The Art of Navigating Tesla’s Financial Terrain

Tesla, Inc.’s TSLA core electric-vehicle manufacturing business hasn’t been immune to the industry-wide downturn, but the stewardship under the helm of Elon Musk has successfully steered the company to bolster its ancillary ventures, earning admiration from an esteemed analyst at Morgan Stanley.

Rising Above the Rest

Reiterated As Top Pick: Adam Jonas of Morgan Stanley reaffirmed Tesla as the firm’s top choice in the U.S. auto sector, attributing this endorsement to the company’s strategic diversification efforts. “The company continues to take steps to mitigate downside risks to the core auto business…while channeling resources towards stationary energy, compute infrastructure, robotics, and other manifestations of embodied AI,” he articulated.

The analyst bestowed Tesla with an Overweight rating along with a $310 price target per share.

A Call for Fiscal Prudence

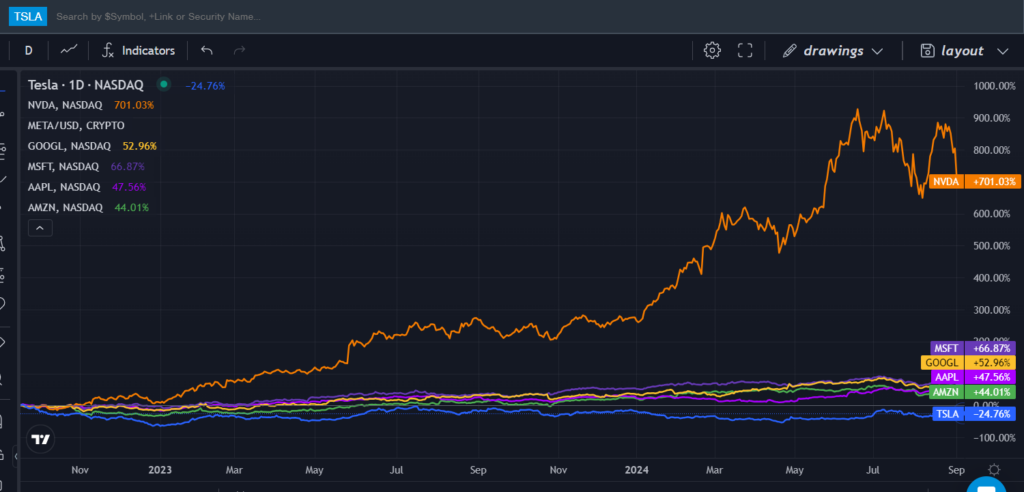

Tesla’s stock has tumbled over 50% from its zenith and has notably lagged behind other tech behemoths over the past trio of years, Jonas pointed out.

Source: Benzinga Pro

This underperformance is rooted in the nearly 50% decrement in consensus estimates over the past year. Jonas implored for stringent cost-cutting measures, stating, “While we are not anticipating an immediate rebound in global EV margins, it is crucial for Tesla to exhibit fiscal prudence to align with the expanding ‘surface area’ bridging its business model and the AI narrative, for investors to truly grasp,” he iterated.

Glimpsing into Margin Pressures

Tesla has prognosticated a GAAP operating profit of $5.6 billion by 2024. After deducting the estimated $2.3 billion in zero-emission vehicle credits and the projected profit from Tesla Energy operations, the fundamental auto operation profit narrows down to $2.2 billion, as per Jonas.

Jonas reflected that a chunk of this profit may originate from captive dealer margins along with various recurring revenue streams like connectivity, charging, software services, upgrades, and full self-driving capabilities, indicative of prospective losses in the auto domain by 2024. He did, however, highlight that a substantial segment of Tesla’s operational expenditure burden lies outside the automobile arena, particularly in AI infrastructure.

Tempering Expectations for Robotaxi Day

Jonas tempered expectations regarding the much-awaited Robotaxi Day slated for October 10, set to take place in Warner Brothers studios. The event is anticipated to showcase the latest version of FSD along with a demonstration of a fully autonomous ‘cyber-cab,’ primarily within a closed or semi-closed circuit, he noted.

Moreover, Jonas observed that Tesla currently holds a permit for autonomous vehicle testing ‘with a driver’ as per the California Department of Motor Vehicles website; however, the company does not possess authorization for testing or deploying autonomous vehicles sans a driver.

During premarket trading on Friday, Tesla stock observed a 0.84% decline, settling at $228.24, based on Benzinga Pro data.

Explore further of Benzinga’s cutting-edge Future Of Mobility coverage through this link.