Fintel reports that on November 8, 2024, Stephens & Co. initiated coverage of Pyxis Oncology (NasdaqGS:PYXS) with a Overweight recommendation.

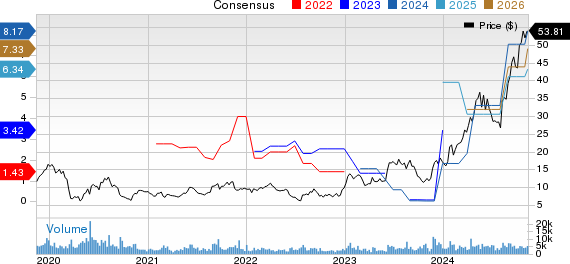

Analyst Price Forecast Suggests 112.02% Upside

As of October 22, 2024, the average one-year price target for Pyxis Oncology is $9.35/share. The forecasts range from a low of $7.07 to a high of $12.60. The average price target represents an increase of 112.02% from its latest reported closing price of $4.41 / share.

See our leaderboard of companies with the largest price target upside.

The projected annual revenue for Pyxis Oncology is 0MM, a decrease of 100.00%. The projected annual non-GAAP EPS is -2.44.

What is the Fund Sentiment?

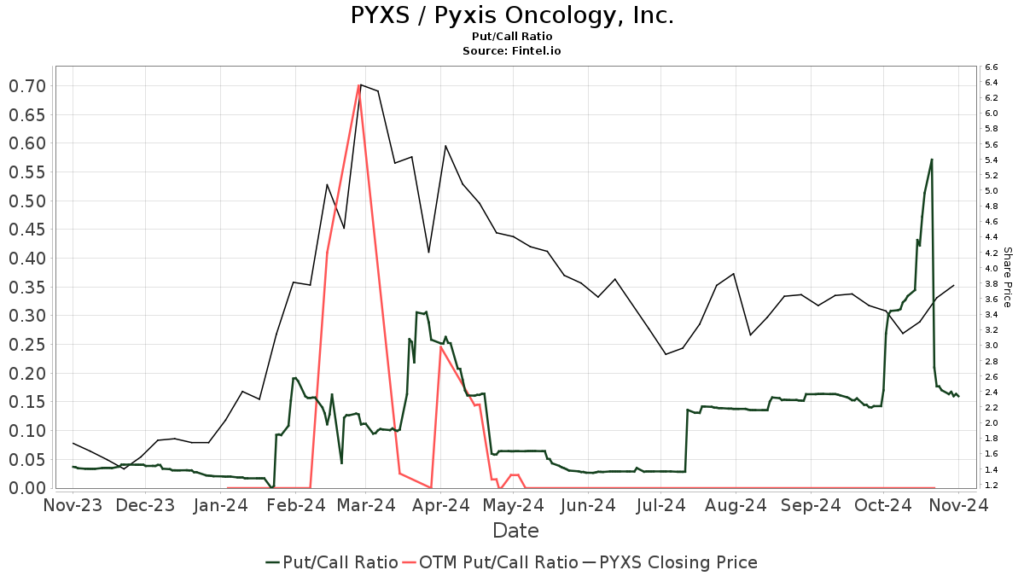

There are 149 funds or institutions reporting positions in Pyxis Oncology. This is an increase of 44 owner(s) or 41.90% in the last quarter. Average portfolio weight of all funds dedicated to PYXS is 0.06%, an increase of 20.99%. Total shares owned by institutions increased in the last three months by 22.03% to 29,726K shares.  The put/call ratio of PYXS is 0.22, indicating a bullish outlook.

The put/call ratio of PYXS is 0.22, indicating a bullish outlook.

What are Other Shareholders Doing?

Deep Track Capital holds 4,184K shares representing 7.04% ownership of the company. No change in the last quarter.

Laurion Capital Management holds 3,861K shares representing 6.50% ownership of the company. No change in the last quarter.

Balyasny Asset Management holds 2,563K shares representing 4.31% ownership of the company. In its prior filing, the firm reported owning 2,594K shares , representing a decrease of 1.22%. The firm decreased its portfolio allocation in PYXS by 23.09% over the last quarter.

Ikarian Capital holds 1,662K shares representing 2.80% ownership of the company. No change in the last quarter.

Millennium Management holds 1,337K shares representing 2.25% ownership of the company. In its prior filing, the firm reported owning 583K shares , representing an increase of 56.39%. The firm increased its portfolio allocation in PYXS by 93.16% over the last quarter.

Pyxis Oncology Background Information

(This description is provided by the company.)

Pyxis Oncology, Inc. is a preclinical oncology company focused on developing an arsenal of next-generation therapeutics to target difficult-to-treat cancers and improve quality of life for patients. Pyxis develops its product candidates with the objective to directly kill tumor cells, and to address the underlying pathologies created by cancer that enable its uncontrollable proliferation and immune evasion. Since its launch in 2019, Pyxis has developed a broad portfolio of novel antibody drug conjugate, or ADC, product candidates, and monoclonal antibody, or mAb, preclinical discovery programs that it is developing as monotherapies and in combination with other therapies.

Fintel is one of the most comprehensive investing research platforms available to individual investors, traders, financial advisors, and small hedge funds.

Our data covers the world, and includes fundamentals, analyst reports, ownership data and fund sentiment, options sentiment, insider trading, options flow, unusual options trades, and much more. Additionally, our exclusive stock picks are powered by advanced, backtested quantitative models for improved profits.

This story originally appeared on Fintel.