Investors tip-toed carefully through the opening days of the week, but the mood took a turn on Friday (August 23) afternoon following an uplifting revelation by US Federal Reserve Chair Jerome Powell

During a speech in Jackson Hole, he hinted at the Fed’s readiness to initiate interest rate reductions.

The week witnessed a surge in crypto markets, finally breaking away from a prolonged pricing standstill. Noteworthy company news arrived as Waymo unveiled a fresh iteration of its autonomous driving technology, adding yet another victory to its recent streak of accomplishments.

Stay updated on the latest occurrences in the tech sector with a comprehensive round-up from the Investing News Network.

1. Markets Embrace Prospect of Impending Rate Cuts

The start of the week was tumultuous for stock markets, with the S&P 500 (INDEXSP: .INX) and Nasdaq Composite (INDEXNASDAQ: .IXIC) opening lower on Monday (August 19) compared to the prior week’s close. However, they rebounded impressively, notching their eighth consecutive day of gains, mirroring the performance of the S&P/TSX Composite Index (INDEXTSI: OSPTX).

The Russell 2000 Index (INDEXRUSSELL: RUT) soared by 1.1 percent throughout the day.

As the week unfolded, major indexes remained relatively stable on Tuesday (August 20) morning as investors awaited fresh inflation data. Wednesday (August 21) saw the release of US non-farm payroll benchmark revisions alongside the minutes from the July Fed meeting. Minutes from the Bureau of Labor Statistics highlighted a slight downward revision in job growth numbers between March 2023 and March 2024.

Simultaneously, insights from the Fed meeting minutes indicated a contemplation of a quarter-point rate cut in July due to softening inflation and rising unemployment, reinforcing expectations of a forthcoming rate cut in September. This development buoyed indexes, with the Russell 2000 taking the lead by surpassing a 1 percent gain to close at 2,170.32.

The positive momentum persisted on Thursday (August 22) morning. Most indices opened higher than the previous day’s close. Economic reports unveiled that the US manufacturing PMI declined to 48 in August from 49.6 in July, falling below projections. Concurrently, initial jobless claims in the week ending August 17 slightly increased by 4,000 to 232,000 compared to the prior week.

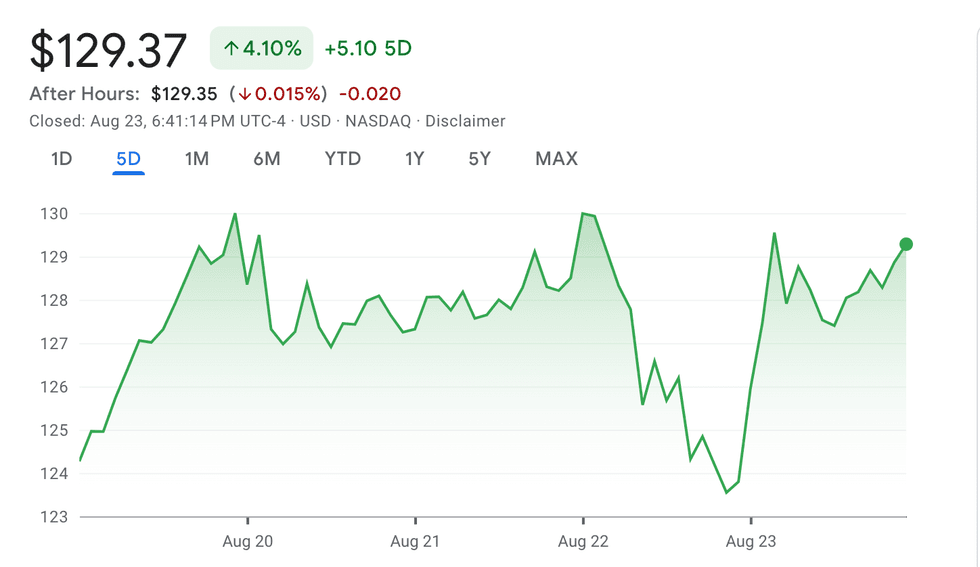

Chart via Google Finance.

NVIDIA performance, August 19 to August 23, 2024.

Stocks took a midday dip on Thursday, with the decline spearheaded by

The Market Rollercoaster: A Week in the Financial World

Following a tumultuous week in the tech sector, NVIDIA (NASDAQ:NVDA) witnessed a 4.77 percent decline in its share price by market close. However, the pendulum of optimism swung back on Friday with Federal Reserve Chairman Powell’s address at the Kansas City Fed’s economic conference in Jackson Hole, Wyoming.

During Powell’s much-anticipated speech, he hinted at an impending rate cut without divulging the exact number of basis points that could be in play. “The time has come for policy to adjust. The direction is clear, with the timing and pace hinging on incoming data and risk assessments,” Powell remarked.

