As the Federal Reserve gears up to implement its first rate cut in the current cycle, a sense of anticipation ripples through the market. Historical data suggests that such rate cuts have often served as the proverbial spark that ignites a stock market rally, potentially fueling significant profits for investors well into the future.

History Repeats Itself: A Look at Previous Rate Cuts

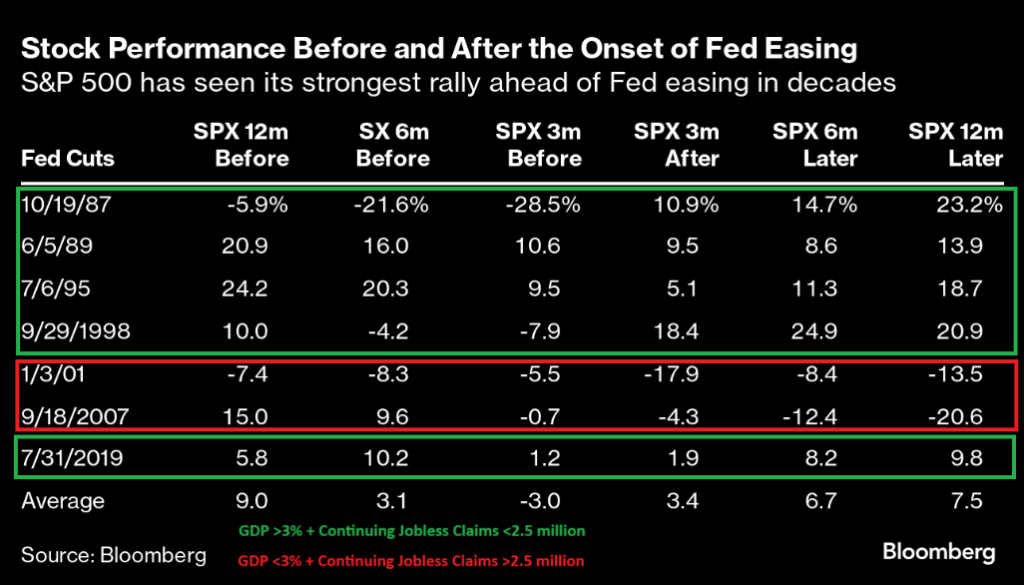

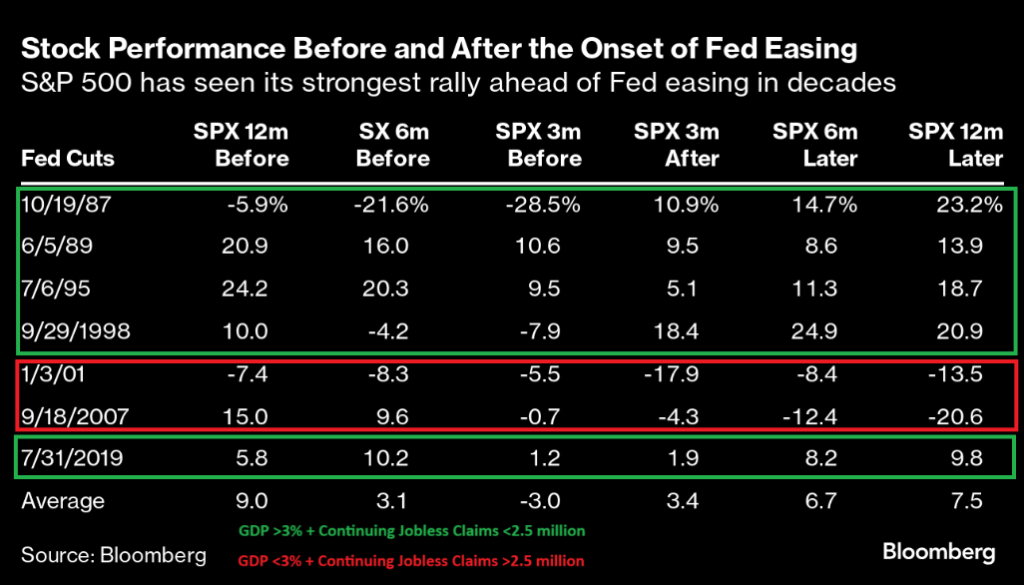

Over the years, the Federal Reserve has initiated seven rate-cutting cycles since 1987. Among these, five were classified as ‘good’ cycles, marked by a robust economy with GDP growth exceeding 3% and low joblessness levels below 2.5 million claims. In these instances, the S&P 500 witnessed remarkable rallies post the first rate cut, with average returns close to 20% in the subsequent year.

Conversely, two cycles – in 2001 and 2007 – fell under the ‘bad’ category, characterized by weak GDP growth of 2% or lower and escalating jobless claims over 2.5 million. These ‘bad’ cycles saw the S&P 500 plummet, experiencing average drops of nearly 20% in the following year.

The looming rate cut takes place against the backdrop of a growing economy, with a 3% growth rate and jobless claims below the 2 million mark. Such favorable economic conditions hint at the onset of a ‘good’ rate-cutting cycle, portending substantial stock gains in the coming months.

The optimism surrounding this rate cut stems from parallels drawn to the rate-cutting cycle of 1998/99, a time when tech stocks experienced an unprecedented surge. The late 1990s witnessed an explosion in internet technologies, prompting companies to invest heavily in new infrastructure and innovative products. Subsequent rate cuts by the Fed in response to a slight economic slowdown provided a boost to the burgeoning tech sector, propelling internet stocks to stratospheric heights.

Envisioning a Powerful Rally Ahead

The similarities between the current economic landscape and that of the late 1990s suggest the potential for a profoundly impactful rally. As we stand on the precipice of this rate-cutting cycle, investors are optimistic about the vast possibilities that may unfold, reminiscent of the tech stock boom that shaped the turn of the century.

Navigating the AI Boom: A Cloaked Economy and Spectating the Rollercoaster

The Rise of AI Technology in Stocks

Recent years have seen a remarkable surge in stocks fueled by the advent of cutting-edge AI technologies. Corporations have poured substantial funds into developing AI frameworks and innovating next-generation products and services. The AI sector has enjoyed soaring stock performance on the bustling streets of Wall Street.

Shifting Economic Winds

Presently, a subtle deceleration in the economic momentum is underway. While not a substantial downturn, it has raised concerns among investors, triggering bouts of stock market turbulence and prompting the Federal Reserve to consider interest rate reductions. Such monetary policy adjustments are anticipated to restore equilibrium to the economy. This, in turn, is poised to ignite the flames of the AI boom, propelling AI stocks to unprecedented heights as we progress into the years 2025 and 2026.

An Era of Anticipation

The imminent rate cuts hold the promise of unleashing a wave of excitement, shaping the landscape for a potentially ‘great’ phase in the market cycle. Investors are brimming with enthusiasm as the stage is set for a triumphant economic trajectory.

Looking Forward

The forthcoming months may offer more than just a glimpse of prosperity; it could be an era of monumental advancement. Seize the opportunity to witness firsthand the impact of the impending rate-cutting cycle as it unfurls before our eyes.

On the date of publication, Luke Lango did not have (either directly or indirectly) any positions in the securities mentioned in this article.

P.S. You can stay updated on Luke’s latest market analyses by delving into our Daily Notes! Explore the most recent edition by visiting your Innovation Investor or Early Stage Investor subscriber portal.