In the convoluted realm of decentralized finance (DeFi), risk management acts as the cornerstone for the sustainability of lending protocols.

The conundrum lies in the quest to find equilibrium between paternalistic risk management (where borrowing limits are dictated by DAO governors and risk managers) and permitting the unseen force of the open market to shape risk tolerance.

As the cosmos expands, it is imperative to grasp the trade-offs intrinsic in various risk management frameworks. The narrative of Euler v1 mirrors the timeless dispute between immutable code and governed code. While Euler v1 embraced a paternalistic protocol blueprint, governed by a decentralized autonomous organization (DAO) capable of adapting to economic shifts or bug discoveries, it faced a monumental juncture in early 2023: a $200 million exploit.

Despite stringent auditing, insurance coverage, and a substantial bug bounty established at inception, a seemingly minor glitch surfaced, necessitating a code amendment followed by an additional audit and DAO referendum in the months leading up to the breach. Regrettably, this rectification inadvertently exposed a broader attack vector, culminating in the exploit last year.

Even though the ensuing actions paved the way for one of the largest recoveries witnessed in the crypto realm, the lingering question remains: is paternalism in DeFi inherently detrimental?

The intricate landscape of risk in lending protocols

Imagine a lending protocol where borrowers leverage USDC as collateral to obtain loans in ETH. Determining the optimal loan-to-value (LTV) ratio for this transaction evolves into a formidable challenge. The ideal LTV is in perpetual flux, influenced by variables like asset volatility, liquidity, market arbitrages, and more. In the fast-paced domain of DeFi, computing the perfect LTV at any given moment proves impractical.

Consequently, lending protocol design necessitates heuristics and pragmatic decisions. This culminates in three overarching classifications of risk management frameworks.

Global oversight via DAO governance

In the current landscape, the widely embraced risk management model for DeFi lending protocols is the “paternalistic” approach, steered by DAOs and risk management entities like Gauntlet, Chaos, and Warden. Termed the “paternalistic” model due to its presumption that a governing body — whether a DAO or another organizational form — comprehends the risk tolerance users should undertake better than the users themselves.

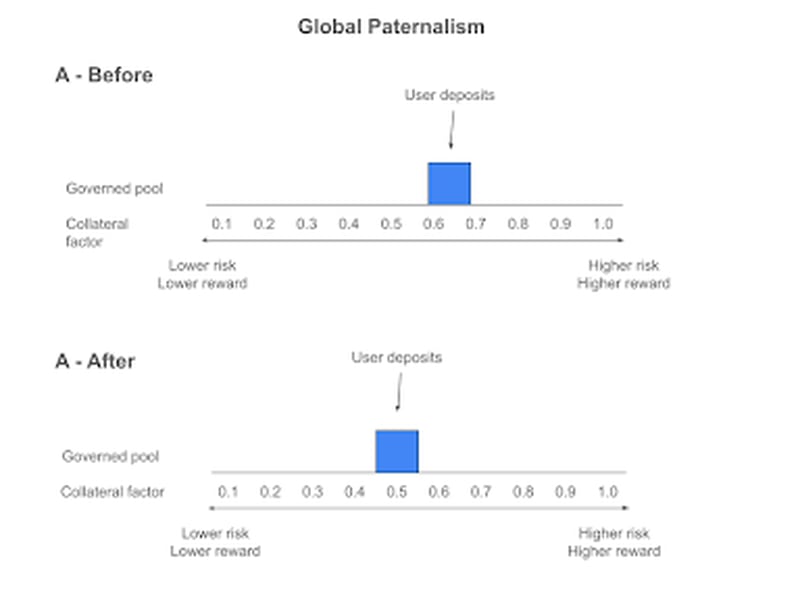

This “global” strategy, adopted by protocols such as Euler v1, Compound v2, Aave v2/v3, and Spark, involves setting LTV ratios relatively conservatively. In the event of deteriorating risk conditions, governance retains the prerogative to revise the protocol-wide LTV ratios for all users.

While this model secures capital efficiency for borrowers and averts liquidity fragmentation, it is not devoid of drawbacks. DAOs consist of individuals with diverse skill sets, many of whom may lack the qualifications to directly vote on risk parameters.

Delegating voting authority may channel control into the hands of more proficient DAO members, yet this often ultimately concentrates decision-making power in the grasp of select individuals, who frequently wield significant influence. Even when these experts make well-informed decisions, DAO governance is time-consuming, and adaptations may lag if the environment shifts swiftly.

Governance obliges protocol users to endorse or reject a singular risk/reward outcome, despite users harboring distinct risk tolerances. This paradigm trains users to anticipate that risk will be regulated for them, consequently conditioning them to rely on paternalistic risk management, conceivably impeding their capacity to make knowledgeable risk/reward determinations autonomously.

