Synopsys’ Strategic Partnerships Fuel Growth

Synopsys (SNPS) has witnessed a remarkable 15.7% surge in its shares year-to-date, outpacing the 15% growth of the Zacks Computer – Software industry. This trend can be attributed to Synopsys’ foray into the realm of artificial intelligence (AI) through collaborations with key players in the AI chip sector.

Over the past year, SNPS has been doubling down on enhancing its AI portfolio, with partnerships inked with tech giants like Intel, Advanced Micro Devices (AMD), and Microsoft. This strategic move underscores Synopsys’ commitment to innovation and market relevance in the dynamic tech landscape.

Expanding Portfolio with Multi-Die Reference Flow

The recent expansion of Synopsys’ portfolio unveils the launch of a production-ready multi-die reference flow that integrates its Synopsys.ai EDA suite, IP, and the 3DIC Compiler, featuring the incorporation of Synopsys 3DSO.ai within the compiler.

This innovative reference flow significantly streamlines the fabrication process for multi-die designs from the initial silicon stage to the final product. Notably, the integration of the 3DIC Compiler optimizes signal integrity, power efficiency, thermal performance, and overall system efficacy.

Moreover, this cutting-edge design flow is set to be integrated into Intel Foundry’s embedded multi-die interconnect bridge packaging platform, amplifying SNPS’ market position and strengthening its collaboration with Intel. The adoption of this enhanced design flow by Intel is poised to propel the sales of Synopsys’ AI-infused products, including Synopsys 3DSO.ai and Synopsys.ai EDA suite.

Market Expansion and Competitive Landscape

Embracing the burgeoning AI market, Synopsys is capitalizing on the projected 28.46% CAGR of the AI sector from 2024 to 2030, as per a Statista report. This aggressive market approach has seen SNPS unveil a host of cutting-edge hardware and software solutions to support AI advancements, including the recent launch of Polaris Assist – an AI-based application security assistant.

Despite its innovative strides, Synopsys faces intense competition in the AI realm, which poses challenges to its growth trajectory. Furthermore, macroeconomic uncertainties and currency fluctuations amid global geopolitical tensions add to the company’s operational complexities.

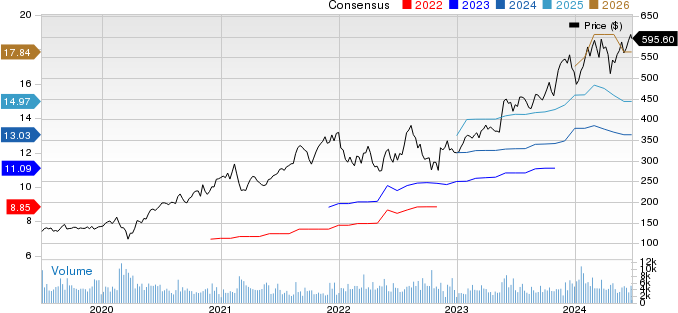

On a brighter note, the latest multi-die reference flow launch reinforces Synopsys’ foothold in the chip manufacturing domain and deepens its ties with key partners like Intel. As SNPS continues to push the boundaries of AI integration in its offerings, the tech sector eagerly observes the evolution of this Zacks Rank #3 (Hold) entity. The Zacks Consensus Estimate for Synopsys’ third-quarter 2024 earnings stands at $3.26 per share, reflecting stable expectations in the past month.