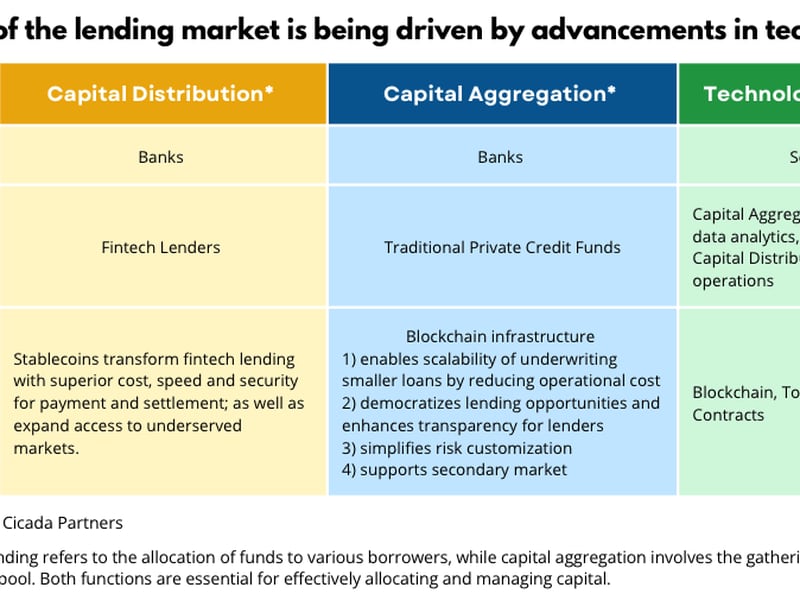

Lending markets have undergone a significant evolution, moving away from traditional bank-focused structures toward a more diverse and technologically advanced ecosystem. This transformation has been particularly prominent since the aftermath of the Global Financial Crisis (GFC) and continues to reshape the landscape of capital aggregation and distribution.

Despite these advancements, the current market structure faces substantial friction. However, we firmly believe that by integrating blockchain technology into the existing financial framework, the efficiency of capital flows can be improved while expanding access to a broader base of participants.

You’re reading Crypto Long & Short , our weekly newsletter featuring insights, news and analysis for the professional investor. Sign up here to get it in your inbox every Wednesday.

Blockchain-Enhanced Capital Distribution

The waning influence of traditional banks in capital distribution post-GFC has paved the way for fintech lending companies like SoFi and Ramp. These firms are filling the void with innovative solutions such as buy now pay later (BNPL) options, leveraging online platforms, data analytics, and machine learning.

However, persistent issues such as archaic payment systems and SME funding gaps can be addressed with the help of stablecoins. Stablecoins have the potential to revolutionize fund disbursement, offering superior cost and speed. By leveraging stablecoins, fintechs can tap into new markets with limited access to conventional banking services, providing more accessible and efficient financial solutions on a global scale.

The $150 Trillion Opportunity

Post-GFC, private credit has flourished, growing to $1.6 trillion and becoming a competitive source of large-scale financing. Yet, compared with the state of innovation in capital distribution, the growth of capital aggregation has historically been hindered by manual processes and numerous intermediaries. Tokenization can streamline and automate these intensive operational processes, making it more economically viable to underwrite smaller loans and democratizing investment opportunities. Other benefits include improved transparency, secondary liquidity, and simplified risk customization enabled by the programmability of smart contracts.

According to recent research by Bain & Co, alternative investments are underrepresented in individuals’ portfolios, with individuals owning 50% of global wealth but only allocating 5% to alternatives. Bain presents a clear case that tokenization can help the private markets industry tap into the $150 trillion individual investor segment, potentially unlocking $400 billion in additional annual revenue for the alternatives industry.

Outlook for Blockchain-Based Credit Ecosystem

- Expand the Role of Stablecoins in Capital Distribution: In 2023, companies like Visa, Mastercard, and Checkout.com integrated stablecoins with various applications. In 2024, broader adoption in global payments is anticipated, encouraged by increasing regulatory clarity in jurisdictions such as Hong Kong and the UK. A key development in this area is stablecoin-based lending services, expected to be particularly impactful in regions where traditional bank financing is inefficient or scarce.

- Tokenization in Alternative Asset Funds: Over the past year, pioneers like Hamilton Lane and KKR adopted tokenization strategies to attract individual investors by reducing costs and lowering minimum subscription amounts. Looking ahead to 2024, more private credit funds are expected to explore the advantages of tokenization and optimize capital aggregation using blockchain technology, while private credit lending solutions on DeFi continue to grow, addressing financing gaps in the real economy.

In conclusion, blockchain technology, through innovations like stablecoins and tokenization, is pivotal in advancing efficiency and access to capital markets.