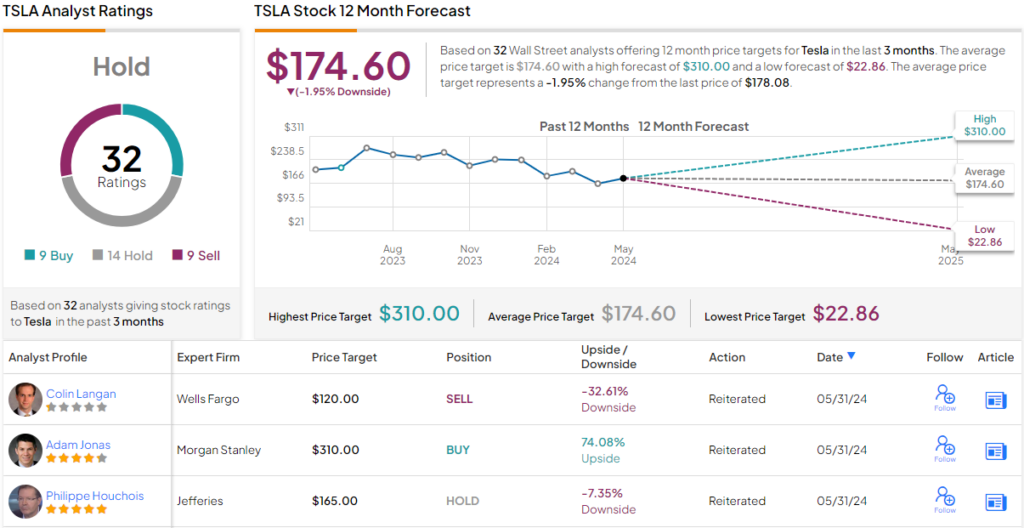

Analyst Recommendation and Price Target

Houchois maintains a “Hold” rating for Tesla shares with a price target of $165, suggesting a current overvaluation of 7%. This sentiment aligns with the consensus among Wall Street analysts, projecting Tesla’s stock to remain rangebound in the near term.