Exploring SoundHound AI

SoundHound AI specializes in voice AI services, offering automated voice technology for businesses globally. Their expertise lies in multi-language support and top-notch accuracy, evident in partnerships with leading automotive and restaurant brands like Honda and White Castle. The recent collaboration with Nvidia signifies a move towards on-chip AI integration, enabling offline access to SoundHound’s voice technology. This partnership, primarily focusing on automotive systems, leverages the strengths of both companies in the sector.

Analyzing Growth and Profitability

SoundHound AI showcases rapid growth, recording a 47% revenue surge in 2023, with a substantial 80% YoY growth in Q4. The company continues to expand its partnerships, including significant deals with automotive manufacturers and renowned restaurant chains. However, despite its impressive growth trajectory, SoundHound AI faces profitability challenges. With an operating margin of -139% and substantial free cash flow burn in 2023, the company’s path to profitability remains uncertain, compelling a need for strategic financial decisions.

Cautionary Investment Advice

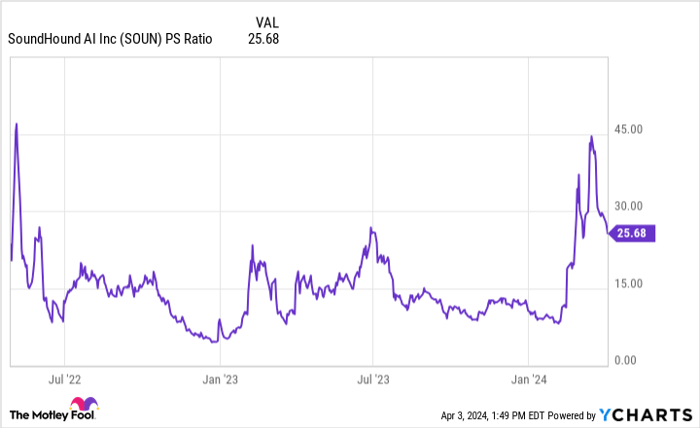

While the allure of voice AI technology is undeniable, investors should exercise caution when considering SoundHound AI stock. Historically, the tech industry witnessed hyped products like Apple’s Siri, Amazon’s Alexa, and Google’s voice assistant without substantial market traction. Given the competitive landscape dominated by tech giants with vast R&D budgets, it remains questionable if SoundHound AI can outpace these industry leaders. Furthermore, the company’s current price-to-sales ratio of 26 indicates a potential overvaluation, warranting prudence in investment decisions.

Final Thoughts on SoundHound AI Stock

Despite the buzz surrounding SoundHound AI and Nvidia’s recent partnership, prudent investors may consider diversifying their portfolios with other growth opportunities. While the company demonstrates promise in the voice AI sector, its financial performance and competitive landscape raise concerns about its long-term sustainability and market competitiveness. With prudent consideration of risk factors and market dynamics, investors can make informed decisions aligning with their investment objectives and risk appetite.