Beta serves as a metric indicating a stock’s volatility concerning the overall market. In essence, a beta of 1.0 signifies parity with the market, such as the S&P 500 Index.

A figure surpassing 1.0 implies heightened stock volatility compared to the broader market, while a value below 1.0 suggests the opposite. Low-beta stocks present several advantages for portfolios, including defensive attributes.

They can contribute to portfolio stabilization when paired with high-beta stocks, fostering a balanced risk profile. Among the three low-beta stocks that stand out – Interactive Brokers IBKR, Elevance Health ELV, and Consolidated Edison ED – investors seeking a cautious strategy may find them compelling.

Alongside reduced volatility, all three stocks boast favorable Zacks Ranks, indicating optimism among analysts. Let’s delve deeper into each of these low-beta stocks.

Analyzing Elevance Health’s Consistent Earnings Surpass

Elevance Health functions as a health benefits provider, assisting consumers, families, and communities in achieving healthier lives throughout their care journey. Garnering a promising Zacks Rank #2 (Buy), ELV has witnessed an upward trend in earnings expectations.

Investors welcomed ELV’s recent quarterly performance, leading to a notable stock price increase post-earnings. Elevance exceeded the Zacks Consensus EPS estimate by 1% and reported sales slightly below the anticipated figures.

With a 12.5% year-over-year earnings growth and a 1% sales increase, the company’s financial performance has been commendable. The chart below illustrates Elevance Health’s quarterly revenue.

Image Source: Zacks Investment Research

Interactive Brokers: Surpassing the S&P 500

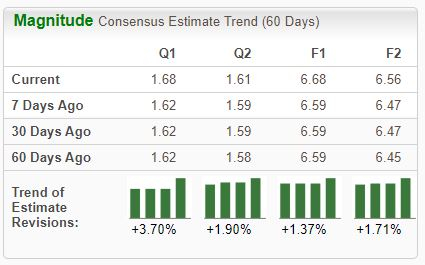

Interactive Brokers Group functions as a global electronic market maker and broker. Witnessing positive revisions in expectations across the board has propelled the stock to a favorable Zacks Rank #2 (Buy).

Noteworthy is the stock’s remarkable outperformance over the last couple of years, with a significant 125% value increase compared to the S&P 500’s 50% surge. The company has reaped benefits from increased trading activity in recent years.

Image Source: Zacks Investment Research

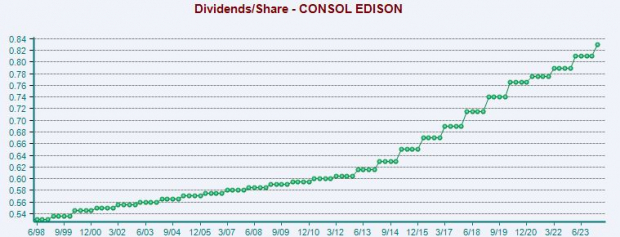

Consolidated Edison: Rewarding Shareholders Continuously

Consolidated Edison, currently holding a Zacks Rank #2 (Buy), functions as a diversified utility holding company with involvement in regulated and unregulated businesses. The company has consistently outperformed earnings estimates by an average of 6% across its last four releases.

Income-oriented investors might find ED shares appealing, offering a substantial 3.8% annual yield. With a 2% five-year annualized dividend growth rate, the company showcases evident dividend expansion trends.

Demonstrating a shareholder-friendly disposition, the company’s behavior towards shareholders is highlighted in the chart below.

Image Source: Zacks Investment Research

Concluding Thoughts

Low-beta stocks offer various advantages for portfolios, including defensive attributes and risk balance. The trio of low-beta stocks discussed – Interactive Brokers IBKR, Elevance Health ELV, and Consolidated Edison ED – stands out for their potential value.

Furthermore, with favorable Zacks Ranks signaling positive analyst sentiment, these stocks present an enticing option for investors exploring a more cautious investment approach.