Making predictions long-term is a challenge. Cast your memory back a decade, and ponder this – could anyone have foreseen Nvidia‘s meteoric rise to become one of the globe’s largest corporations by market cap? Precious few indeed.

Despite the murky crystal ball that is the future, a forward-looking peek spanning five to ten years can be enlightening for investors. Otherwise, it’s akin to shooting in the dark, prompting a more prudent recourse to perhaps favor index funds.

While not etched in stone, I venture to posit that the towering “Magnificent Seven” stalwarts Amazon (NASDAQ: AMZN) and Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL) will reign as the globe’s two premier companies by 2030. Let’s explore why.

Amazon: Clouding the Skies

An ethos of innovation has set Amazon apart, catapulting it to triumph across various mammoth product spheres. While it stands as the foremost e-commerce juggernaut in North America, grossing billions annually, the crown for Amazon’s profit realm today rests on Amazon Web Services (AWS).

Boasting the throne as the world’s top cloud infrastructure provider, AWS raked in $91 billion in revenue and nearly $25 billion in operational income just last year. A playground shared with rivals like Microsoft Azure and Google Cloud, AWS has maintained its zenith in the cloud service domain since inception nearly two decades ago, clutching a 31% market share.

Despite AWS’s vast footprint, ample space remains for the cloud to gnaw at market share versus antiquated computing solutions. Analysts prognosticate a 19% industry growth rate till 2030. Sustaining its market share and profit margin configuration could propel AWS to grow its earnings at a 19% clip annually, poised to hit over $90 billion by 2030. Coupled with the colossal e-commerce sphere, international forays like in India, and ventures like the Project Kuiper internet service, Amazon’s ascent to being a global juggernaut by 2030 seems within tantalizing reach.

Alphabet: Unleashing Growth Serendipity

And who shall perch by Amazon’s side? A mere glimpse at Amazon’s cloud computing rivals will unravel the enigma.

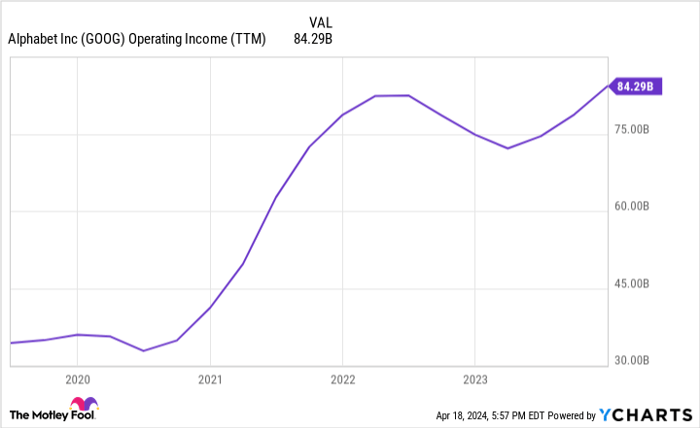

GOOG Operating Income (TTM) data by YCharts

The Alphabet empire, harboring Google Search, YouTube, Google Cloud, and ventures like autonomous driving enterprise Waymo, stands at the precipice of promise. Google Cloud, mirroring AWS, destined for a growth arc from a $36 billion annualized revenue rate in 2023’s waning to a near $100 billion revenue reservoir by 2030, promises bountiful harvests for Alphabet. Yet, this isn’t Alphabet’s solitary ace.

Google Search’s revenue stream warrants highlighting. The ubiquitous global search engine raked in $48 billion in revenue solely in Q4 2023, with envisaged $200 billion in annual sales a stone throw away. As the lifeblood for myriad sectors like travel, insurance, and financial services, Google Search’s revenue is poised to burgeon in tandem with global GDP, as burgeoning smartphone and internet penetrations become the norm.

Let’s not sideline YouTube. As the globe’s titan video platform, YouTube amassed $9.2 billion in advertising revenue in the preceding quarter, captivating billions worldwide and reigning as America’s preferred video streaming service on TV sets. Yes, that’s TV sets in the USA, not all devices.

YouTube burgeons as a global entertainment cornerstone. A premise exists for its heightened eminence by 2030.

In the bygone year, Alphabet amassed $85.7 billion in operational earnings. Armed with numerous avenues for growth, prospects seem rife for Alphabet to perpetuate earnings expansion in the imminent years. By 2030, this trajectory is likely to propel the Magnificent Seven magnate to outstrip the likes of Apple and Microsoft, snugly nestled beside Amazon as one of the world’s two preeminent corporations.

Should you invest $1,000 in Amazon right now?

Before embarking on Amazon stock acquisitions, a mull on this serves wise:

The Motley Fool Stock Advisor luminary team recently unearthed what they vouch to be the 10 best stocks for investors to acquire presently… with Amazon scantily in the mix. These 10 stocks touted to potentially reap mammoth returns in the impending years.

Stock Advisor offers a user-friendly blueprint for investor success, encompassing portfolio construction insights, zeitgeist updates from analysts, and bi-monthly fresh stock recommendations. Since 2002*, the Stock Advisor service trifolded the S&P 500 return.

*Stock Advisor returns as of April 15, 2024

Suzanne Frey, an Alphabet executive, serves on The Motley Fool’s board of directors. John Mackey, erstwhile CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Brett Schafer holds stakes in Alphabet and Amazon. The Motley Fool holds and advocates Alphabet, Amazon, Apple, Microsoft, and Nvidia. The Motley Fool advises the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool abides by a comprehensive disclosure policy.