“Tokenization,” particularly of “real-world assets” (RWAs), has recently been lauded as the next big thing in the crypto world. However, the truth is that this trend is just a reincarnation of security tokens, a term that’s resurfaced after fading in 2018 for good reasons.

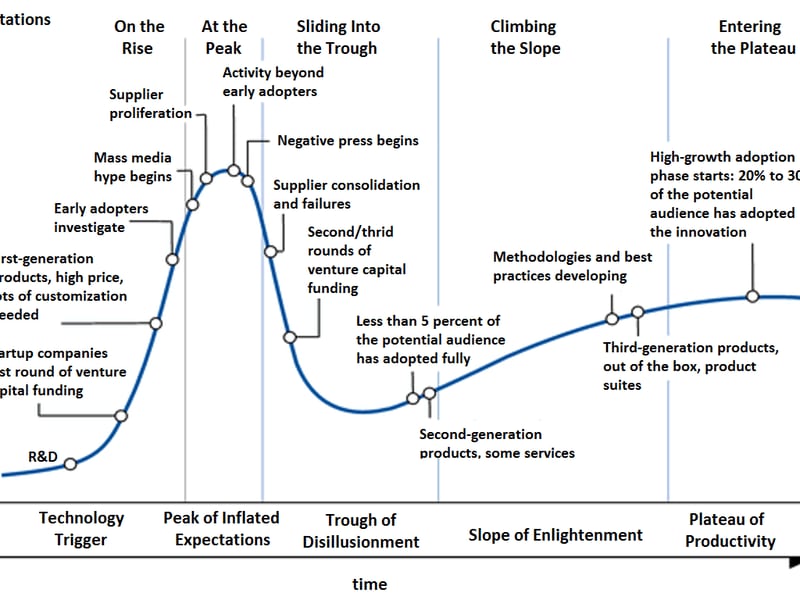

The proponents of tokenization are eager, but often misinformed. The fault doesn’t lie with anyone specific – trends come and go. Yet, if “security tokens,” “tokenization,” and RWAs are all part of the same technological continuum, and if the Gartner “Hype Cycle” is accurate, another downturn may be looming.

Many of the current promoters of tokenization have shifted from the hype-cycle favorite, decentralized finance (DeFi).

While influential traditional finance (TradFi) personalities view tokenization as a natural evolution in finance, the tokenization of “every financial asset” is noticeably more intricate and mostly misunderstood by proponents and critics alike.

The RWA assets industry began nearly eight years ago, kicking off in late 2017. My company, Vertalo, launched one of the earliest fully compliant, Reg D/S equity tokenizations in March 2018, facing numerous challenges leading us to switch our focus from issuing tokenized equity to a broader enterprise software company aiming to “connect and enable the digital asset ecosystem.”

Since then, we’ve witnessed the expansion and subsequent massive contraction of non-fungible tokens (NFTs) and DeFi. NFTs and DeFi were simpler and more user-friendly applications of tokenization technology. For NFTs, you could purchase computer-generated art represented by tradable tokens on accessible platforms like OpenSea.

If we were to gauge the progress of NFTs on Gartner’s Hype Cycle, they would currently appear post-peak, hurtling rapidly through the “trough of disillusionment.” For instance, OpenSea investor Coatue marked down their $120 million investment to $13 million due to the platform’s declining fortunes.

Similarly, the once red-hot DeFi market has shown signs of cooling down, with many projects now rebranding and focusing on real-world assets. This includes DeFi giants like MakerDAO and Aave.

Teams emphasizing their RWA expertise now highlight large traditional financial institutions as clients or partners, a logical move since many DeFi founders honed their skills at prestigious business schools before joining Wall Street banks.

Teetering between boredom in quantitative jobs supporting bond salespeople and equity traders and a fascination with the volatility and work-life balance facilitated by decentralization, the DeFi movement comprehends global finance but is less enamored with its rules, regulations, and rigor.

Insightful DeFi founders and their mathematical engineers detected the shifting tides and transitioned from the governance token-airdrop game in 2022, focusing on rebranding and strategy to champion the “new, new thing,” namely tokenization. The outcome? A widespread adoption of the RWA label and a swift retreat from anything reminiscent of a copy-paste rug pull, a trademark move and risk in the anonymous-loving DeFi world of 2020-2022.

Despite the fact that the assets and collateral typically managed in most RWA projects are primarily stablecoins rather than tangible assets, this doesn’t seem to pose a concern.

Tokenization is nothing short of a revolution. If we were to map the current RWA market on the hype cycle, it would likely fall under “Supplier Proliferation” at present. Everyone is eager to plunge into the RWA business, striving to do so as quickly as possible.

Tokenization of RWAs is indeed a brilliant concept. Most private asset ownership, the primary target for RWA, is currently tracked on spreadsheets and centralized databases. When an asset is restricted from being sold, such as a public stock, bearer bond, or cryptocurrency, there is little incentive to invest in technology that facilitates sales. The archaic data management infrastructure prevalent in private markets is a result of inertia, and tokenization aims to rectify this.

The Reality of Tokenization

There’s some truth to this notion, but the complete truth is that although tokenization alone doesn’t resolve liquidity or legality concerns related to private assets, it also introduces new challenges. RWA tokenization advocates conveniently sidestep this issue, facilitated by the fact that most so-called real-world assets being tokenized are simple debt or collateral instruments subjected to less compliance and reporting standards than regulated securities.

Indeed, most RWA projects engage in an old process called “rehypothecation,” where the collateral itself comprises lightly regulated cryptocurrency and the product serves as a form of a loan. That’s why nearly all RWA projects advertise money-market type yields as their allure. It’s best not to scrutinize the quality of the collateral too closely.

Borrowing and lending constitute a substantial industry, so the future and long-term success of tokenization shouldn’t be dismissed. However, claiming to bring real-world assets on-chain is far from accurate. It’s essentially the collateralization of crypto assets represented by a token. Tokenization is just one vital piece of the puzzle.

When Larry Fink and Jamie Dimon discuss the tokenization of “every financial asset,” they aren’t referring to crypto-collateral RWAs – they are actually alluding to tokenizing real estate, private equity, and eventually public equities. Achieving this won’t be as straightforward as merely employing smart contracts.

Personal Insight

Having spent over seven years constructing a digital transfer agent and tokenization platform that has tokenized almost four billion units representing interests in nearly 100 companies, the actuality of widespread financial asset tokenization is far more complex.

Firstly, tokenization is a relatively uncomplicated and minor aspect of the process. It is a commoditized industry where hundreds of firms can tokenize assets. Tokenization, on its own, isn’t particularly lucrative and devolves into a competitive race to the bottom regarding fees due to the profusion of suppliers offering similar services.

More crucially, there are fiduciary responsibilities associated with tokenizing and transferring RWAs. This is where the challenging aspect, the ledger, comes into play.

Distributed ledgers offer tangible benefits for tokenizing financial assets by providing immutability, auditability, and trust – fundamental components for demonstrating ownership and ensuring an error-free record of all transactions in real-time. Without this, the finance revolution using tokens will not materialize.

Distribution ledgers cultivate trust, thereby enabling finance professionals and their clients to embrace the concept of asset tokenization endorsed by Larry Fink and Jamie Dimon – but in a manner that garners more adoption than the intricate and technical realm of DeFi and cryptocurrency. Therefore, before succumbing to the hype cycle, it is imperative to reflect on past occurrences and what the future may hold. Steering clear of the wrong section of the cycle is imperative to avoid landing on NFT version two.