Wall Street Heavyweights and Their Say on Salesforce.com

Investors often turn to analyst recommendations when pondering over their investment decisions. The brokerage recommendations can significantly impact a stock’s price, but are they truly reliable?

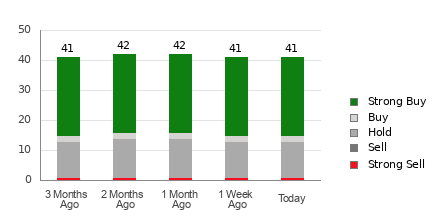

At present, Salesforce.com (CRM) boasts an Average Brokerage Recommendation (ABR) of 1.73, falling between Strong Buy and Buy on a scale from 1 to 5. This rating is based on the collective suggestions of 41 brokerage firms, with a majority tipping towards Strong Buy.

The Murky Waters of Brokerage Recommendations

While the ABR for Salesforce.com looks appealing on the surface, placing complete faith in it might not be wise. Studies have shown that brokerage recommendations, often tainted by the vested interests of the firms they represent, hold little weight in guiding investors towards lucrative stock picks.

The positive bias of brokerage analysts towards the stocks they cover is glaring, with a ratio of five “Strong Buy” recommendations for every “Strong Sell.” Such skewed ratings, driven by institutional interests, often fail to align with the actual market sentiments.

Exploring Alternative Investment Tools

For investors seeking a more reliable compass in the investment realm, tools like the Zacks Rank come into play. This proprietary stock rating system, backed by audited performance records, segments stocks into different categories ranging from Strong Buy to Strong Sell.

Unlike the brokerage recommendations, the Zacks Rank derives its insights from earnings estimate revisions, offering a more grounded perspective on a stock’s potential performance. The correlation between earnings trends and stock price movements underscores the pragmatic approach of this model.

Deciphering the Numbers for Salesforce.com

Amidst the buzz surrounding Salesforce.com, the Zacks Consensus Estimate for the current fiscal year stands at $9.71, holding steady over the past month. Such stability in analyst forecasts could indicate a moderate trajectory for the stock in the near term.

Based on the recent adjustments in consensus estimates and other pertinent factors, Salesforce.com currently holds a Zacks Rank #3 (Hold), marking a cautious outlook in light of the Buy-equivalent ABR.