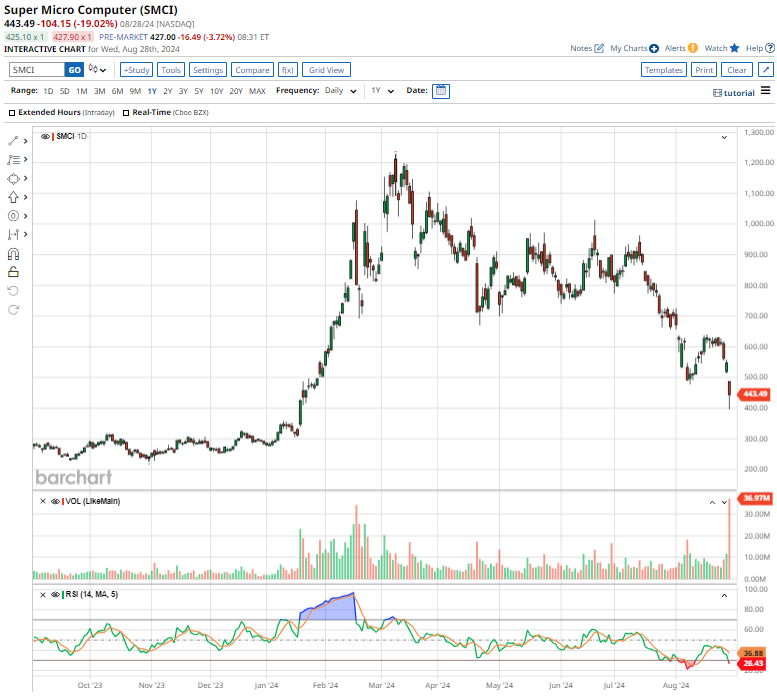

Super Micro Computer, Inc. (SMCI) rode the wave of artificial intelligence (AI) to extraordinary heights, emerging as a top supplier of AI-processing servers. The stock hit an all-time high of $1,229 in March, surpassing the broader S&P 500 Index’s returns, driven by robust revenue and profit growth.

Despite a recent pullback as investors cashed in their winnings, the anticipation surrounding its upcoming 10-for-1 stock split in October has rekindled interest in SMCI. Stock splits often entice investors by lowering share prices, broadening accessibility, and historically leading to substantial share price increases, far outstripping the S&P 500’s typical returns.

Market Volatility Amid Various Factors

Amid this optimism, recent challenges have emerged for SMCI. A report by short seller Hindenburg Research jolted the market, causing a 19% drop in the stock price after the company delayed filing its annual Form 10-K with the SEC.

Yet, despite these hurdles, prominent analysts maintain a cautious optimism towards the AI server company. With SMCI’s stock currently hovering near year-to-date lows, some investors are contemplating whether this could be an opportune moment to enter the market before the pending split.

Exploring Super Micro Computer Stock

Established in 1993 and headquartered in San Jose, Super Micro Computer, Inc. (SMCI) has grown into a tech powerhouse valued at $24.8 billion. Specializing in liquid-cooling server and storage solutions, SMCI provides a range of products catering to enterprise data centers, AI, and cloud computing sectors, fostering a reputation for innovation and personalized customer service.

Despite a recent downturn from its March peaks, SMCI has demonstrated resilience, boasting a 56% gain in 2024 and 73.8% over the past 52 weeks, outperforming the S&P 500 over both time frames.

Earnings Report Impact and Future Outlook

Following a disappointing fiscal Q4 earnings report, SMCI witnessed a sharp decline in its stock price. Despite a significant revenue surge, the company’s earnings per share fell short of expectations, with gross margins shrinking due to higher costs and delays in product shipments.

Looking ahead, management projects a robust rebound in gross margins driven by an improved supply chain. With forecasts indicating substantial revenue growth and earnings per share estimates on the rise, SMCI is positioning itself for a promising future.

Challenges and Opportunities Ahead

Despite recent setbacks, including mounting regulatory scrutiny and short seller allegations, SMCI remains focused on its expansion plans and operational improvements. Management’s strategic initiatives to enhance margins and broaden its global presence signal a proactive approach in overcoming obstacles and fueling future growth.

Super Micro Stock Faces Uncertainty Amid Allegations and Analyst Reactions

Resurfacing Issues Amplify Concerns

Allegations of shady revenue recognition, executive rehiring controversies, and questionable relationships with related parties have once again surfaced around Super Micro stock. The troubles trace back to 2018 when the company got delisted from the Nasdaq due to missing financial filings. Despite a $17.5 million SEC settlement in 2020, concerns escalated as reports surfaced of dubious practices, including the rehiring of scandal-linked executives and close business ties with the CEO’s brothers, who control crucial suppliers.

Raising Eyebrows on Export Practices

Recent reports hint at Super Micro possibly skirting sanctions by increasing exports to Russia. Coupled with customer service issues leading to the departure of major clients such as Nvidia, CoreWeave, and Tesla, the company finds itself in a precarious position with its reputation at stake. The uncertainty surrounding these allegations poses a significant risk to the stock’s growth, potentially fostering volatility and leaving investors cautious about its future prospects.

Analyst Sentiments and Reactions

Following the storm of controversies, investment firms have weighed in on Super Micro stock. Wells Fargo reacted swiftly, slashing the company’s price target from $650 to $375, citing revenue recognition uncertainties and the company’s troubled history. JPMorgan, on the other hand, defended Super Micro, highlighting the limited new evidence brought forth by the Hindenburg report.

Analyst Consensus and Price Targets

Currently, Super Micro holds a consensus rating of “Moderate Buy” among analysts, albeit with a declining bullish sentiment over time. Out of the 13 analysts covering the stock, six rate it as a “Strong Buy,” six as a “Hold,” and one as a “Strong Sell.”

The mean price target for Super Micro stands at $922.54, implying a potential upside of 108% from current levels. However, amidst the accounting delays and uncertainties, the stock’s higher-risk profile warrants caution as investors evaluate their comfort with volatility.