Deciding to invest in a stock often involves analyzing analyst recommendations. While these recommendations can sway a stock’s price, their reliability is sometimes questionable. Let’s delve into what renowned institutions on Wall Street are expressing about Commvault Systems (CVLT) before we scrutinize the significance of brokerage suggestions and ways to leverage them effectively.

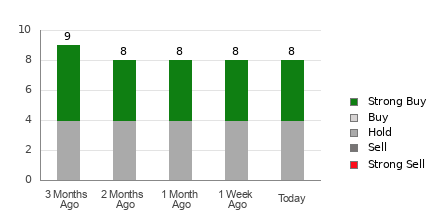

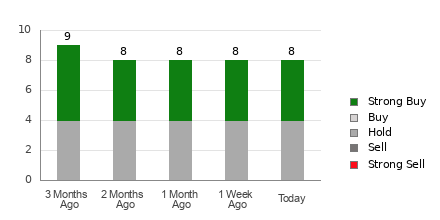

Currently, Commvault holds an average brokerage recommendation (ABR) of 2.00 on the 1 to 5 scale, signifying a Buy sentiment derived from recommendations of eight brokerage firms. Of these recommendations, 50% advocate a Strong Buy.

Breaking Down Brokerage Trends for CVLT

Despite the positive ABR for Commvault, it’s unwise to base your investing decisions solely on this information. Studies show brokerage recommendations have limited success in predicting stock price increases. Why? Analysts often exhibit a strong bias towards positive ratings due to their firms’ interests, skewing their recommendations.

The Zacks Rank, a tool with a robust track record, categorizes stocks from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell), offering insights into a stock’s future price performance. Validating the ABR with the Zacks Rank could facilitate profitable investment decisions.

Evaluating Zacks Rank Against ABR

While both ABR and Zacks Rank use a 1-5 scale, they differ significantly. ABR relies solely on brokerage recommendations, often exhibiting decimals, while Zacks Rank, depicted in whole numbers, is a quantitative model driven by earnings estimate revisions. Unlike brokerage analysts’ overly optimistic ratings, Zacks Rank is propelled by factual earnings revisions, which correlate strongly with stock price movements.

Further, Zacks Rank ensures balance among all covered stocks and promptly reflects earnings estimate revisions, helping investors gauge future price movements accurately.

Is Commvault (CVLT) a Worthwhile Investment?

Considering Commvault’s unaltered Zacks Consensus Estimate at $3.32 for the current year, analysts’ consistent views on the company’s earnings prospects have led to a Zacks Rank #3 (Hold). This stability in consensus estimate indicates potential market performance alignment in the short term.

Given the cautious Zacks Rank #3 (Hold) and the optimistic ABR for Commvault, investors may need to exercise prudence in their investment decisions.

Editor’s Note:

Predicting the market is not an exact science, and investors should always conduct thorough research or consult with financial advisors before making investment choices.