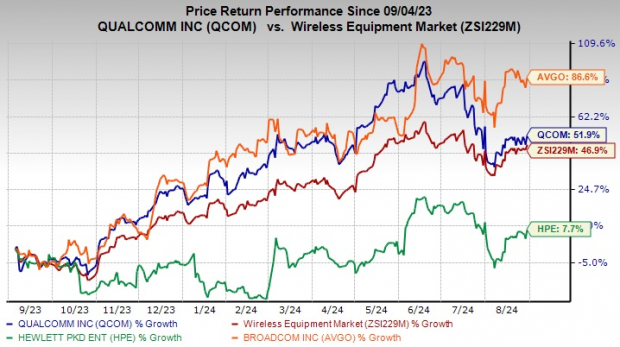

In the cutthroat world of financial markets, Qualcomm Incorporated (QCOM) has emerged as a phoenix, soaring high on its own flames. Ignited by a holistic growth model, QCOM has left competitors in the rearview mirror with a remarkable 52% surge in shares over the past year. This meteoric rise stands tall against the industry’s growth of 46.9%, showcasing Qualcomm’s unwavering resilience in the face of adversity.

While giants like Hewlett Packard Enterprise Company (HPE) and Broadcom Inc. (AVGO) have occupied the limelight, Qualcomm’s strategic pivot from a wireless communications firm to an intelligent edge processor company has proven to be a visionary move. The company’s trajectory is set to intercept long-term revenue targets, powered by the roaring success of 5G technology, augmented visibility, and a diversified revenue stream.

Image Source: Zacks Investment Research

QCOM Gaining Healthy Traction in EDGE Networking

Qualcomm’s stride in EDGE networking reflects a foray into cutting-edge connectivity solutions for a spectrum of industries. From cars to smart factories, the company’s foray into artificial intelligence is poised to meet the burgeoning demands of a digitally transformed world.

As the 5G wave accelerates, Qualcomm rides high on investments in its mobile licensing program. The relentless pursuit of revenue targets coupled with an amplified visibility in the market sets the stage for Qualcomm’s continued success.

Snapdragon Mobile Platform Series: QCOM’s USP

Qualcomm’s Snapdragon mobile platforms serve as the company’s flagship offering, boasting a brilliant tapestry of multi-core CPUs, top-tier graphics, and a global network connectivity. These platforms enable a realm of possibilities, from immersive augmented reality experiences to state-of-the-art security solutions.

Teaming up with the tech juggernaut Microsoft Corporation (MSFT) to launch the Snapdragon Dev Kit for Windows, Qualcomm charts a course towards AI-powered PCs. The collaboration unfolds a new chapter in the realm of AI applications, offering developers a playground to unlock the true potential of generative AI in cutting-edge computing devices.

QCOM Focusing More on Automotive Business

In the fast lane of automotive innovation, Qualcomm’s telematics and connectivity platforms revolutionize the concept of connected vehicles and digital cockpits. With a robust growth trajectory, Qualcomm emerges as a principal player in the smartphone radio frequency front-end domain.

The recent surge in automotive revenues speaks volumes about Qualcomm’s knack for capturing market trends. As the automotive landscape evolves, Qualcomm’s Snapdragon Digital Chassis platform propels the company into a leading position with successive record-breaking quarters.

Estimate Revision Trend for QCOM

Earnings estimates paint a rosy picture for Qualcomm, with forecasts for fiscal 2024 and 2025 swelling by 9.5% and 14.5%, respectively. These upward revisions underscore a bullish sentiment towards Qualcomm’s continued growth.

Image Source: Zacks Investment Research

Margin Woes Persist for QCOM

The journey to success is fraught with challenges, and Qualcomm is no exception. A decline in margins over the years poses a significant hurdle, fueled by soaring operating expenses and R&D costs. Factors like a soft handset market and shifts in device preferences present ongoing challenges.

Furthermore, the specter of fierce competition in the mobile chipset market looms large, chipping away at Qualcomm’s margins. As the global smartphone market tilts towards emerging economies, Qualcomm faces headwinds that threaten to dampen its profitability.

Image Source: Zacks Investment Research

Adverse U.S.-China Geopolitical Ties Hurt QCOM

Qualcomm’s expansive footprint in China, brimming with promises of technological advancements, finds itself at a crossroads marred by geopolitical tensions. U.S.-China trade disputes cast a shadow over Qualcomm’s operations, disrupting its relations with local smartphone giants like Huawei and Xiaomi.

The geopolitical quagmire imperils Qualcomm’s foothold in the Chinese market, jeopardizing its growth prospects in the region. The company’s resilience is put to the test as regulatory barriers threaten to impede its quest for global dominance.

End Note

In the symphony of financial success, Qualcomm’s melody rings loud and clear. With sturdy fundamentals and a robust revenue stream, Qualcomm stands tall against the backdrop of a dynamic industry. The company’s unwavering commitment to quality, operational efficiency, and innovation cements its position as a beacon of promise in the tech sphere.

While hurdles like fierce competition and margin pressures persist, Qualcomm’s essence lies in its ability to weather storms and emerge stronger. Earnings estimates cast a favorable light on Qualcomm, garnering positive sentiments from investors.

Qualcomm: A Steady Yet Cautious Bet for Investors

The Middle Road of Qualcomm

Qualcomm, a stalwart in the tech industry, seems to be meandering along the middle road in recent times. As investors eye their next moves, caution appears to be the name of the game. The company’s performance is steady, like a seasoned marathon runner pacing themselves through a race, mindful of the hurdles that may lie ahead.

Potential Growth Amid Uncertainty

Despite the air of caution surrounding Qualcomm, there are whispers of potential growth on the horizon. Like a hidden treasure waiting to be unearthed, Qualcomm’s stock holds promise for those who are patient and astute. With the right strategies in place, investors may yet discover a pot of gold at the end of the rainbow.

Flying Under Wall Street’s Radar

Many stocks often operate incognito, evading the watchful eyes of Wall Street analysts. In Qualcomm’s case, this stealth mode presents a unique opportunity for investors to dive into the market at its nascent stage. It’s akin to being an early bird catching the worm, reaping the benefits before the rest of the flock arrives.

In Search of Stability

Amidst the ever-evolving financial landscape, stability is a rare gem that investors seek. Qualcomm’s performance over the years has been a beacon of consistency, offering a sense of reassurance in turbulent times. Like a sturdy oak tree standing tall amidst a storm, Qualcomm exudes resilience and reliability to those who choose to tread its path.