Sam Bankman-Fried’s legal team crafted an intricate sentencing memo, bundled with 29 character references and allied documents in a fervent plea against an excessively draconian prison term post his conviction last November on various charges of fraud and conspiracy.

Perusing through State of Crypto, a CoinDesk communiqué that delves into the intertwined realms of cryptocurrency and governance.

Crafting a Counter-Narrative

The Presentence Investigation Report proposed an exorbitant century-long imprisonment for Sam Bankman-Fried, deemed “grotesque” by his counsel who vouched for a more humane span of 5 to 6.5 years. This duration, they argued, would enable Bankman-Fried to swiftly reintegrate into societal productivity.

Significance in the Balance

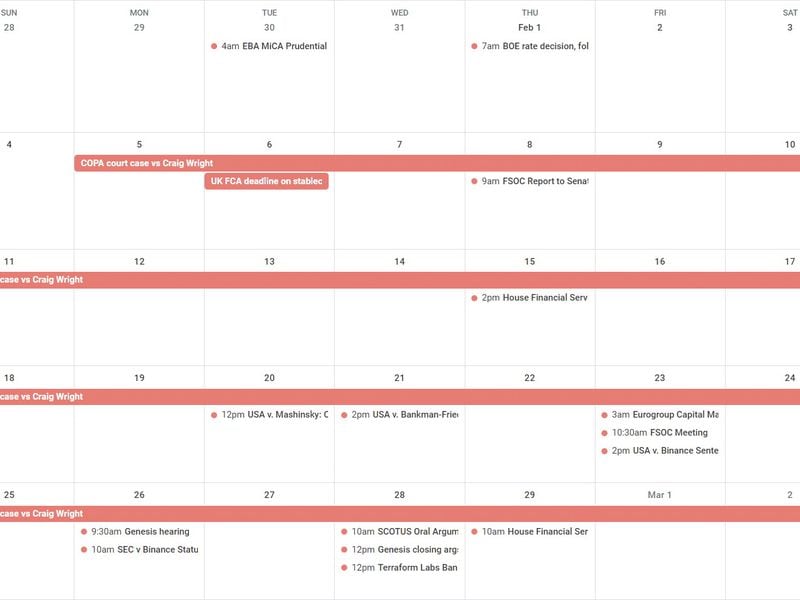

Bankman-Fried’s sentencing is slated for March 28, posing a grave scenario of potentially up to 115 years behind bars. Pretrial conjectures had initially surmised a narrower 10 to 20-year spectrum. The recent revelation of a probation officer’s 100-year suggestion, dismissed as “barbaric” by the defense, compounds the gravity of the situation.

Dissecting the Defense

Emphasizing Bankman-Fried’s non-malicious intent and expressing remorse for unintended customer harm, the defense underscored that his actions did not warrant a life sentence. The unfolding legal quagmire has dissipated Bankman-Fried’s personal assets, leaving a bleak financial horizon.

A sidebar revealed the probation officer’s stark alignment with the Department of Justice’s stance, evidently downplaying the defense’s contentions.

The recent court filings, a maiden effort by Bankman-Fried’s reconstituted legal team following the departure of his trial attorneys, epitomize the standard tenets of a sentencing dossier. It grapples with nuances such as mitigating harm and the perpetual repercussions of a tarnished legal record.

Accompanying the memorandum were over 30 corroborating documents encompassing character testimonials and a comprehensive analysis intending to rationalize a milder sentencing stance.

Laudatory testimonials highlighted Bankman-Fried’s industry, empathy, and philanthropic endeavors, echoing a sentiment of altruistic regard for his contributions.

A poignant narrative surfaced from his kin, attesting to his work ethic, social awkwardness, and altruism even in the ostensibly callous prison environment.

Conversely, a letter from Bankman-Fried’s cellmate, amid his own legal entanglements, iterated profound repentance exhibited by the embattled FTX founder.

As the impending sentencing looms, the looming specter of a prior conviction on malfeasance charges reinforces a foreboding uncertainty. The presiding judge’s judicious discretion in assimilating the evidential mosaic takes center stage.

The Department of Justice is scheduled to deliver its counterargument by March 15, heralding a dialectical climax in this legal odyssey. Future appellate undertakings linger on the horizon, predicting a protracted legal saga.

FTX Collapse: A Tough Lesson on Financial Responsibility

Legal Proceedings Unfold

As the dust settles on the FTX debacle, the legal landscape comes into sharp focus. This Monday, a Genesis bankruptcy hearing laid bare the stark consequences of financial mismanagement.

Regulatory Storm on the Horizon

Wednesday witnessed the brewing storm of regulatory actions. The SEC’s case against Binance raised eyebrows during a crucial status conference. Meanwhile, arguments in Coinbase v. Suski heralded a new chapter in the exchange’s legal saga, casting shadows on arbitration agreements.

Congressional Antics

Thursday saw the House Financial Services Committee gear up for a crucial markup session. Bills addressing crypto issues took center stage, promising a legislative showdown. From combating money laundering to spurring financial innovation, the political theatre was in full swing.

Intriguing Side Notes

Outside the courtroom and legislative chambers, intriguing narratives unfolded. From the aspirational bid of attorney John Deaton to challenge Elizabeth Warren for her Senate seat to Salesforce CEO Marc Benioff’s mysterious land acquisitions in Hawaii, a tale of power, ambition, and influence emerged.

Looking Ahead

As we navigate the fallout of the FTX collapse and the regulatory whirlwind sweeping the financial sector, one thing is clear – the need for vigilance and responsibility in the realm of finance has never been more critical. Let these events serve as a stark reminder of the perils of unchecked ambition and the consequences of financial missteps.