As Wall Street eagerly awaits Thursday’s inflation readings, investors are playing their hands cautiously.

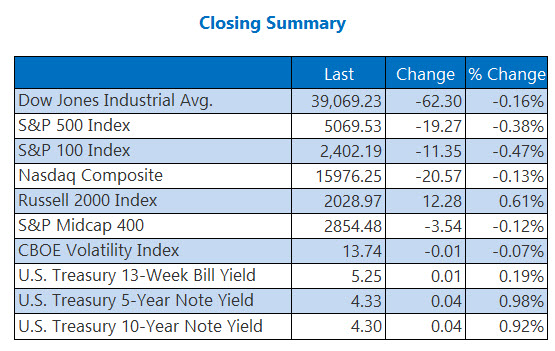

The midday performance remained subdued, with the Dow and S&P 500 taking a slight step back from their record highs, disrupting their three-day winning streaks. Additionally, the Dow welcomed Amazon.com (AMZN) as a new member, replacing Walgreens Boots Alliance (WBA). Meanwhile, the Nasdaq, dominated by tech stocks, dipped as the 10-year Treasury note surged to 4.301%.

Looking back into history, such fluctuations often preceded pivotal economic data releases, signaling a market anxiously perched on the precipice of potential ramifications.

5 Key Developments Today

- The Federal Trade Commission (FTC) has intervened, seeking to halt the whopping $24.6 billion merger of Kroger (KR) and Albertsons (ACI).

- The U.S. Treasury recently conducted its largest-ever auction of 5-year notes, garnering significant attention from market analysts.

- Meta Platforms Inc. emerges as a top choice among call traders, further solidifying its market presence.

- Gap stock experiences a surge following a favorable rating upgrade, highlighting the impact of analyst recommendations on market sentiment.

- Alcoa stock registers a decline post-billion-dollar merger, showcasing the inherent risks associated with major corporate consolidation.

Oil Prices Bounce Back from Weekly Loss

Oil prices witnessed a rebound today, recouping losses from the previous week as traders carefully evaluated the supply and demand landscape. Notably, April-dated West Texas Intermediate (WTI) crude saw a gain of 1.4%, closing at $77.58 per barrel for the session.

On the flip side, gold prices experienced a decline ahead of the imminent inflation data release. The April-dated gold price dropped by 0.5%, settling at $2,038.90 per ounce by day’s end.