Not long ago, the electric vehicle (EV) industry was the hottest segment of the U.S. economy. Now it increasingly appears the industry could be entering a long winter. And investors want nothing to do with EV stocks – especially not after such a massively disappointing quarterly update from Tesla (TSLA).

The EV maker just reported its fourth-quarter earnings, and they were not great. The firm came in below consensus estimates for both earnings and revenues. And management’s outlook wasn’t any better. It warned that its vehicle volume growth “may be notably lower” in 2024 than it was in 2023. Moreover, it seems competitors from China’s electric car market are giving Musk & Co. a run for their money right now. And that headwind is one that could impact all U.S. EV makers. As a result, the entire sector has been in decline, led by TSLA, which has plummeted around 12% since announcing Q4 earnings. It’s a bloodbath out there.

And the bad news is that this EV Winter is far from over. Dozens of EV startups will go bankrupt, which means many EV stocks will go to zero. Poorly positioned investors will likely lose everything. But here’s the good news: This EV Winter will end. And when it does, the EV stocks that survive will absolutely soar.

And well-positioned investors could stand to make fortunes.

Why EV Stocks Are Freezing Cold This Winter

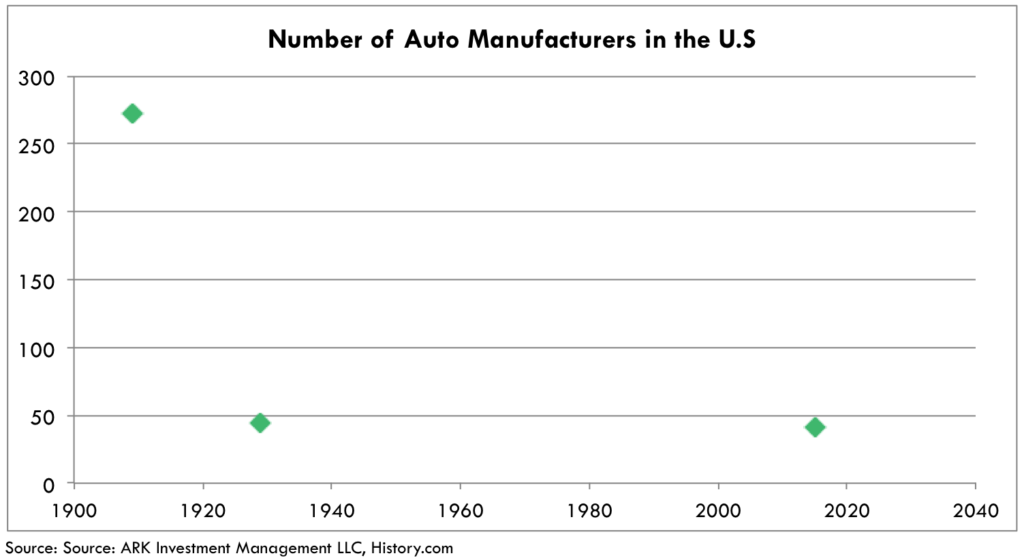

So, what’s going on for this once-hot sector? Every new technological revolution goes through the same three steps: invention, consolidation, then boom. When a new technology is first introduced, everyone gets really excited about it. There is a premature euphoria about that technology’s potential applications. Then, a sobering reality sets in. New technology will not change the world overnight – it will take time. Consumers and investors alike cool on the industry. The market stalls. Dozens of startups in that tech industry go bankrupt. And the whole industry consolidates around a few solid names. Once that happens, the technology starts to live up to its early promise and starts to change the world. Consumers and investors jump back on the bandwagon. And the tech firms that survived the sector’s consolidation become industry titans. This is exactly what happened when the automobile was first introduced to the world.

