Former President Donald J. Trump recently addressed his supporters, declaring victory in the contentious 2024 election. While several major networks had yet to call the race in the wee hours of Wednesday morning, Trump won key battleground states, including pivotal Pennsylvania. With its 19 electoral votes in the bag, it appears that his second term is all but a foregone conclusion.

Assuming no shocking or extraordinary developments, Trump’s strong support of the fossil-fuel industry could help boost enterprises like Exxon Mobil Corp XOM. Indeed, entrepreneur Mark Cuban blasted the former reality television star for being loyal to “his oil company cronies” at the expense of the American public via high inflation. Still, another go at the White House should benefit the “black gold” industry.

To be fair, higher production of hydrocarbon assets could pressure prices. Notably, one of the recent upward catalysts of oil prices was OPEC+’s decision to postpone an anticipated production increase. However, it’s also fair to point out that under a Kamala Harris administration, the domestic oil industry may have lagged in favor of green energy alternatives.

In September, the valuation of solar companies swung higher following the presidential debate between Trump and Harris. Following a poor performance by the former president – in which he made controversial remarks that were heavily criticized and ridiculed – momentum swung toward the Democrat. Now, the pendulum seems to have swung firmly into the Republican candidate’s court.

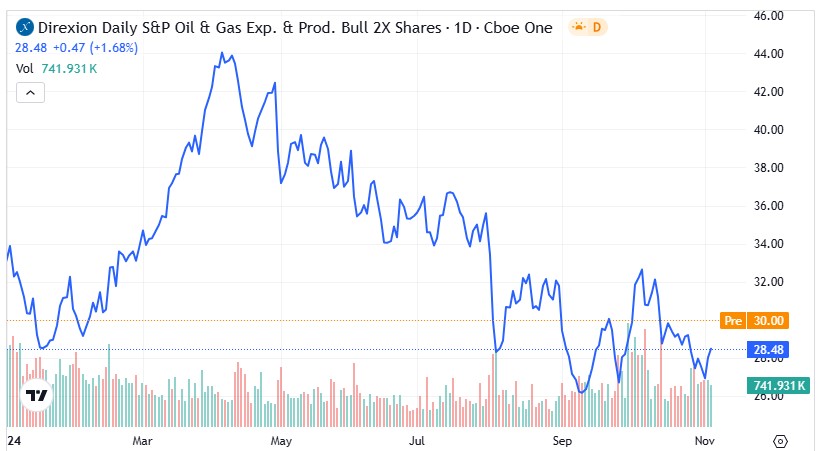

The Direxion ETFs: With fossil fuels back in vogue, investors wanting to speculate on the turn of events may consider two exchange-traded funds. First, the Direxion Daily S&P Oil & Gas Exp. & Prod. Bull 2X Shares GUSH offers a compelling canvas for highly optimistic traders. Per its prospectus, GUSH seeks the daily investment results of 200% of the S&P Oil & Gas Exploration & Production Select Industry Index.

On the other hand, investors who are skeptical about the rise in fossil fuels may consider the Direxion Daily S&P Oil & Gas Exp. & Prod. Bear 2X Shares DRIP fund. DRIP offers an identical leverage to that of GUSH. Of course, the difference is that the bear fund is an inverse ETF: as the underlying index falls in value, DRIP rises and vice versa.

It’s critical to realize that both ETFs can be incredibly choppy. Furthermore, interested parties must never hold a position in either ETF for a period lasting longer than one day. Otherwise, the daily compounding of volatility could lead to valuation decay.

The GUSH ETF: Thanks in part to growing momentum among Democrats prior to the election, the GUSH ETF has declined more than 14% since the beginning of this year.

- Fundamentally, Trump being on the verge of victory may translate to a reversal in technical sentiment for the 2X-leveraged oil ETF.

- Since September, GUSH has been printing a series of rising lows, which may have been a clue regarding the market’s electoral expectations.

The DRIP ETF: While DRIP was slightly below parity on a year-to-date basis, it gained almost 24% in the past six months as Harris chipped away at Trump in the polls.

- With Harris having no real pathway to victory, the underlying oil index may rise, which would be negative for DRIP.

- The inverse ETF’s inability to convincingly break above the resistance level at $12 apparently represented a harbinger.

Featured photo by John R Perry on Pixabay.

Market News and Data brought to you by Benzinga APIs