Stock Indexes Soar

The news sparked a frenzy among investors, resulting in a surge across all major stock indexes. The Russell 2000 stood out by commanding an impressive climb of over 3 percent midday, mirroring the recent trend of heightened interest in mid-cap stocks following favorable Fed data in recent months.

The week drew to a close on a positive note, with all four major indexes reporting gains of over 1 percent. The Russell 2000 outperformed the rest, concluding the week with a remarkable surge of over 3 percent.

Bitcoin’s Price Swings

Bitcoin’s price journey was nothing short of a rollercoaster ride. The cryptocurrency experienced a dip below US$58,000 in pre-market trading on Monday, only to recover and breach the US$61,000 mark between Monday and Tuesday.

Tuesday saw a sharp pullback in conjunction with a slump in US stock indexes. Simultaneously, K33 analysts highlighted a concerning trend with Tuesday marking the lowest seven-day average annualized funding rate since March 2023, signaling a rise in short bets and the potential for a squeeze.

Bitcoin’s price exhibited more dramatic movement throughout the week, meandering in the US$59,000 range before shattering the US$60,000 and US$61,000 thresholds. Despite the ebb and flow, the cryptocurrency held steady above US$60,000 for the remainder of the week.

The Crypto Conundrum

Recent data unveiled a slight downtrend in Bitcoin demand, juxtaposed against persistent accumulation by long-term holders. Furthermore, the institutional embrace of Bitcoin ETFs witnessed a notable 14 percent uptick in Q2 compared to Q1, signaling sustained interest from major market participants.

However, a note of caution emerged from Fairlead Strategies, pointing towards a potential downturn for Bitcoin driven by the 14-month stochastic indicator’s signaling of an impending reversal in momentum. Amidst such projections, the crypto market rallied on Friday in response to positive economic cues, propelling Bitcoin’s price above US$64,000 by late afternoon.

Democrats Navigate Crypto World

Prior to the Democratic National Convention, the party laid out its 2024 Platform, a comprehensive 92-page document encompassing economic policies and social justice perspectives. Notably absent was a clear stance on cryptocurrency and web3 infrastructure from Vice President Kamala Harris, raising questions within the crypto community about her potential support for the industry.

Despite optimistic whispers in the air, Harris has remained tight-lipped on issues surrounding decentralized finance regulation and taxation. The platform’s mention of “Biden’s second term” stirs intrigue, especially considering the tight deadline for finalizing the plan.

Embracing Financial Evolution: Recent Industry Developments and Insights

Democratic Shifts in Cryptocurrency Support Post-Biden Withdrawal

Less than a week before President Joe Biden’s surprising withdrawal from the 2024 race, speculations are swirling about Vice President Kamala Harris potentially taking a more assertive stance on cryptocurrency and web3 infrastructure throughout the campaign.

During a recent Bloomberg News roundtable at the Democratic National Convention, Brian Nelson, the senior adviser for policy in the campaign, hinted at Harris supporting measures to foster the growth of emerging technologies and industries. This shift could signal a strategic move amidst the evolving financial landscape.

Notably, the absence of a clear stance on cryptocurrency in the Democratic Party’s platform has raised discussions about its impact on voter sentiments and preferences, potentially influencing the dynamics of the ongoing election race.

Waymo’s Revolutionary Leap with 6th Generation Self-Driving Technology

Waymo, a subsidiary of Alphabet (NASDAQ:GOOGL), made waves in the autonomous driving industry with the unveiling of its 6th Generation Waymo Driver. This cutting-edge technology, introduced just this week, promises enhanced capabilities and cost-efficiency, reinforcing Waymo’s position as a trailblazer in self-driving innovation.

Boasting the ability to perceive its surroundings up to 500 meters away and withstand challenging weather conditions, the new system features advanced sensor technology that augments its navigation prowess. Waymo’s recent milestone of exceeding 100,000 rides per week via its robotaxi service, Waymo One, underscores the company’s exponential growth and market influence.

With origins dating back to 2009, Waymo’s foray into commercial services and strategic partnerships reflects a trajectory from a mere project to an industry leader, exemplifying the enduring spirit of innovation.

AMD’s Strategic Move into AI Terrain with ZT Systems Acquisition

Advanced Micro Devices (AMD), a prominent semiconductor manufacturer, made headlines with its acquisition plans for ZT Systems, a specialized developer of servers and network equipment. The strategic move, unveiled this week, forms an integral part of AMD’s broader strategy to fortify its artificial intelligence capabilities within the data center domain.

Dr. Lisa Su, the Chair and CEO of AMD, articulated the company’s forward-looking vision, emphasizing the acquisition’s role in delivering cutting-edge AI solutions on a scale tailored to cloud and enterprise clientele. The substantial deal, valued at US$4.9 billion, signals a significant step towards solidifying AMD’s position in the evolving tech landscape.

The positive market response, with AMD shares surging by 4.66 percent following the announcement, reflects investor confidence and the strategic foresight driving AMD’s AI expansion agenda.