Week-over-Week Inflows in QQQ ETF

Exploring the latest trends in ETF market activity, particularly within the holdings of the Invesco QQQ ETF, recent data shows a notable $2.3 billion inflow. This reflects a 0.9% increase in outstanding units from 580,050,000 to 585,550,000. Among the top constituents of QQQ, Microsoft Corporation has surged by 3.1%, Apple Inc. by 0.6%, and NVIDIA Corp by 4.7% in today’s trading.

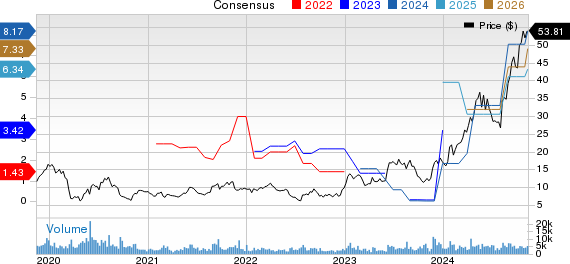

Price Performance Insights

Highlighting the one-year price performance of QQQ against its 200-day moving average, recent data indicates a range between QQQ’s low point of $315.05 per share and high point of $449.34. The most recent trade settled at $430.72, highlighting a dynamic market scenario. Comparing these figures to the 200-day moving average offers valuable insights into technical analysis methodologies.

Understanding ETFs and Inflows

ETFs, akin to stocks, operate on the exchange platform, with investors trading units rather than shares. These units can be freely traded, bought, sold, and even created to meet market demands. Monitoring week-over-week changes in shares outstanding is crucial to gauge notable inflows or outflows impacting ETFs. Large inflows necessitate the purchase of underlying holdings, while outflows involve selling these assets, subsequently affecting individual components.

![]() Click here to find out which 9 other ETFs had notable inflows »

Click here to find out which 9 other ETFs had notable inflows »