The Earnings Extravaganza: April 29 – May 3

Prepare yourself for a rollercoaster of epic proportions as a staggering array of 39 companies are set to reveal their financial truths. While slightly less than last week’s grand total of 52, this earnings parade remains a crucial, potentially market-molding event for investors this week.

Among the key stocks baring their souls are tech titans like Apple, Amazon, and AMD, alongside other noteworthy players including Coinbase, Super Micro Computer, Paypal, and Starbucks.

The Dance of Implied Volatility

Prior to an earnings unveiling, the atmosphere is electric with anticipation, as evidenced by the soaring implied volatility. Speculators and hedgers, like performers under the big top, feverishly trade options, inflating volatility and consequently, option prices.

Post-reveal, the curtain falls, and implied volatility descends towards normalcy once more.

Forecasting Stock Expectations

Ancient and mystical calculations are shared to predict the dark arts of stock movements. By combining the price of at-the-money put and call options post-earnings, a rough estimation is conjured. The crystal ball gazes upon the hallowed ground of the first expiry date following the earnings spectacle.

And lo, the expected range for the chosen few is revealed:

Monday

DPZ – 5.8%

MSTR – 11.6%

ON – 10.0%

And so the mystical numbers continue their dance through Tuesday, Wednesday, Thursday, and the enchanted realm of Friday’s void.

Strategies for the Option Magicians

Options alchemists assemble! Bearish sorcerers may weave bear call spreads, while bullish enchanters can craft bull put spreads or dare to gaze into the abyss with naked puts.

Neutral mystics can summon forth iron condors, their incantations whispering caution to keep strikes beyond the expected boundary.

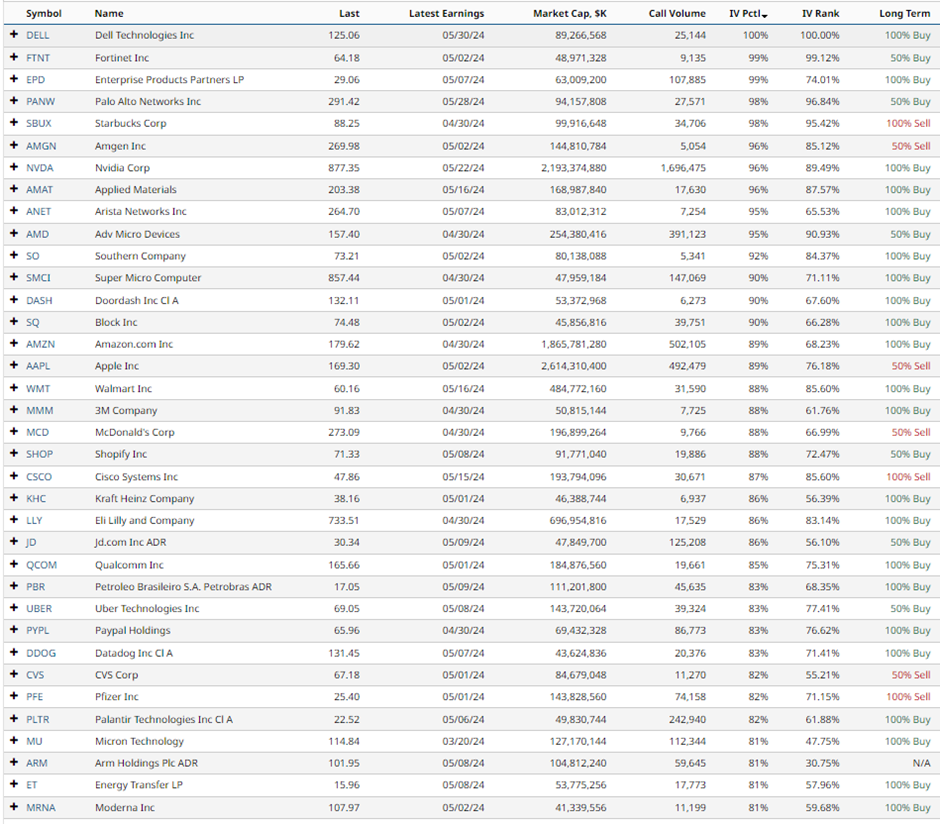

High Flyers in the Implied Volatility Sky

The seekers of high implied volatility venture forth with Barchart’s Stock Screener as their compass, setting filters to unveil the hidden gems shimmering with possibility. Their quest to uncover the IV Percentile treasures leads to a land of abundance, too vast to capture in a mere glimpse.

Reflections on Last Week’s Earnings Maelstrom

In the wake of the previous week’s earnings tempest, actual versus anticipated movements unfold:

VZ -4.7% vs 4.1% expected

TFC +3.4% vs 4.6% expected

NUE -8.9% vs 4.5% expected

Through the looking glass of hindsight, the dance of numbers continues, revealing lessons for those brave enough to engage.

Market Insights: A Rollercoaster Ride of Surprises and Predictability

Market Performance Review

NOW -4.0% vs 7.2% expected

LRCX +1.9% vs 6.2% expected

T +1.9% vs 4.8% expected

BA -2.9% vs 5.6% expected

CME -1.9% vs 3.1% expected

VALE -2.5% vs 3.7% expected

F +0.7% vs 6.4% expected

HUM -3.7% vs 5.5% expected

MSFT +1.8% vs 4.8% expected

MRK +2.9% vs 3.5% expected

CAT -7.0% vs 5.6% expected

INTC -9.2% vs 7.6% expected

HON -0.9% vs 3.8% expected

BMY -8.5% vs 4.2% expected

GILD +0.2% vs 3.8% expected

MO +1.4% vs 2.8% expected

VLO +0.1% vs 4.2% expected

COF +0.2% vs 5.2% expected

NEM +12.5% vs 5.1% expected

DOW -1.0% vs 3.7% expected

RCL +0.5% vs 7.6% expected

SNAP +27.6% vs 20.2% expected

LUV -7.0% vs 6.4% expected

XOM -2.3% vs 2.9% expected

CVX +0.4% vs 3.1% expected

ABBV -4.6% vs 4.5% expected

CL +1.9% vs 2.9% expected

Despite the volatility, 31 out of 50 stocks remained within the anticipated range, signaling a mix of stability and surprises in the market.

Unveiling Unusual Options Activity

MSFT, META, INTC, GOOGL, NVDA, and SNAP were among the key players experiencing unconventional options activity in the previous week.

Furthermore, a number of other stocks also witnessed unusual options activity, painting a picture of intriguing market maneuvers.

It’s crucial to be mindful that options trading carries inherent risks, with the potential to result in a complete loss of investment. This article serves purely as an educational piece and should not be construed as trading advice. Remember, always conduct thorough research and seek counsel from your financial advisor prior to engaging in any investment decisions.