Yesterday, Andy Pai – the man behind ProPicks AI – and I gave our members an exclusive behind-the-scenes tour of how our AI stock-picker works under the hood.

If you haven’t yet checked it out, I strongly suggest you do. The webinar recording can be found on our YouTube channel or X (formerly Twitter).

Among the many topics discussed, we showed in detail the logic that makes ProPicks AI what it is – that is, combining thousands of financial metrics and signals into one investment-grade type report on the stocks that show the best risk-return proposition on a monthly basis.

On the webinar, we also revealed our number-one trade of the year: Super Micro Computer (NASDAQ:).

Today, we will provide more background details on how ProPicks AI made that trade, as well as why it decided to remove it from the strategy in July, booking a phenomenal 185% gain.

We also encourage all Investing.com users to take advantage of our ongoing Early Bird Black Friday sale to access ProPicks for less than $7 a month for a limited time only!

How ProPicks AI Identified the SMCI Surge Early on

As 2024 kicked off, one name quickly dominated investor conversations: SMCI. The stock skyrocketed almost overnight, fueled by the AI frenzy sweeping across the market.

Known for its high-performance, efficient servers, SMCI captured investors’ attention as the AI boom gained momentum. It became the “it” stock, with investors clamoring to get a piece of this AI “gem.”

The buzz around SMCI was palpable. Its stable fundamentals and skyrocketing momentum made it an obvious choice, and by March 2024, its chart was showing a parabolic rise that was hard to ignore.

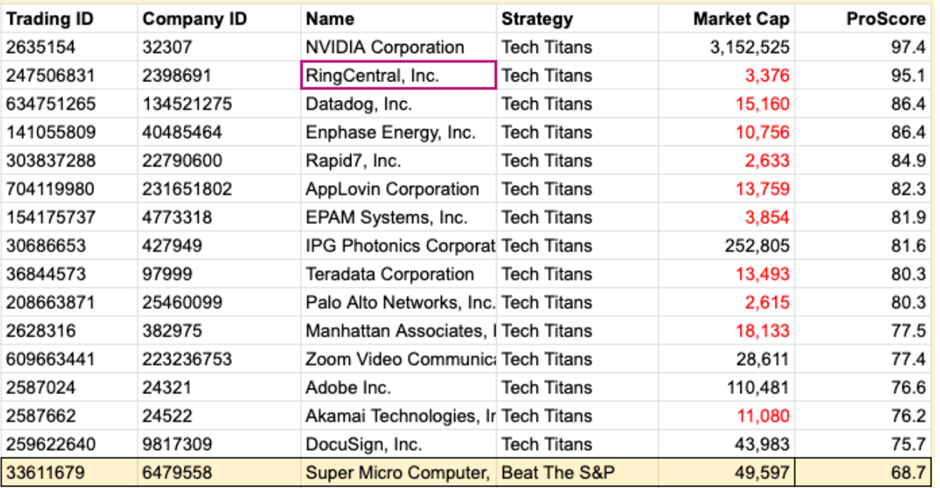

Adding to its appeal, ProPicks AI included SMCI in its ‘Tech Titans‘ strategy starting January 1, 2024. This wasn’t a surprise—ProPicks AI had analyzed a vast amount of data and key metrics, deciding SMCI was a solid bet for its strategy rebalance.

But here’s the real question for investors who were riding SMCI’s wave: When would it be the right time to sell?

After surging 218% in the first three months of the year, some might have been wondering how long this bull run would last.

But of course, no one could have predicted the emotional rollercoaster that would follow—especially once the company became entangled in accounting-related allegations.

How Did ProPicks Cash Out Before the Roller Coaster Began?

ProPicks AI, however, didn’t have to play a guessing game when deciding to cash out. The algorithm—free from human emotion—kept SMCI in its portfolio through six consecutive rebalances after adding it on January 1, 2024.

Every month, the AI analyzed the stock’s risk-to-reward ratio alongside several other key metrics and held firm. But on July 1, 2024, after months of steady growth, ProPicks made a critical move: it removed SMCI from its strategy.

It could be that the AI detected a shift in the stock’s fundamentals, or perhaps ProPicks saw more promising opportunities elsewhere considering the risk-to-reward proposition.

Regardless, SMCI missed out by a whisker from being added to the rebalance that month.

For those who held on beyond this AI hype-driven surge, the ride quickly turned volatile as the company faced a host of headwinds in the months that followed, leading to large price swings.

Bottom Line

As our six-part series on ProPicks AI’s top-10 trades of the year comes to an end, we want to remind our readers of the real reason why we got so many 100%+ gainers in 2024: quality and breadth of data.

This edge comes from leveraging Investing.com’s 25+ years of historical market data and the extensive R&D invested in refining its insights.

It’s like equipping the AI with the expertise of a seasoned analyst—without the trial-and-error learning process.

With this depth of knowledge, it was able to spot several different market signals for fantastic results, as shown in our series.

Just to recap:

- Stocks #9 and #10 – Insulet Corp (NASDAQ:) and Xerox (NASDAQ:): .

- Stocks #7 and #8 – IDEXX Laboratories (NASDAQ:) and Williams-Sonoma (NYSE:): .

- Stocks #5 and #6 – Shift4 Payments (NYSE:) and Broadcom (NASDAQ:): .

- Stocks #3 and #4 – Vistra Energy (NYSE:) and MicroStrategy (NASDAQ:): .

- Stock #2 – Nvidia (NASDAQ:): Investment-grade fundamental analysis showed the stock had far more upside despite earlier gains. .

And you’ve just read about our number 1 pick of the year!

Still curious to understand a little more about how ProPicks AI works under the hood? Then check out our exclusive webinar here!

Also, do not miss out on the opportunity of notching the market’s top AI-generated picks with an up to 55% discount as part of our Early Bird Black Friday Campaign.

***

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.