Salesforce Inc. CRM is cruising ahead, with its stock flashing a powerful Golden Cross signal, propelling the tech giant into fresh bullish territory.

The crossover of its 50-day moving average rising above the 200-day average is typically seen as a green light for investors. And with shares recently trading at $310.78, up 46.96% in the past year, it’s clear that Salesforce is in the fast lane.

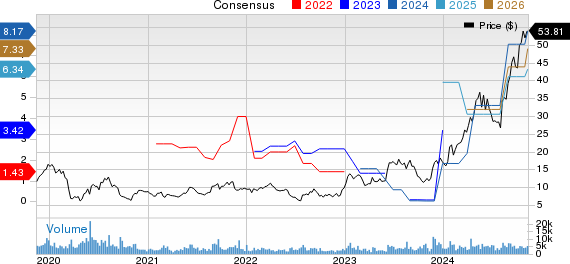

Chart created using Benzinga Pro

Read Also: Marc Benioff Warns Microsoft’s Copilot ‘Spills Corporate Data,’ Emphasizes Security Gaps Ahead Of Salesforce Agentforce Launch

Agentforce: Salesforce’s New AI Play

But it’s not just the technicals that have caught investors’ attention. The launch of Agentforce, Salesforce’s latest innovation, is sending ripples through the business world.

Agentforce allows companies to create AI agents capable of managing tasks across various functions—think customer support, marketing optimization, and order management—autonomously. These agents are powered by advanced AI reasoning and are designed to perform at scale, all while seamlessly integrating into Salesforce’s Customer 360 ecosystem.

In other words, Salesforce is positioning itself as a leader not just in CRM, but in AI-driven business automation.

Golden Cross: A Bullish Signal For CRM Stock

On the technical front, Salesforce’s stock is flexing its muscles.

The Golden Cross, combined with a strong eight-day, 20-day and 50-day moving average performance, signals strong buying pressure. The Moving Average Convergence Divergence (MACD) indicator at 7.55 and a relative strength index (RSI) of 71.84 suggest further upward momentum, though the overbought condition implies caution for short-term traders.

As Salesforce continues to evolve with cutting-edge features like Agentforce, it’s no surprise that the stock is making waves.

With solid fundamentals, a technical breakout, and AI innovation leading the charge, CRM investors are witnessing a potential tech giant in the making.

Read Next:

Image: Shutterstock

Market News and Data brought to you by Benzinga APIs