Entering a stock market frenzy at or close to 52-week highs signifies a flourishing bullish trend, empowering buyers to take the reins. These highs typically propel stocks to even loftier summits, especially when backed by encouraging earnings forecasts from analysts.

Riding the Wave – Arista Networks Thrives in AI Uptrend

Recent earnings glory prompted Arista Networks to revise up its revenue growth outlook for the current fiscal year (FY24), propelling its shares to new heights. Specializing in cloud networking solutions for data centers and cloud computing realms, Arista positions investors strategically amidst the AI surge.

Boasting a Zacks Rank #1 (Strong Buy), Arista Networks is riding a wave of optimism rooted in robust business demand. With a staggering Q1 sales figure of $1.5 billion, marking a remarkable 16% jump from the previous year, ANET has been on a winning streak.

Forecasts suggest continued robust growth, with consensus projecting 14% EPS growth and a 14% uptick in sales for the current fiscal year. Looking ahead, expectations hint at another 12% surge in earnings and a 15% boost in sales for the subsequent year.

Unstoppable Momentum – Datadog’s Stellar Sales Growth

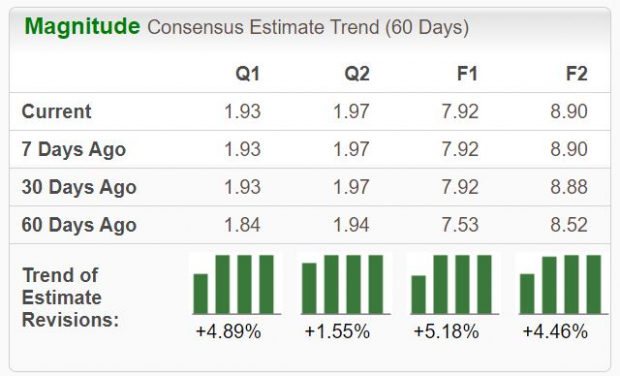

As a Zacks Rank #1 (Strong Buy), Datadog operates as a monitoring and analytics platform for cloud-savvy developers, IT teams, and business users. Analysts have substantially elevated their earnings projections, forecasting a bright future ahead.

Notable for its consistent quarterly performance, Datadog has surpassed our consensus EPS estimate by a whopping 23% in the last four quarters. The company has demonstrated remarkable sales growth, with double-digit year-over-year revenue hikes witnessed in each of the past ten quarters.

Dive into the chart below for visual insights into Datadog’s quarterly revenue:

Evolution in Full Swing – Walmart’s Strategic Split

A corporate metamorphosis took place at retail behemoth Walmart this year, as it executed a 3-for-1 split starting February 26. Driving forward with a Zacks Rank #1 (Strong Buy), Walmart’s revisions trend for the current fiscal year bodes well, reflecting a tilt towards positive sentiments.

Impressive headline figures from its latest financial report indicate a stellar 15% earnings beat relative to the Zacks Consensus EPS estimate and a 1.3% surge in reported sales. Year-over-year comparisons reveal a healthy 22% rise in earnings and a 6% climb in sales from the corresponding period last year.

Post-earnings, Walmart shares soared, adding icing on the cake to its already remarkable year-to-date gains. Witness the trajectory in the chart showcased below:

Additionally, Walmart boasts a shareholder-friendly stance, with a modest 2.2% five-year annualized dividend growth rate. The current annual yield of 1.2% is nearly on par with the S&P 500’s yield.

Riding the Highs – A Summary

Stocks cruising at or near their highs often extend their winning streak, especially when backed by positive earnings forecasts.

The journey of Arista Networks (ANET), Datadog (DDOG), and Walmart (WMT) is a testament to that, with these stocks flaunting a favorable Zacks Rank while basking in the glow of trading near their 52-week peaks.

Where the path leads next in this dynamic stock market environment remains to be seen. Investors are on the edge of their seats, eagerly watching for the next turn in this exhilarating ride.