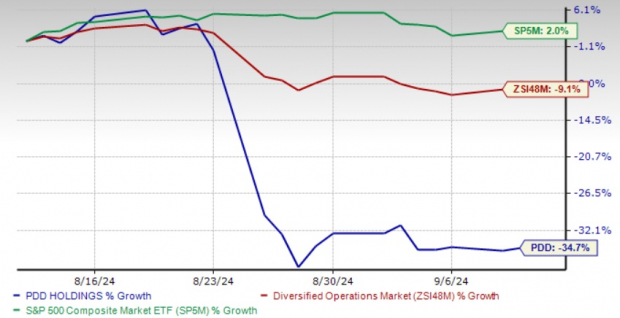

Despite facing a tempest of macroeconomic worries, PDD Holdings has suffered a staggering blow, with its stock plummeting 34.7% in the past month. This downtrend can largely be attributed to the turbulent global landscape, shifting consumer behaviors, recessionary concerns, market volatility, and the intricate challenges besieging China’s economy.

Comparatively, this dismal performance starkly contrasts with the industry’s 9.1% decline and the S&P 500 index’s 2% upswing during the same period.

The e-commerce titan PDD Holdings finds itself in a fierce battleground, confronting robust competition both domestically and globally. Giants like Amazon, JD.com, and Alibaba cast a looming shadow over its operations.

Examining the Last Month’s Stock Performance

PDD remains an entity of fascination, driven by the strength of its e-commerce model anchored on the commendable Pinduoduo platform. Noteworthy accolades are also bestowed upon its sound presence in the agricultural sector, tapping into the burgeoning opportunities within this realm.

In contemplating the paradox of potential and risk, investors are faced with a pivotal decision: to buy, to hold steady, or to sell?

Pinduoduo’s Long-Term Growth Trajectory Shines

Despite the prevailing macro jitters, the robust momentum on Pinduoduo’s platform fueled by its diverse product offerings, particularly in agriculture, stands out as the driving force behind PDD’s growth trajectory.

In the second quarter of 2024, total revenues soared to RMB 97.06 billion, marking an 86% year-over-year surge.

Continuing its crusade, PDD customizes fulfillment solutions across unique markets to enhance supply-chain efficiency and slash costs — a strategic move applauded by many.

The fortified Temu platform, a hub of innovation leveraging online ads, social media, and more to engage users, serves as another beacon of optimism.

PDD’s alliance with local communities, retailers, farmers, and agri-merchants paves the way for a flourishing agriculture business, bolstered by a new cadre of skilled entrepreneurs straddling both farming and e-commerce.

Pinduoduo’s Bright Valuation Prospects

PDD Holdings currently touts a tempting valuation, trading at a modest forward 12-month Price/Earnings ratio of 7.12X, a stark discount compared to the industry’s 14.66X and the median of 18.37X, presenting a lucrative window for potential investors.

Boasting a Value Score of A and a Growth Score of A further accentuates its investment appeal.

Microscopic Examination of Macro Woes on PDD Holdings

Amidst a canvas of evolving consumer demands and a shift towards experience-driven consumption, PDD grapples with diversifying preferences. To combat this, the company is ramping up investments and forging alliances with premier brands to concoct bespoke products, potentially impacting its bottom line.

Mounting geopolitical tensions between the United States and China add another tier of complexity to PDD’s landscape, potentially unsettling its maneuvers.

These creases in the fabric have instilled a sense of unease among investors, notably reflected in the downward revisions of the company’s earnings estimations.

Concluding Thoughts: Steady the Ship with Pinduoduo

While the tempest of macroeconomic uncertainties rages on, the fundamental vigour and growth prospects of PDD remain steadfast. With a sturdy foothold in the realm of agriculture, a strategic focus on high-growth sectors, and an enticing valuation, PDD emerges as a stock worth holding amidst the current storm of volatility.

Current standings award PDD Holdings a Zacks Rank #3 (Hold), signifying a cautious yet hopeful stance in navigating the complex waters ahead.

Zacks Research Unveils a Diamond in the Rough

Exploring a Hidden Gem

Amidst the tumultuous landscape of the stock market, Zacks Research has discovered a potential diamond in the rough. Evaluating numerous contenders, the Director of Research, Sheraz Mian, meticulously singled out a company with the promise of soaring to new heights in the months to come.

Millennial and Gen Z Favored

This particular company has its sights set on engaging millennial and Gen Z audiences, drawing in nearly $1 billion in revenue just last quarter. A recent dip in its stock price presents an opportune moment to hop on board this intriguing investment journey. While not all elite picks pan out as hoped, this one shows potential to outshine the likes of previous Zacks’ standout performers such as Nano-X Imaging, which saw a remarkable surge of +129.6% in little over 9 months.

Past Performers and Current Contender

Reflecting on past success stories like Amazon, JD.com, Alibaba, and PDD Holdings, Zacks Research is now turning the spotlight onto this underappreciated player, poised for potential growth and prosperity. The current lull in its stock price serves as a tantalizing invitation for investors seeking the next big breakthrough.