Oracle ORCL has set the stage for a groundbreaking maneuver in the realm of AI and cloud computing with its pledge to inject $6.5 billion into a new Malaysian public cloud region. This move not only marks a historic foreign investment in Malaysia’s tech domain but also positions Oracle at the forefront of the burgeoning Southeast Asian market while bolstering its global AI arsenal.

The planned cloud region promises a wealth of advanced AI infrastructure and services for Oracle’s clients and partners in Malaysia. Key offerings include OCI Generative AI Agents with RAG capabilities and OCI Supercluster, touted as a potential titan among cloud-based AI supercomputers. Oracle’s strategic pivot aligns seamlessly with the rising clamor for sovereign AI solutions and high-powered computing resources. Nonetheless, the fruition of this endeavor hinges on Oracle’s adept execution and its ability to seize ripe opportunities in the Southeast Asian tech landscape.

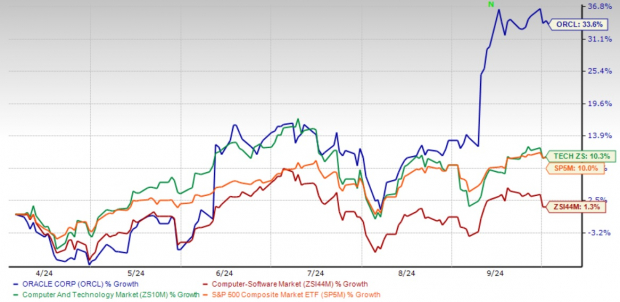

Over the past six months, Oracle has stood as a stalwart among large software stocks, garnering a notable 33.6% hike year-to-date, leaving the Zacks Computer and Technology sector and the S&P 500 trailing at 10.3% and 10%, respectively. As the company braces for its upcoming earnings disclosure, investors are advised to hone in on pivotal metrics such as cloud revenue, with special emphasis on AI-driven services, fresh customer acquisitions, and the efficacy of AI-infused upselling tactics.

Oracle’s ASEAN AI Thrust: Crafting the Malaysia Cloud Landscape

This monumental capital injection arrives at a pivotal juncture as Oracle embarks on an ambitious expansion drive within the cloud infrastructure and AI sphere. The strategic choice of Malaysia as Oracle’s hub leverages the nation’s burgeoning tech talent reservoir and its pivotal position within the ASEAN region. This move strategically enables Oracle to tap into a swiftly expanding market while fortifying its global AI prowess. The upcoming AI hub is primed to synergize harmoniously with Oracle’s existing network of cloud domains and innovation hubs, fostering a robust ecosystem for AI evolution and deployment.

For investors eyeing Oracle’s stock, this resounding investment ticks several critical boxes. It serves as a testament to Oracle’s unwavering allegiance to AI and its readiness to allocate considerable resources to remain a heavyweight in this swiftly evolving arena. Such a strategic gambit holds promise for sprucing up product portfolios and birthing new revenue springs, particularly within the lucrative Southeast Asian marketplace.

Oracle’s trailblazing AI capabilities are emerging as a linchpin in the increasingly AI-centric tech panorama. Noteworthy clients like Reka and Elon Musk’s xAI are already under Oracle’s wing due to its prowess in generative AI workloads. This positions Oracle favorably in the cutthroat cloud infrastructure and services market, where global AI investments hit a whopping $78.2 billion in the second quarter of 2024, with a significant chunk channeled towards AI-centric ventures.

To bolster its AI ecosystem, Oracle has rolled out new AI features within its Fusion Cloud Applications Suite, flaunting over 50 fresh AI agents and diverse AI attributes spanning sectors like finance, supply chain, HR, sales, marketing, and service. Furthermore, Oracle ventures into generative development (GenDev) for enterprises, proffering avant-garde technologies for swift application development.

Oracle’s Gen2 Cloud infrastructure, tailored to accommodate AI and machine learning mandates, could emerge as a formidable edge. The enterprise has also unveiled AI-driven capabilities for Oracle Fusion Data Intelligence, aimed at aiding organizations in maximizing the value derived from their data assets.

