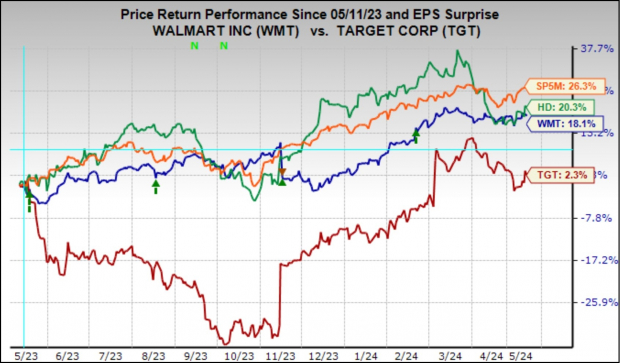

Walmart Holds Steady Amid Market Volatility

As the market faced turbulence in recent weeks, Walmart’s resilience stood out, positioning itself as a sturdy anchor amidst the storm. This steadfast performance, notably in contrast to Target and Home Depot, showcased Walmart’s defensive prowess.

The Grocery Giant’s Strategy

Embodying a heavy grocery exposure and a reputation for value, Walmart’s defensive attributes have played a significant role in securing its position. The retailer’s value-focused approach and effective digital strategy have fueled its ascent in the grocery market, attracting even higher-income households in the process.

Challenges on the Horizon

Despite its success in capturing higher-income grocery spending, Walmart remains tethered to lower-income consumers facing mounting financial pressures, as reflected in rising loan delinquencies. This vulnerability among lower-income segments could potentially impact Walmart’s same-store sales in the upcoming quarterly release on May 16th.

Projected Earnings and Revenues

Market expectations hover around $0.52 in EPS and $159.2 billion in revenues for Walmart, signaling year-over-year changes of +6.1% and +4.5%, respectively. With non-grocery segments showing lackluster performance, any favorable shift in demand patterns for discretionary goods could offer a welcome counterbalance and augur positively for Target and Home Depot.

Insights From Retail Sector Earnings

With 21 out of the 34 retailers in the S&P 500 having disclosed their Q1 results, significant patterns are emerging. This dedicated scrutiny of retail space within Zacks’ economic sector framework sheds light on the resilience of the industry amidst market fluctuations.

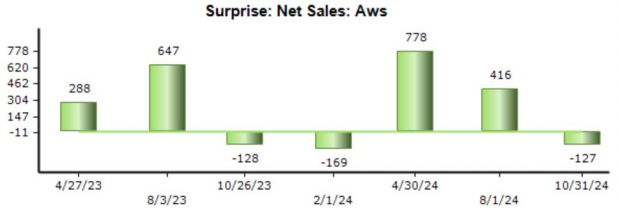

Amazon’s Impact on the Landscape

Among the notable players, Amazon’s staggering Q1 performance warrants attention, with a surge in earnings and revenues outpacing estimates. Amazon’s foray into brick-and-mortar markets, alongside traditional giants like Walmart, underscores the convergence of digital and physical realms exacerbated by the pandemic-induced lockdowns.

Trends in Earnings and Revenue Growth

The juxtaposition of Amazon’s results with industry peers highlights the evolving landscape where digital disruptors challenge conventional business paradigms. While income disparities and inflation pose challenges, a robust labor market continues to buoy consumer confidence.

Earnings Season Overview

With a bulk of Q1 earnings unveiled, the stage is set for a comprehensive evaluation of corporate performances. Amidst robust earnings growth, the Energy sector drag has tempered overall figures, underlining the sectoral nuances at play in the financial markets.

Insights into S&P 500 Earnings and Revenues

Overview of the Earnings Landscape

The S&P 500 index has seen some fluctuations, particularly on the revenues side, which has been weaker compared to recent periods.

Analyzing Q1 Performance

In the first quarter of 2024, S&P 500 earnings are anticipated to show a 6% increase from the same period in the previous year, with revenues expected to rise by 4.2%. This follows a prior period where earnings grew by 6.8% and revenues by 3.9%.

It is crucial to note the significant impact of the Technology and Energy sectors on the overall growth scenario. Excluding the Tech sector, earnings for the rest of the index would have experienced a decline of 1%. However, the growth pace improves to 8.9% when excluding Energy sector contributions.

Projections for Q2

Looking ahead to the second quarter of 2024, total earnings for the S&P 500 are forecasted to rise by 9.2%, supported by a 4.5% increase in revenues. Encouragingly, revisions for Q2 estimates have been on an upward trajectory, reflecting positive momentum in the market.

Annual Performance Outlook

On an annual basis, the total earnings for the S&P 500 in 2024 are expected to demonstrate a 9% increase, alongside a 1.5% growth in revenues. This data paints a picture of steady growth and resilience in the overall market performance.

For investors seeking a more detailed analysis of the earnings landscape, reference to the weekly Earnings Trends report is recommended.

Conclusion

Overall, the data indicates a dynamic and evolving market environment with opportunities for growth and development. Investors are advised to stay informed and remain vigilant to capitalize on the potential avenues for financial gain within the S&P 500 index.