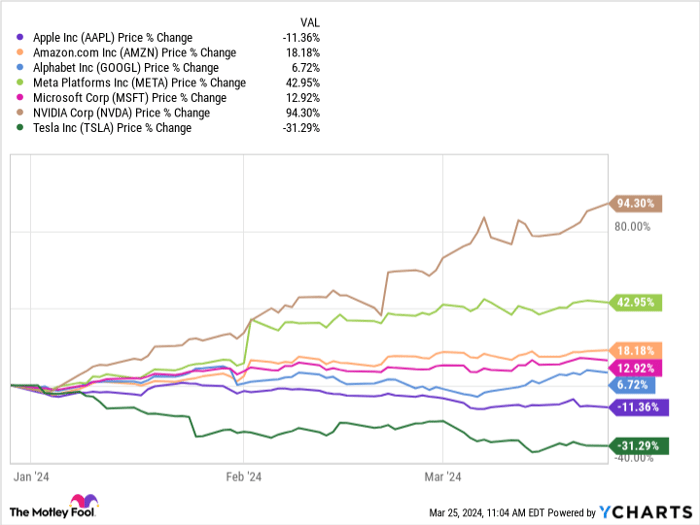

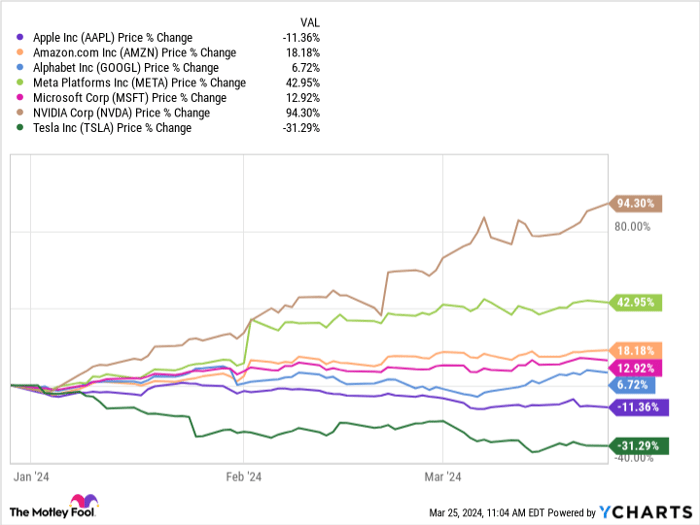

The tech industry’s “Magnificent Seven” have endured a tumultuous year, with Apple (NASDAQ: AAPL) facing a particularly rough patch, only surpassed by Tesla among its peers in this unfortunate category.

Apple’s financial performance has failed to impress investors, and a recent clash with regulatory authorities has further dulled its allure. The question arises: Should investors hold onto Apple stock?

The Antitrust Quandary Revisited

Apple and its peers in the “Magnificent Seven” have long been under the antitrust microscope. Allegations contend that these tech titans have leveraged anticompetitive tactics to secure their dominant market positions, ultimately disadvantaging consumers. On March 21, the U.S. Department of Justice, with support from 16 states, initiated an antitrust suit against Apple, accusing the company of upholding an illicit monopoly in the smartphone realm.

The lawsuit accuses Apple of various misdeeds, such as impeding the seamless exchange of communication between iPhones and other brands, imposing exorbitant fees on app developers through the App Store, and stunting innovation on its platform. These are just a few charges hurled by the DOJ against Apple’s cornerstone: the iPhone.

Stay Composed for Now

The outcome of this legal battle remains uncertain, potentially stretching over years. Fortunately, Apple wields the financial wherewithal to weather such storms, boasting substantial free cash flow. Moreover, the tech giant is no stranger to legal tussles, although this may prove to be one of its most pivotal engagements to date.

So, what’s the prudent course for investors? To borrow from Wall Street parlance, I’d advocate a “hold” stance on Apple stock presently. While divesting shares may not be advisable, caution should be exercised when contemplating augmenting one’s stake post-decline. This recommendation transcends Apple’s legal woes, extended to its apparent lag behind peers in the burgeoning frontier of artificial intelligence (AI).

Apple’s rumored forays into AI notwithstanding, uncertainties shroud the company’s trajectory within this domain. The firm’s legacy of refining existing technologies to achieve resounding success endures, yet its AI market strategy remains nebulous.

Though iPhones, once the primary growth driver, have seen their dominance wane, Apple’s burgeoning services segment, characterized by robust margins, paints a promising picture. Though the company boasts an installed base exceeding 2 billion, the resolution of the DOJ lawsuit could dramatically reshape its ecosystem monetization prospects.

The confluence of these challenges renders Apple a far cry from a compelling buy during this downturn.

Should you invest $1,000 in Apple at this juncture?

Prior to plunging into Apple stock, a pivotal consideration surfaces:

The Motley Fool Stock Advisor team pinpointed what they deem the 10 best stocks for prospective investors, with Apple notably absent from this elite selection. These chosen stocks hold the potential for colossal returns in the ensuing years.

Stock Advisor furnishes investors with a lucid roadmap to success, offering insights on portfolio construction, analyst updates, and two fresh stock picks monthly. Since 2002, the service has eclipsed the S&P 500 return threefold.*

Prosper Junior Bakiny holds no positions in any of the stocks mentioned. The Motley Fool maintains positions in and endorses Apple and Tesla. The Motley Fool abides by a strict disclosure policy.