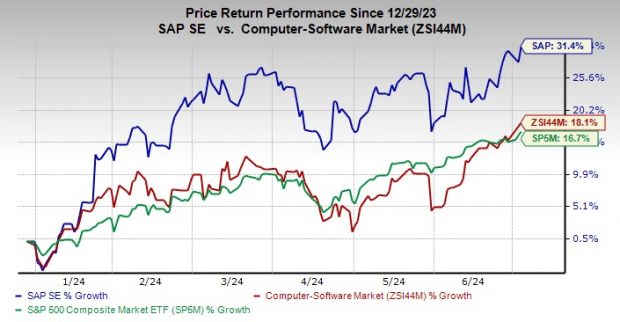

SAP SE has witnessed an exhilarating surge in its stock price by a staggering 31.4% year to date, outshining the growth of the S&P 500 composite and the computer software sub-industry. The prominent purveyor of enterprise resource planning (ERP) software has established itself as a major contender in the software domain, boasting a vast partner network spanning over 20,000 partners worldwide in more than 140 countries.

The Cloud Strategy Triumph

SAP has strategically prioritized the expansion of its cloud business, marking its presence as one of the premier players in this realm. Recent financial reports indicate a significant 27% surge in the current cloud backlog to €14.18 billion, demonstrating a robust go-to-market success pattern for the company’s cloud business initiatives.

The launch of the Rise with SAP solution has provided a substantial impetus to SAP’s operations, enabling businesses to metamorphose their operational structures into more agile, digital, and intelligent entities. Moreover, this solution has garnered substantial traction and is expected to bolster the company’s market share in the cloud ERP solutions landscape.

Rise with SAP serves as a catalyst for the uptake of SAP’s S/4HANA solution, offering customers enhanced implementation options and support through certified partners. The vigor exhibited by SAP in its other cloud offerings like Grow with SAP and SAP Datasphere, coupled with strategic acquisitions and collaborations, paints a promising future for its cloud business.

SAP anticipates cloud revenues for 2024 to be in the range of €17-€17.3 billion and total revenues exceeding €37.5 billion by 2025.

The Landscape of Generative AI Opportunities

With a sanguine outlook on the generative AI trend, SAP foresees a positive impact on its future revenues. The company is strategically positioning itself to harness the potential growth opportunities, especially in Business AI, through a restructuring program aimed at optimizing resources.

Estimate Revisions and Forecast

Market analysts have pegged SAP’s 2024 and 2025 revenues at $36.46 billion and $40.69 billion correspondingly, reflecting healthy growth rates. Forecasts also indicate a 34.9% surge in the 2025 EPS from the prior-year actuals to $6.15.

Challenges Amidst Triumph

Despite its soaring success, SAP faces challenges from the persisting softness in the Software license and support business segment, compounded by global economic fragility. Additionally, escalating costs and fierce competition pose as formidable headwinds for the company.

Exploration of Promising Stocks

In the broader technology domain, investors eyeing resilient picks may find solace in stocks like NVIDIA Corporation, Onto Innovation, and Woodward, accorded a Zacks Rank #1 (Strong Buy). These companies’ robust performance metrics and growth potential bode well for investors seeking promising prospects.

Embrace these insights to navigate the dynamic landscape of the stock market and steer your investment decisions towards sustainable growth.