Steady Progress for Schwab (SCHW)

Schwab recently reported its Q1 ’24 financial results, facing challenges due to the inverted yield curve and the need to maintain a competitive 5.35% money market yield for clients. However, the company saw significant growth in net new assets, totaling $88 billion, with a notable portion acquired in March ’24. The net interest margin also increased from 1.89% to 2.02% during Q1 ’24, marking the first sequential revenue increase since Q3 ’22 according to Morningstar.

Despite trading close to its fair valuation, with a model value of $88 and a Morningstar fair value estimate of $73, SCHW is currently below its all-time high of $96 from early February ’22. Trading at 21x expected ’24 EPS and anticipating 9% EPS growth this year, the stock’s potential is yet to fully incorporate future Fed funds rate cuts despite updated EPS projections post-earnings.

One critical factor contributing to Schwab’s undervaluation is the decline in pre-tax margin, dropping from the low 50% range to 37.9% in Q1 ’24 since the Fed started raising rates in early ’22. The path to regaining a 50% pre-tax margin likely hinges on a return to a normal yield curve and a lower Fed funds rate.

Technical Analysis and Future Outlook

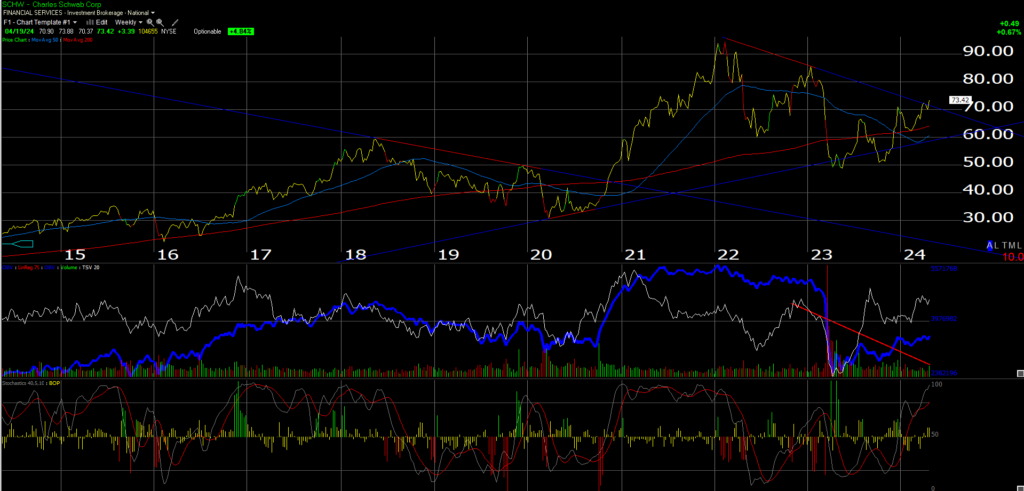

Analysis of SCHW’s weekly chart reveals a potential shift in trend, possibly signaling a positive change post-Q1 ’24 earnings. Schwab’s ability to surpass the $73 technical level, coupled with favorable trading activity post-earnings, suggests an optimistic outlook for the stock’s trajectory. For Schwab, a lower Fed funds rate and a traditionally sloped yield curve are crucial factors to navigate back to its peak performance.

Insights on Schwab’s Evolution and Market Position

Schwab’s strategic moves, including the elimination of management fees and leading the industry shift to commission-free trading, have positioned the company as a top player since post-2008. Amidst evolving market dynamics, Schwab’s historical resilience and adaptive strategies could pave the way for enhanced earnings power, contingent on aligning with the current Fed policies and market conditions.

Exploring Netflix’s Market Behavior

Netflix (NFLX) experienced a market selloff on Friday, April 19th, 2024, influenced by broader technology sector trends rather than intrinsic changes in the company’s fundamentals. Despite the negative sentiment surrounding Netflix’s decision to halt disclosing net paid additions and memberships, the company’s extended data disclosure plan through Q4 ’24 aims to mitigate investor apprehensions over underlying business stability.

