As we navigate through the tumultuous waters of the 2024 earnings season, one company that has caught everyone off guard is the renowned coffee giant, Starbucks (NASDAQ: SBUX). The recent financial report from Starbucks revealed a worrisome decline in both foot traffic and comparable-store sales, causing a significant tumble in its stock price. Year to date, shares have plummeted by a staggering 25%, while the broader S&P 500 index boasts a robust 9% increase.

A Steep Decline in Transactions and Consumer Discontent with Price Hikes

The latest quarterly performance of Starbucks paints a grim picture. Global comparable-store sales dropped by 4% year over year, a stark contrast to the 5% growth seen in the previous quarter. Notably, North American comparable sales slumped by 3%, while China, the brand’s second-largest market, witnessed a concerning 11% decline in comps. This metric is crucial for a retail entity, and Starbucks faced significant repercussions in the stock market following these disappointing figures.

In North America, consumer dissatisfaction with Starbucks’ price increases has become apparent. With prices reaching $5 or more per drink in various locations, patrons are opting for more economical alternatives, shifting towards home-brewed coffee options. This behavioral change is evident in the data, with North American per-ticket prices rising by 4% year over year while total transactions plummeted by 7%.

China, on the other hand, presents a fierce battleground for Starbucks, as it grapples with intense competition from budget-friendly chains like Luckin Coffee. The cutthroat market dynamics in China manifested in an alarming 11% decline in comparable sales for Starbucks in the first quarter. In comparison, Luckin Coffee alone opened a staggering 2,342 stores in China during the same period, flooding the market with coffee shop options and creating a substantial threat to Starbucks’ market share.

Furthermore, Starbucks is contending with persistent wage inflation, eroding its margins. Operating expenses at its stores rose by 2.4% year over year, while revenue saw a 1.8% decline, leading to operating margin contraction from 15.2% to 12.8% compared to the previous year.

Short-Term Hurdles or Long-Term Woes?

Every company faces rough patches, but the crucial question for investors is whether Starbucks is grappling with transient setbacks or entrenched challenges that could jeopardize its future standing. Delving deeper into each market segment sheds light on the correct course of action.

In North America, the surge in food costs has impacted consumer spending patterns at restaurants, with coffee aficionados altering their consumption habits as well. Addressing this issue is within Starbucks’ capabilities – a moderation in rapid price escalations is imperative. Moreover, the company is not experiencing cost pressures from its products; in fact, product and distribution costs decreased by 5.5% in the first quarter. Therefore, a pause in price hikes is essential for regaining consumer trust in its primary market.

Nevertheless, curbing price hikes might hinder revenue growth and profit margins for Starbucks in the foreseeable future. The company has historically leveraged price increases to fuel comparable sales growth, but this strategy might encounter headwinds amidst the current climate of diminishing consumer spending on dining out.

Meanwhile, Starbucks faces a more formidable challenge in China, where market saturation caused by a proliferation of coffee shops could impede the company’s growth trajectory. While Starbucks aims to maintain its premium brand status in the region, escalating competition poses a formidable obstacle to its expansion plans.

Attractively Priced, Yet Rife with Uncertainty

Presently, Starbucks trades at a price-to-earnings ratio of 20, lower than the S&P 500 average of 27 and one of the lowest levels witnessed by the company in recent years. If history repeats itself, with sustained revenue growth, robust margins, and an expanding store network, investing in Starbucks stock could prove lucrative.

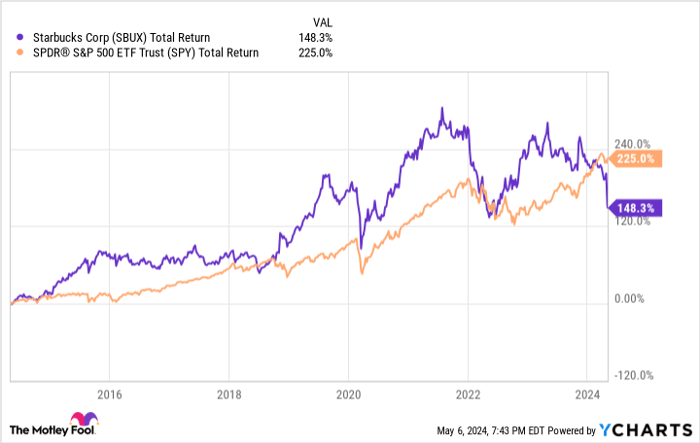

However, prospective investors must acknowledge the brewing storm on the horizon. Starbucks might have reached a saturation point with price hikes, and the rapidly saturating Chinese market poses a formidable challenge to its growth trajectory. Despite the seemingly attractive valuation, Starbucks finds itself in a precarious position that may persist for an extended period, possibly continuing to underperform the broader market as it has done over the past decade.

Investing in Starbucks: A Cause for Pause

Before diving into Starbucks stock, cautious deliberation is prudent. The renowned Motley Fool Stock Advisor analyst team recently disclosed their top picks for investors, and Starbucks did not make the list. The selected stocks carry the potential for substantial returns in the forthcoming years, unlike the current predicament of Starbucks.

Reflect on the historical success stories, like Nvidia’s inclusion in the list back in 2005, where a $1,000 investment at the recommendation would have grown to a staggering $550,688. The Stock Advisor service provides a roadmap to financial success, offering portfolio-building guidance, regular analyst updates, and two new stock recommendations monthly. Since 2002, the service has outperformed the S&P 500 by a significant margin.

As Starbucks contends with a confluence of challenges, investors are urged to tread cautiously and evaluate the broader investment landscape before committing funds to Starbucks, considering the current headwinds impacting the coffee giant’s growth prospects.

*Stock Advisor returns as of May 6, 2024