Snowflake SNOW is on the brink of unveiling its performance for the first quarter of fiscal 2025 on May 22.

Diving into the figures, the Zacks Consensus Estimate for revenue sits at a towering $786.95 million, showcasing a robust year-over-year upswing of 26.19%.

As for the bottom line, analysts are eyeing earnings of 17 cents per share, which marks an increment of a cent over the trailing 30 days, translating to a 13.33% year-over-year growth.

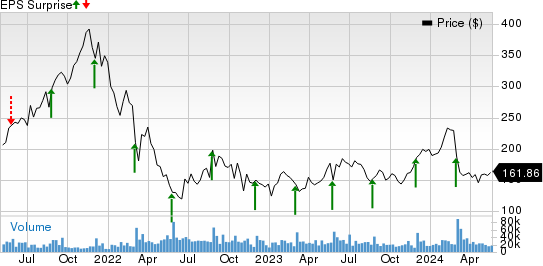

Over the past four quarters, Snowflake has surpassed the Zacks Consensus Estimate for earnings, with an average surprise of a staggering 129.25%.

In a recent downturn, Snowflake shares have dipped by 29.7% since the release of fourth-quarter earnings on Feb 28, 2024, in stark contrast to the broader Zacks Computer & Technology sector delivering a 7.1% return.

A Close Look at Snowflake’s Performance

Nonetheless, despite the recent setback, the allure of Snowflake shares remains intact due to a cutting-edge portfolio, a robust partner network, and an expanding client base.

Snowflake, at present, holds a promising Zacks Rank #2 (Buy) complemented by a Growth Score of A and a Momentum Score of B, making SNOW a compelling investment prospect according to the Zacks methodology.

Snowflake’s Resilience Amidst Turbulent Conditions

Navigating through turbulent economic headwinds, Snowflake has shown resilience despite challenges like sustained inflation impacting customer spending patterns.

The company’s innovative solutions, particularly the Snowpark platform, are anticipated to contribute significantly to product revenues in fiscal 2025, with a projected growth rate of 22% year-over-year, pegged at $3.25 billion.

The growing traction of Snowpark among data scientists and engineers is expected to underpin the company’s revenue growth in the upcoming quarter, with revenue forecasts ranging between $745 million and $750 million, indicating a substantial 26% to 27% year-over-year growth.

Introductions like Cortex and a suite of AI-driven tools are positioned to fortify Snowflake’s revenue streams, with initiatives such as Document AI and Cortex adding to the growth narrative. Moreover, Snowflake’s expansion into government services following the FedRAMP high authorization is set to instill further trust among clientele.

A thriving ecosystem of partners, counting major players like NVIDIA, Microsoft, Amazon, ServiceNow, Cognizant, and Dell Technologies, has propelled Snowflake’s upward trajectory. Strategic collaborations with Microsoft and NVIDIA have opened avenues for leveraging cutting-edge technologies and enhanced data processing capabilities.

The Final Verdict

In conclusion, Snowflake’s robust portfolio, bolstered by innovative solutions like Snowpark, places the company on a trajectory of growth despite external challenges. The strategic partnership landscape further heightens the appeal of Snowflake stock to investors.

For more updates on imminent earnings releases, refer to the Zacks Earnings Calendar.