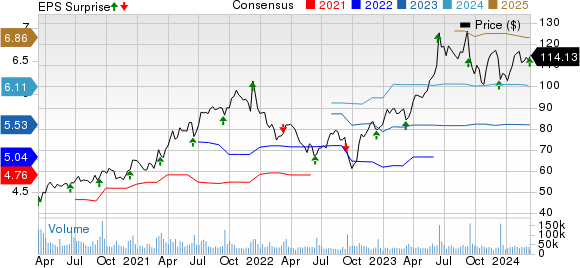

Oracle Beats Estimates with Stellar Q3 Earnings

In a surprising turn of events, Oracle (ORCL) reported non-GAAP earnings that outpaced the Zacks Consensus Estimate by a substantial 2.92%, showcasing a robust 15.6% year-over-year increase. The firm’s earnings at constant currency soared by an impressive 16% year over year.

Furthermore, revenues witnessed a commendable growth of 7% (also up 7% at constant currency) compared to the previous year, reaching a staggering $13.28 billion, exceeding the Zacks Consensus Estimate by 0.04%.

Investors were elated as Oracle’s stock surged by 15% in premarket trading, fueled by the company’s strategic efforts to capture a larger market share in the cloud-computing sector through its collaboration with AI chip titan, NVIDIA Corporation (NVDA).

Oracle’s relentless investment in cloud infrastructure, coupled with innovative solutions like the Ambulatory Clinic Cloud Application Suite, positions the tech giant for sustained growth in the ever-evolving software industry.

Impressive Revenue Breakdown

The revenue surge was driven by a 12% year-over-year (11% at constant currency) increase in cloud services and license support revenues, totaling $10 billion. This growth was powered by strategic cloud applications, autonomous database, and Oracle Cloud Infrastructure (OCI).

On the flip side, cloud license and on-premise license revenues experienced a slight decline of 3% year over year (down 3% at constant currency) to $1.3 billion.

Oracle’s aggregated cloud revenues (IaaS plus SaaS), which includes Cerner, amounted to $5.1 billion, reflecting a substantial 25% year-over-year increase (24% at constant currency).

Notably, cloud Infrastructure (IaaS) revenues surged to $1.8 billion, up a remarkable 49% year over year (49% at constant currency).

Operating Efficiency and Financial Strength

The firm’s non-GAAP total operating expenses witnessed a moderate 3.8% year-over-year increase (3% at constant currency) to $7.48 billion, while non-GAAP operating income experienced a significant 15% growth to reach $5.79 billion.

This growth resulted in a healthy non-GAAP operating margin of 43.6%, expanding by 180 basis points compared to the previous year.

Robust Balance Sheet & Positive Cash Flow

As of February 29, 2023, Oracle boasted cash & cash equivalents and marketable securities totaling $9.9 billion, representing a noticeable uptick from the preceding quarter.

The firm’s operating cash flow and free cash flow stood at an impressive $18.23 billion and $12.25 billion, respectively.

Additionally, Oracle’s remaining performance obligation (RPO) exceeded $8 billion, showcasing a solid 41% increase at constant currency, with a significant portion expected to translate into revenues within the next 12 months.

Guidance Paints a Bright Future

Looking ahead to the fourth quarter of fiscal 2024, Oracle anticipates total revenues to grow between 4% to 6%, with a more robust 6-8% growth expected when excluding Cerner from the calculation. Cloud revenues, excluding Cerner, are forecasted to grow in the impressive 22-24% range.

The company projects its non-GAAP earnings per share to range from a 2% decline to remain flat at $1.62 to $1.66.

Investor Considerations

Despite Oracle’s stellar performance, the firm currently holds a Zacks Rank #3 (Hold). Nevertheless, shares of ORCL have surged by 8.3% year to date, signaling ongoing investor interest in the stock.

For investors seeking alternatives, top-notch performers like Meta Platforms (META) and Amazon.com (AMZN) with a Zacks Rank #1 (Strong Buy) each present promising opportunities in the competitive tech industry landscape.

With robust financial performance and positive guidance, Oracle emerges as a formidable player in the software domain, poised for continued growth and success in the foreseeable future.