While a reduction in US/Canadian market growth is anticipated due to nearing market saturation and intensified password sharing regulations, Netflix’s focus on expanding into new regions like Southeast Asia presents avenues for continued development.

Netflix’s strategic shift towards the advertising business and exploration of live sports integration could potentially impact revenue streams and margin dynamics significantly, indicating a fluid business model adapting to industry demands.

Embracing Market Evolution Amidst Business Changes

The evolving landscape of both Schwab and Netflix underscores the necessity for adaptability within the financial and entertainment sectors. As market forces shape investment strategies and content consumption patterns, investors must remain attuned to the dynamic shifts in these industries, recognizing the importance of forward-looking analysis and strategic foresight in navigating evolving market terrains.

Strategic Shifts in the Streaming Industry Prompt Expectations

Perhaps in a bid to enhance their returns and bolster dwindling market shares, some of the lesser-ranked streaming platforms have reportedly contemplated offloading premium content to the juggernaut that is Netflix. For many avid viewers, such a move cannot come soon enough, with a wealth of desirable content currently eluding the Netflix catalog. Take, for instance, the absence of riveting films such as Tom Hanks’ “Greyhound” on AppleTV, or classic gems like “Das Boot” and “U-571” in the World War II submarine genre. The yearning to access such titles on Netflix, even if it entails a nominal fee, echoes the sentiment of many enthusiasts.

Following the latest earnings report, despite the subdued response from the stock market, Netflix’s earnings per share (EPS) and revenue estimates have seen an upward revision. The trajectory of Netflix’s full-year 2024 EPS estimates over the past five quarters underscores a positive growth outlook, with a notable progression from a 28% year-over-year growth rate in March 2023 to a projected 51% growth rate for the upcoming quarter.

Beyond Expectations: Strengthened Growth Outlook

Netflix navigated through 2022 and 2023 with a mix of disappointing and promising EPS growth rates. While the company weathered a slump in EPS growth in 2022 with a -11% decline, it rebounded in 2023 with a commendable +22% growth rate, setting the stage for a more robust growth trajectory ahead.

The Path Ahead: Technical Analysis and Projections

As illustrated in the weekly stock chart, Netflix appears poised to oscillate within a consolidation phase between the highs of late 2021 and the subsequent lows. The stock’s movement is anticipated to align with its upward-sloping trendline and the critical 200-week moving average, providing structural support levels.

To mitigate downside risks, prudent investors are advised to set stop-limits at the 200-week moving average, followed by the trendline, with current levels ranging between $400 and $437, subject to fluctuations in daily trading activities.

Strategic Insights: Advertising and Live Sports Initiatives

In the realm of strategic evolution, two pivotal segments hold the key to future growth prospects for Netflix: advertising initiatives and forays into live sports content. The upcoming Mike Tyson – Jake Paul boxing spectacle is poised to serve as a litmus test for Netflix’s audience receptivity to such sporting events. Managing this event successfully and leveraging key learnings to refine future sports offerings could herald a new era of growth.

Despite the company’s robust cash flow and free cash flow performance, Netflix’s valuation remains elevated at 33x to 35x cash flow and free cash flow, respectively, underscoring the premium associated with its stock.

Strategic Outlook: The Road Ahead

Both Schwab and Netflix exemplify adaptive business models that have evolved to meet shifting market demands over the years. Amidst economic headwinds post-2008, Schwab weathered challenges posed by a near-zero interest rate environment and subsequent yield curve inversions. The trajectory of Schwab’s total asset growth underscores the latent earnings potential within its model, contingent upon a conducive yield curve and financial stability.

Looking ahead, Netflix’s foray into advertising and live sports realms holds promise for unlocking new revenue streams and enhancing margins. The interplay between advertising endeavors and sports content is positioned to drive incremental value for the company. While Netflix’s stock may experience fluctuations in the near term, pending the Q2 ’24 results, developments in the advertising and sports spheres could catalyze a significant upside move in the future.