Market Highlights and Insights

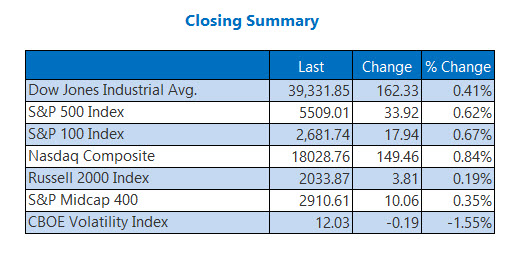

The bellwether S&P 500 index triumphed over the 5,500 milestone, sending waves of enthusiasm rippling through the markets. Both the Nasdaq and Dow Jones Industrial Average surged by triple digits on Tuesday fueled by an uptick in investor sentiment.

Market Performance Analysis

Investors eagerly absorbed Federal Reserve Chair Jerome Powell’s insights on inflation, painting a picture of progress in the nation’s economic fabric. Powell’s comments hinted at a posture of cautious optimism, with the central bank holding steady on interest rates for now.

Stock Movements and Records

Treasury yields found a moment of respite, mirroring the shift in dynamics, while technology behemoth Nvidia (NVDA) witnessed a cooling-off trend. Tech giant Apple (AAPL) surged to a fresh record high, adding to the day’s exuberance.

Current Market Landscape

Amidst this backdrop, analysts weighed in on the prospects of cloud-based software stocks and identified three solar stocks with compelling entry points. The day also witnessed notable movements in the construction sector and captivating merger-and-acquisition talks in the streaming space.

Insights and Expectations

As the markets continue to ebb and flow, it’s essential to track the pulse of various industries and gauge their performance against the backdrop of evolving economic narratives.

5 Key Developments Today

- The FDA granted approval to Eli Lilly’s (LLY) Alzheimer’s drug donanemab, signaling a breakthrough in healthcare innovation.

- The FTC intervened to halt Tempur Sealy’s (TPR) proposed $4 billion acquisition of Mattress Firm, citing concerns over competitive landscapes.

- Downgrades hit the construction sector as risk-reward dynamics came under closer scrutiny.

- Excitement brewed in the streaming sector as merger discussions fueled market buzz.

- A mid-year reflection on the S&P 500 provides valuable insights into the market’s trajectory over the past six months.

Oil Markets and Precious Metals

Despite the impending U.S. holiday and potential disruptions from Hurricane Beryl, oil prices closed lower. August’s West Texas Intermediate (WTI) crude slid by 0.7% to settle at $82.81 per barrel.

Powell’s comments on inflation tugged gold futures downwards, with eyes set on upcoming job data releases. August’s gold futures witnessed a modest 0.2% decline, settling at $2,335.30 per ounce.