The recent predicament faced by Tesla eerily resonates with the classic ’90s film, Tommy Boy, where a car hood disrupts the driver’s view while on the move. Tesla’s encounter with a similar issue stemming from a software glitch failing to detect an unlatched hood has left around 1.85 million vehicles in jeopardy. The potential safety hazard, likened to a scene from Tommy Boy, stirred unease among shareholders, reflected in the nearly 5% decline in Tesla’s shares during Tuesday afternoon trading.

A variety of Tesla models fell prey to this unsettling glitch, including Model 3 and Model Y vehicles from 2020 to 2024, alongside Model S and Model X cars. The origin of the problem traces back to China in March, prompting Tesla to swiftly address it through an over-the-air software update. This incident marks Tesla’s second recall this year, following concerns raised about warning lights’ visibility in several models, including the Cybertruck.

Challenges with Autopilot Features

While a hood unexpectedly popping open might seem less daunting with Tesla’s Autopilot and Full-Self Drive systems, new revelations cast a shadow on their efficacy. Reports allude to a significant flaw in Tesla’s Autopilot/Full-Self Drive setup, undermining its efficiency in handling unforeseen circumstances. By heavily relying on cameras over other sensory inputs like lidar or radar, Tesla’s system struggles with novel or unanticipated scenarios, potentially putting drivers at risk.

Assessing Tesla’s Stock Performance

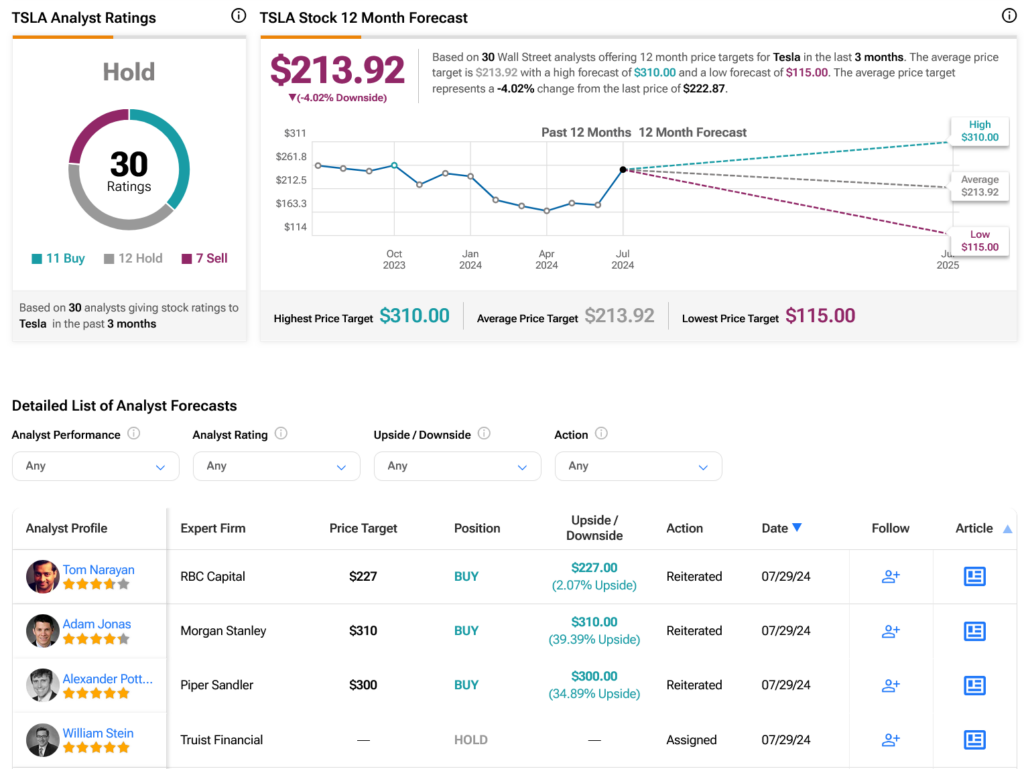

Wall Street analysts currently maintain a Hold consensus rating on TSLA stock, comprising 11 Buy, 12 Hold, and 7 Sell recommendations in the last three months. Following a 17.25% decline in share value over the past year, Tesla’s average price target of $213.92 per share projects a 4.02% downside risk, as illustrated in the graph below.