The Small-Cap Rally

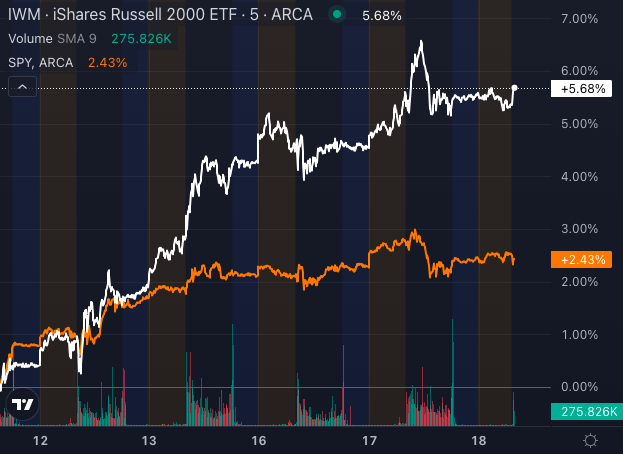

Small-cap stocks are ablaze, stealing the limelight as investors eagerly await the anticipated interest rate cut by the Federal Reserve. The Russell 2000 Index, a barometer of small-cap performance, has roared ahead by more than 5% in the past week, outpacing the modest 2.5% gain seen in its larger-cap counterpart, the S&P 500 Index.

Evidently, the small-cap fervor is exemplified by the exceptional performance of the iShares Russell 2000 ETF (IWM) when compared to the traditional SPDR S&P 500 ETF (SPY). Stocks like IGM Biosciences Inc, Intuitive Machines Inc, and Applied Therapeutics Inc have soared, signaling an exciting trend with gains over the past five days hovering around 40-60%.

Anticipating a Reprieve in Borrowing Costs

Expectations of an impending rate cut by the Federal Reserve have spurred small-cap investors into action. Especially for companies entangled in debt obligations tied to floating rates, the prospect of lower borrowing costs is a golden opportunity. Lower interest rates translate into reduced financial burdens, injecting vitality into the finances of companies perched on shaky ground.

However, amidst the optimism, a caveat looms.

Market Volatility on the Horizon

While the allure of cheaper debt is enticing, whispers of lackluster earnings and an uncertain U.S. economic landscape are echoing through the markets. Should these concerns materialize, the current small-cap exuberance could peter out.

For investors eyeing a piece of the small-cap pie, ETFs like the IWM and the Vanguard Small-Cap ETF (VB) offer a diversified gateway to this segment. Trackers of small-cap indexes, these funds open avenues for potential gains without the hassle of cherry-picking individual stocks.

Yet, the burning question remains – how sustainable is this current small-cap boom?

Bullish Trends in Small Cap ETF

The IWM, emblematic of small-cap stocks, is riding a robust bullish trend, with its share price soaring high above key moving averages. The ETF’s positive trajectory is accentuated by its position above the five, 20, 50, and 200-day simple moving averages (SMAs).

While signs point to a bullish disposition, a hint of selling pressure suggests short-term volatility. However, the ETF’s substantial margin above its 200-day SMA underscores a promising technical outlook, foreshadowing continued resilience in the small-cap sector.

Whether the Fed opts for a substantial 0.5% reduction or a more modest 0.25% cut, the small-cap arena looks primed to capture the spotlight. Monitoring offerings like the SPDR S&P 600 Small Cap ETF (SLY) could provide broader exposure to potential beneficiaries of the anticipated rate shift.