When contemplating stock investments, the sway of analyst recommendations cannot be underestimated. These pronouncements from brokerage analysts extensively impact stock prices, yet the question lingers – how pivotal are they truly?

Before examining the credibility of brokerage endorsements and methods to leverage them judiciously, let’s delve into the sentiments of Wall Street titans regarding Pure Storage (PSTG).

Understanding Brokerage Recommendations for PSTG

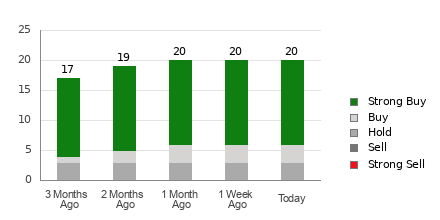

Pure Storage currently stands adorned with an Average Brokerage Recommendation (ABR) of 1.42, nestled between Strong Buy and Buy on a scale of 1 to 5. This numerical artifact is a composite of recommendations (Buy, Hold, Sell, etc.) from 20 brokerage entities. Out of these 20 evaluations, 14 lean towards Strong Buy and 3 opt for Buy, constituting 70% and 15% of all endorsements, respectively.

Real Value Behind Brokerage Suggestions

Signs may point to a resounding call to buy Pure Storage, but solely relying on this metric might not be the wisest move. Research indicates that brokerage recommendations hold minimal success in steering investors towards stocks with the most robust potential for price appreciation.

Why, you may ask? The ingrained interests of brokerage firms in stocks under their coverage can often lead to a pronounced positivity bias among their analysts when assessing these assets. Reports even suggest that for each “Strong Sell” endorsement, brokerage firms counterbalance with five “Strong Buy” laudations, signaling a scenario where their motives may not entirely align with those of retail investors.

Given this reality, it would be astute to treat this data as a cross-reference point for your personal analysis or a tool renowned for accurately predicting stock price movements.

Unveiling the Zacks Rank

Zacks Rank, a proprietary stock evaluation instrument with a well-documented track record, segments stocks into five categories, spanning from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell). In the realm of anticipating a stock’s forthcoming price performance, juxtaposing ABR with Zacks Rank could prove to be a pragmatic move.

A significant point of differentiation between Zacks Rank and ABR resides in their fundamental underpinnings. The former hinges on quantitative models leveraging earnings estimate revisions, while the latter hinges predominantly on brokerage valuations. This distinction is crucial given the propensity of brokerage analysts to lean towards fervent positivity due to institutional interests.

It’s noteworthy that the Zacks Rank sustains equilibrium among the five ranks it assigns across all stocks appraised by brokerage analysts, showcasing a uniform application of its grading system.

Moreover, the Zacks Rank harbors a timeliness advantage notably absent in ABR. The dynamic nature of earnings estimate revisions quickly permeates into Zacks Rank assessments due to the proactive stance of analysts in recalibrating their predictions in line with market fluctuations, a feature that bolsters its reliability in presaging future stock prices.

Should Pure Storage Find a Spot in Your Portfolio?

In the context of Pure Storage, the Zacks Consensus Estimate for the prevalent year holds steadfast at $1.59, signaling an unaltered outlook over recent times. This stable projection mirrors analysts’ unwavering confidence in the company’s earnings trajectory, potentially paving the way for a performance parallel to broader market trends in the imminent future.

This unswerving stance, alongside nuances linked to earnings estimates, has warranted a Zacks Rank #3 (Hold) for Pure Storage. While the ABR leans towards a Buy-equivalent sentiment for the company, circumstantial caution appears prudent.

It’s clear that a prudent investor must navigate the seas of brokerage recommendations with a discerning eye, seeking validation through tools like Zacks Rank that offer a more objective assessment of stock potentiality, unclouded by institutional interests.