Amid debates over Elon Musk’s worthiness of a substantial pay package, Nvidia’s co-founder Jensen Huang emerges as an unexpected ally. In a rare show of support, Huang lauds Musk’s strides, particularly in the realm of self-driving technology, ahead of an impending crucial vote.

Nvidia, known for its soaring success driven by the surging demand for AI chips and infrastructure, recognizes Musk’s advancement, with Huang emphasizing that “Tesla is far ahead in self-driving cars.”

This acknowledgment holds significance as Musk’s foray into self-driving tech underscores a seismic shift from Tesla’s original focus on sustainable transportation. While Tesla initially aimed to ramp up production, a strategic retreat to AI technology became imperative.

The Significance of Tesla’s Strategic Pivot

Although Tesla’s pivot may unsettle some, it resonates with prevailing market dynamics. While sustainability was Tesla’s initial ethos, the current market shows diminished enthusiasm for this concept, mirrored by a dip in Tesla sales and a broader wane in the electric vehicle sector. With traditional automakers like Ford veering towards hybrids over pure electric vehicles, Tesla’s shift appears less of a choice and more of a necessity.

Honing their self-driving system to transform it into a truly autonomous entity, as opposed to the current “mostly self-driving but with frequent human intervention” model, emerges as a logical trajectory for Tesla. Jensen Huang’s endorsement of this path underscores its rationale.

Assessing Tesla’s Stock Position

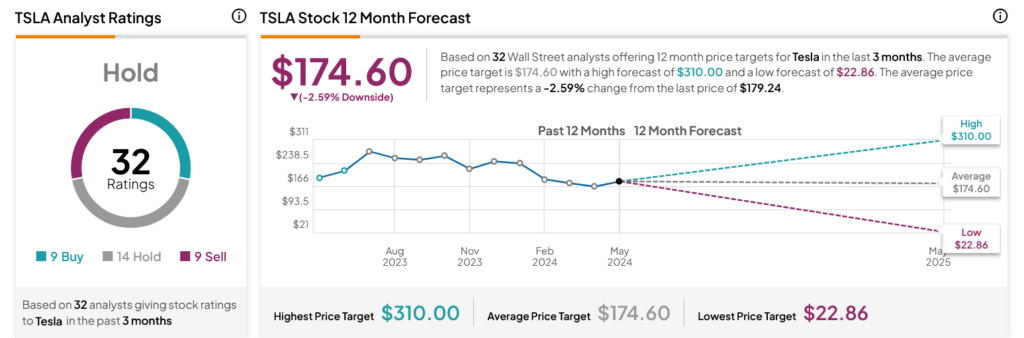

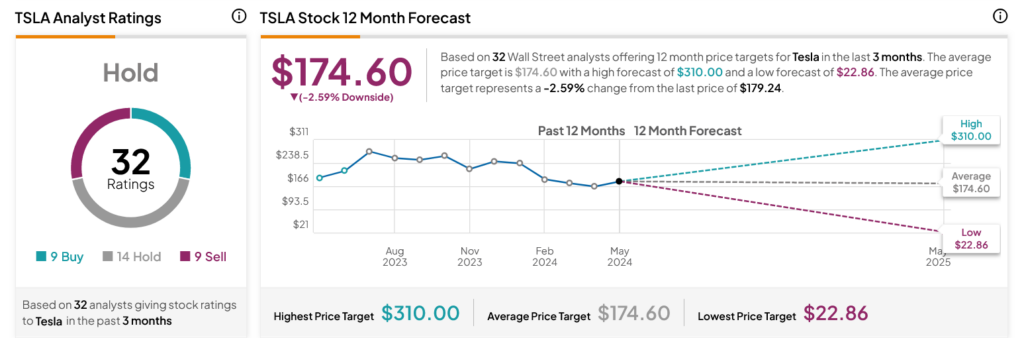

On Wall Street, analysts maintain a Hold consensus on TSLA stock, with nine Buys, 14 Holds, and nine Sells recorded in the last three months. Despite a 10.9% decline in its share value over the past year, the average TSLA price target of $174.60 per share suggests a marginal 2.59% downside.