The S&P 500 surged past the 5000 level, riding a wave of optimism about six expected rate cuts by the Federal Reserve this year. On Friday, the index eclipsed the record-breaking threshold. This bullish momentum has been supported by the Bureau of Labor Statistics reporting that the Consumer Price Index for the final quarter of 2023 remained stagnant at 3.3%. Attention now turns to the upcoming release of January’s CPI data, anticipated to show a slowdown in the yearly headline inflation rate from December’s 3.4% to 3%.

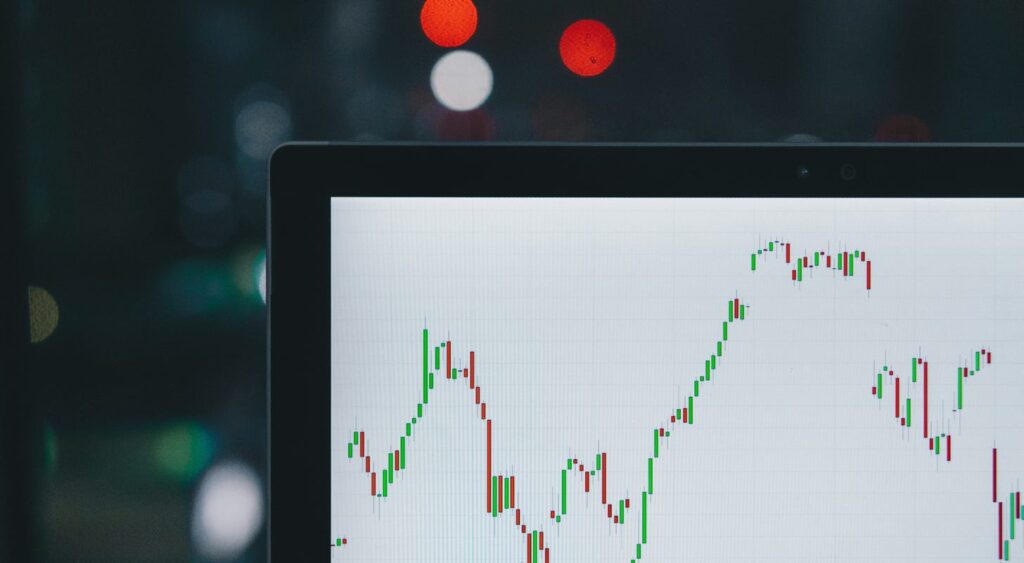

The relentless climb of the stock market since Jan. 19 has steered it to unprecedented highs, with the Magnificent Seven leading the way, as five mega-cap stocks reach new peaks. However, despite the upward trajectory, caution looms as both the S&P 500 and the SPDR S&P 500 (SPY) have stepped into overbought territory, hinting at an imminent short-term pullback.

Experienced traders looking to capitalize on SPY’s bull or bear movements may consider the Direxion ETFs as an option. The Direxion Daily S&P 500 Bull 3X Shares (SPXL) caters to bullish traders, while the Direxion Daily S&P 500 Bear 3X Shares (SPXS) is for those with a bearish outlook. These leveraged funds are meant for short-term trading, not long-term investment.

The SPY’s relative strength index (RSI) soared near the 72% area, signifying that the ETF has entered overbought territory. When an RSI crosses the 70% mark, it typically acts as a sell signal for short-term technical traders.

- The SPY has been tracing a steep uptrend since Oct. 27, consistently forming higher highs and higher lows on the daily chart. The most recent higher low was recorded on Jan. 31, and the latest confirmed higher high on Jan. 29.

- An impending higher low is expected due to the SPY’s elevated RSI and declining volume, indicating a waning bullish sentiment. For bullish traders, the focus will shift to the lower ascending trend line of the ascending channel pattern for a bounce during the next retracement.

- Conversely, bearish traders anticipate strong bearish volume to breach the bottom trend line of the rising channel, potentially triggering a longer-term retracement. If this occurs, the 50-day simple moving average might provide temporary support.

- Key resistance levels for the SPY are at $500 and $505, while crucial support exists at $496.05 and $491.42.