The unseen force through secluded pools

The economic doctrine underlying the “invisible hand” model empowers lenders to actively select their risk/reward proclivities. Coined by economist Adam Smith, the “Invisible Hand” signifies the enigmatic forces conducing a free-market economy towards optimal solutions. Albeit fallible, it underpins the majority of present-day free-market capitalism.

Protocols such as Kashi, Silo, Compound v3, Morpho Blue, Ajna, and FraxLend enable lenders to deposit into various (largely) ungoverned, isolated pools, providing flexibility in LTV ratios premised on free-market principles. With an array of pools to opt from, users possess the liberty to lend across a broad spectrum of conceivable LTV ratios (and other risk parameters). Certain users might adopt a prudent approach, lending at modest LTV ratios and attracting fewer borrowers, while others might demonstrate more openness to risk and leverage.

Consequently, this fosters diverse use cases for lending and borrowing. At the protocol layer, operations are generally more straightforward with free-market models too. The absence of governance allows the creation of immutable primitives that can be utilized by all. The intricacies and product-specifics can be relegated to an aggregation-layer or user-interface layer. While this may not necessarily reduce the overall system’s complexity, it does simplify the complexity of the trusted codebase for the subset of users content with managing their own risks.

Nonetheless, this approach is not devoid of its challenges, such as liquidity fragmentation, which renders it arduous for lenders and borrowers to connect. Isolated pools not only render it complicated for lenders and borrowers to locate each other but also often render borrowing more costly (even if users manage to find a match). This stems from the fact that in most isolated lending market protocols, borrowers employ collateral that accrues them no yield (e.g., Morpho Blue, Compound v3, FraxLend).

Contrary to monolithic lending

Revolutionizing Decentralized Lending with Modularity

Redefining Borrowing Dynamics

Protocols that permit borrowers to use an asset as collateral while simultaneously lending it out are reshaping the financial landscape. This dual functionality not only slashes borrowing costs but can even turn borrowing into a profitable endeavor, ushering in the era of interest-rate arbitrage known as “carry trades.” The symbiotic relationship of increased borrowing translating to higher yields for lenders sounds like a musical crescendo, but it’s not without its risks. Lenders are now exposed to rehypothecation dangers on consolidated lending protocols, a concern absent in segregated lending environments.

The Role of Aggregators in Local Paternalism

Aggregators step in as a remedy for the limitations of isolated pools. While some argue that aggregators alleviate liquidity fragmentation issues tied to isolated pools by abstracting away the isolation for lenders, the narrative is incomplete without considering borrowers. Despite lenders benefiting from aggregators, borrowers still grapple with a fragmented scenario. Aggregators facilitate asset deposits into a pooled system managed by local risk managers. They streamline the intricacies of isolated pools, granting passive exposure to a spectrum of risk/reward prospects.

Today’s aggregators span different categories, ranging from neutral platforms like Yearn and Idle, which remain indifferent to the downstream lending markets they engage with, to more protectionist entities like MetaMorpho, which maintain a stronghold on yield sourcing by focusing on internal ecosystems and products to mitigate risks. While aggregators offer enhanced flexibility for lenders, they accompany additional fees and inherent paternalistic drawbacks. Regrettably, the challenges faced by borrowers persist, necessitating unique strategies or models for effective risk management.

The Imperative of Modularity and Flexibility

To scale decentralized lending and vie with traditional finance, DeFi demands a lending structure anchored in modularity, adapting to diverse user requisites. The conventional one-size-fits-all model falls short in the intricate web of lending protocols, with monolithic systems excelling in capital efficiency but failing to offer varied risk/reward prospects. Conversely, isolated lending markets, steered by market dynamics, provide flexibility but grapple with liquidity fragmentation and escalated borrowing expenses. Aggregators, while a step forward, bring along their unique set of challenges.

The essence of protocols embracing modularity lies in their ability to create customized experiences, bridging the gap between centralized lending protocols and isolated pools. Catering to an array of user preferences, these protocols facilitate the deployment and interconnection of tailored lending vaults in open environments. This shift marks a pivotal juncture in DeFi’s composability and interconnectedness, empowering users to seamlessly transition between diverse risk management models, fostering innovation and network effects with a deluge of vault types gaining ground.

Empowering Through Flexibility and Choice

Euler v2 epitomizes this design philosophy, with the Ethereum Vault Connector (EVC) at its core. While the EVC is still in development, undergoing stringent reviews and audits alongside a substantial bug bounty, it promises to be the foundation for creating layered vaults. This inclusive approach caters to immutable as well as governed preferences. Users inclined towards governance-free vaults can craft and employ them without constraints, fostering a permissionless environment where freedom reigns supreme.

Conversely, those seeking a more paternalistic journey guided by a DAO, risk management entities, or specialized aggregators can opt for an alternative path. Crucially, the underlying code maintains neutrality, empowering users to articulate their preferences freely.