Whales of the investment world have showcased their bullish proclivities towards Cameco, with intriguing implications for retail traders eyeing the stock. The high-stakes maneuvering in Cameco, identified through Benzinga’s meticulous tracking of public options data, hints at a narrative pregnant with possibility. While the architects of these maneuvers remain shrouded in mystery, significant shifts in CCJ typically hint at a behind-the-scenes dance with privileged insights.

Setting the stage, Benzinga’s options scanner has flagged 11 distinctive options trades revolving around Cameco – an anomaly worth meticulous scrutiny for those in the trading arena.

The prevailing sentiment among these financial magnates is a tale of two halves, bifurcated between 81% bullish and 18% bearish ideologies. Within this intricate web of options, a solitary put looms at $25,810, dwarfed by the grandeur of 10 calls ringing in at an astounding $997,051.

Decoding Projected Price Horizons

A keen inspection of Volume and Open Interest on these contracts unravels a scripted saga – one that casts a spotlight on whales fixated on a pricing spectrum spanning $35.0 to $48.0 for Cameco over the bygone 3-month vista.

Tides of Volume & Open Interest

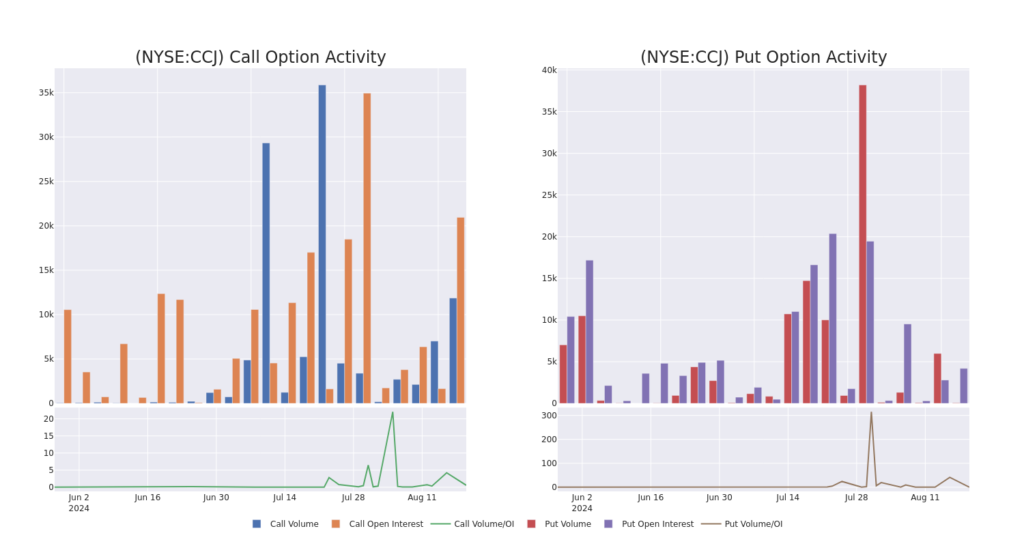

Steering the ship towards liquidity metrics and overarching interest, the average open interest for Cameco’s options trades stands at 2794.11, with a combined volume tally of 11,922.00 – rendering a picture of bustling market activity.

In the ensuing graphical exposition, the trajectory of volume and open interest surrounding both call and put options for Cameco’s high-stakes trades, delineated within a strike price domain of $35.0 to $48.0, unfolds across the past 30 sunsets.

Delving into Cameco’s Option Rendezvous: Last Month’s Edition

Parade of Premier Options

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CCJ | CALL | TRADE | BULLISH | 09/20/24 | $0.42 | $0.25 | $0.38 | $48.00 | $190.0K | 13.0K | 5.0K |

| CCJ | CALL | SWEEP | BULLISH | 09/20/24 | $1.49 | $1.48 | $1.49 | $43.00 | $177.7K | 1.0K | 54 |

| CCJ | CALL | TRADE | BULLISH | 10/18/24 | $1.62 | $1.5 | $1.62 | $45.00 | $162.0K | 82 | 1.0K |

| CCJ | CALL | SWEEP | BULLISH | 11/15/24 | $2.3 | $2.29 | $2.29 | $45.00 | $145.4K | 679 | 660 |

| CCJ | CALL | SWEEP | BULLISH | 10/18/24 | $0.88 | $0.87 | $0.88 | $48.00 | $121.4K | 14 | 1.3K |

Decoding the Essence of Cameco

Cameco Corp emerges as a vital cog in the global quest for uranium aimed at generating clean, unwavering baseload electricity across borders. Anchored by three key segments – uranium, fuel services, and Westinghouse – the company predominantly sails on the revenues derived from its Uranium Segment. Notable projects like Millennium, Yeelirrie, Kintyre, and Exploration dot Cameco’s landscape, with operational footprints spanning Canada, Kazakhstan, Germany, Australia, and the United States.

Having sifted through the enigmatic dance of options trades surrounding Cameco, our gaze now shifts to the company itself, offering a panoramic glimpse into its existing market stance and performative mettle.

Navigating Cameco’s Current Market Terrain

- Attracting a bustling volume of 1,643,103, Cameco’s share price chalks up a 0.44% leap, anchoring itself at a firm $41.4.

- Signals relayed by RSI metrics hint at a possible march towards oversold territories by the stock.

- An impending earnings revelation sets the clock ticking, with the grand reveal slated in 70 sunrises.

Insights from the Maven Minds on Cameco

In the recent moonlit epoch, 2 savants unfurled their ratings on this stock, casting a lens towards an average target price of $71.865.

- Standing their ground, an expert torchbearer from Scotiabank clutches onto an Outperform rating for Cameco, illuminating a price target lofting at $80.

- Mirroring caution, a sage from GLJ Research steps back, relegating its rating to Buy, anchoring its price prognosis at $63.

Options trading, a realm fraught with perils and prospects in equal measure, beckons intrepid navigators to don their astute capes. A prudent playbook entails a zealous dedication to continual education, flexible strategy pivots, multilayered indicator vigilance, and an unwavering fixation on the ebbs and flows of the market. Stay abuzz with the latest revelations from Cameco’s options escapades through real-time alerts sculpted by Benzinga Pro.