Looking Back to the Gas-Powered Auto Boom

In 1893, bicycle mechanics (and brothers) J. Frank and Charles Duryea of Springfield, Massachusetts, designed the first successful American gasoline automobile. An automotive gold rush ensued. A decade later, some 485 companies entered the automobile manufacturing business. All were hoping to strike it rich as the gas-powered car redefined the world of transportation. It was a “gas-powered car boom” – much like the “electric vehicle boom” of today. What happened next? Well, the gas-powered car did go on to redefine the world. Today, around 70 million new passenger cars are sold every single year. But almost none of those 485 companies that popped up back in the early 1900s became a success story. Less than 50 were still in operation by 1930. And just three accounted for 80% of the market. But then, the automotive industry entered its “boom.” Throughout the 1900s, the market grew like crazy. And the auto makers that survived the consolidation have become titans of the modern economy. I’m talking about companies like Toyota (TM), Ford (F), and General Motors (GM) – multi-billion-dollar centerpieces of the global economy. So, the investment takeaway here? When it comes to technological revolutions, invest in the next generation of winners during the consolidation phase – when the industry is whittled down from hundreds of hopeful startups to a handful of future titans.

The EV Industry Has Screeched to a Halt

Due to a confluence of headwinds ranging from high financing rates to flailing consumer interest, U.S. EV sales have slowed dramatically. In 2021, the EV market grew by nearly 90%. In 2022, it grew by 65%. But in the final three months of 2023, the EV market in the U.S. grew by just 40%. Sure, that is still 40% growth – but it’s much lower than 65%. The EV market is slowing. Perhaps more importantly, EVs have stopped gobbling up market share from traditional autos. From mid-2021 to mid-2023, EV sales penetration soared from 3% to 8%. But over the past six months, EV sales penetration has plateaued around 8% of total auto sales in the U.S. No matter which way you slice it, the EV market is slowing. This is the consolidation phase of the EV industry. Over the next 12 months, the industry will keep struggling. Dozens of EV startups will file for bankruptcy. Many EV stocks will head to zero. And some investors are likely to lose everything. It will get rough for the industry in 2024. But some EV firms will survive. And those that do stand to make fortunes once this winter ends, likely in 2025. That means that the best time to buy the right EV stocks is now, while they’re on sale – and before they rebound with a vengeance.

Revving Up: Navigating the EV Winter for Investment Opportunities

As the electric vehicle (EV) industry experiences a period of consolidation, it can seem daunting to identify the most promising investments amidst the shuffle. However, these times of industry recalibration are essential, laying the groundwork for the rise of future industry champions. The EV Winter, as it is colloquially known, may be challenging, but prudent investors can harness this phase to position themselves advantageously for the resurgence that is bound to follow.

Promising Contenders

Among the few that stand tall in the face of the EV Winter, Rivian (RIVN) emerges as a stalwart. Backed by substantial financial support, Rivian’s robust manufacturing ramp and the increasing visibility of its vehicles indicate a strong position for the company. Additionally, the positive reception from customers further fortifies its standing in the industry.

Another noteworthy contender is QuantumScape (QS). This company is at the forefront of developing next-generation solid-state batteries, holding the potential to revolutionize the entire EV industry. Recent breakthrough data reported by QuantumScape suggests that its innovative batteries are nearing viability for practical automotive applications.

However, caution should be exercised with regard to other stocks in the EV space, as they may be best avoided during this period of industry consolidation.

Embracing the EV Winter

The notion of an industry winter may initially evoke trepidation, but it is imperative to embrace this phase rather than shy away from it. The EV Winter is an essential stage that paves the way for the rise of the next generation of industry leaders, ultimately underpinning the future growth of the EV sector. As such, investors are encouraged to seize this opportune moment to strategically position themselves amidst this industry evolution.

Amidst the turbulence of industry consolidation, there exist opportunities for investors to discern the right stocks at the right time, positioning themselves optimally for the inevitable resurgence that follows the EV Winter.

Nonetheless, it is crucial for investors to exercise caution and prudence in navigating the EV Winter, carefully identifying the most resilient and promising entities within the industry.

Final Considerations

As the EV industry undergoes its period of recalibration, it is paramount for investors to intricately assess the key players and potential opportunities as the industry prepares for its next phase of growth. While the EV Winter may be challenging, it also presents a window of opportunity for savvy investors to position themselves strategically for the future resurgence of the industry.

It is important for investors to remain discerning and vigilant, leveraging this period thoughtfully to fortify their investment portfolios for the bright chapters that await the EV sector.

On a final note, investors should closely monitor the developments within the EV industry and capitalize on the valuable opportunities that arise from this period of recalibration, ensuring that they are primed to harness the potential resurgence of the sector.