These strategic maneuvers reverberate within Oracle’s sanguine cloud business projections, foreseeing total cloud revenue growth of 23-25% at constant currency rates for the second quarter of fiscal 2025. Oracle anticipates its cloud infrastructure services to outshine the growth witnessed in fiscal 2024 by a whopping 50% in the upcoming year.

Projections paint an optimistic picture for ORCL’s fiscal 2025 revenues, set at $58.02 billion, indicating a year-over-year growth of 9.55%. Consensus estimates for fiscal 2025 earnings land at $6.20 per share, nudging up by 0.2% in the past month while projecting a year-over-year growth of 11.15%.

Headwinds Ahead: Navigating Competition and Valuation Waters

The battleground of AI and cloud computing teems with stiff competition, with tech leviathans like Alphabet’s Google, Microsoft, and Amazon incessantly pushing the envelope through innovation and substantial investments. Oracle must grind diligently to ensure that this colossal investment yields tangible technological breakthroughs and market traction, justifying the outlay to its stakeholders.

Equally crucial is the scrutiny demanded by the stock’s valuation against the backdrop of its long-term growth prospects and its prowess in traversing the competitive expanse.

ORCL currently trades at a premium within the price/book realm, hovering at 41.03X compared to the 8.99X price/book ratio of the Computer-Software industry, an indicative stretch in valuation assessments.

Parting Thoughts

Oracle’s whopping $6.5 billion plunge into a Malaysia AI nucleus unfolds as a seismic move that could potentially reconfigure the company’s trajectory in the AI and cloud computing spheres. For investors, this watershed moment offers both vistas of promise and shadows of risk. Conservative investors might opt to bide their time, observing how this colossal investment pans out and shapes Oracle’s financial landscape in the impending quarters. They could be on the lookout for signals of successful implementation—be it through new product unveilings, strategic partnerships within the Southeast Asian milieu, or amplified market domination in cloud services—before placing their strategic stock wagers.

Analyzing Oracle’s Strategic Investment in Malaysia AI Hub

Oracle’s Investment Strategy

Oracle Corporation (ORCL) has made a strategic move by announcing a $6.5 billion investment in a Malaysia artificial intelligence (AI) hub. This decision not only demonstrates the company’s commitment to innovation but also signifies its bullish outlook on the future of AI technology. By delving into this sector, Oracle aims to position itself at the forefront of the AI revolution, which is projected to reshape various industries in the coming years.

The Brimming Potential of AI

Artificial intelligence has emerged as a transformative force across sectors, offering groundbreaking solutions that enhance efficiency, accuracy, and overall performance. With the global AI market gaining momentum and new applications constantly being discovered, Oracle’s foray into this realm is not just a strategic investment, but a bold statement of readiness to capitalize on the burgeoning opportunities that AI presents.

Oracle’s Competitive Edge

With Oracle’s rich history of delivering cutting-edge technological solutions and a solid reputation in the tech industry, the company is well-positioned to leverage its expertise in AI. By investing significantly in the Malaysia AI hub, Oracle is not only expanding its global footprint but also signaling its intent to be a frontrunner in the AI domain. This move underscores Oracle’s proactive approach to staying ahead of the curve and adapting to the evolving tech landscape.

Strategic Implications

The decision to invest in a Malaysia AI hub holds significant strategic implications for Oracle. By establishing a strong presence in the AI sector, Oracle is poised to unlock new revenue streams, foster innovation, and strengthen its position as a tech industry leader. Moreover, this investment underscores Oracle’s commitment to fostering technological advancement and capitalizing on emerging trends to drive sustainable growth and competitiveness in the long run.

Conclusion

As Oracle embarks on this transformative journey into the realm of artificial intelligence through its investment in the Malaysia AI hub, the tech giant is not just making a financial commitment but paving the way for future innovation and growth. By seizing the opportunities presented by AI technology, Oracle is positioning itself for success in a rapidly evolving digital landscape, where adaptability, foresight, and strategic investments are key to staying ahead of the curve.

Source:

To read this article on Zacks.com click here.